Who is to blame for shrinking real wages in the UK? Nobody?

The squeeze on UK consumers through falling real wages has been regarded as a significant factor in the (until recently) anaemic economic recovery. Employers have taken a good share of the blame for this – but is that fair? Have employers deliberately kept earnings below inflation as a means of boosting their own profitability, or was this an unintended outcome of upside inflation shocks?

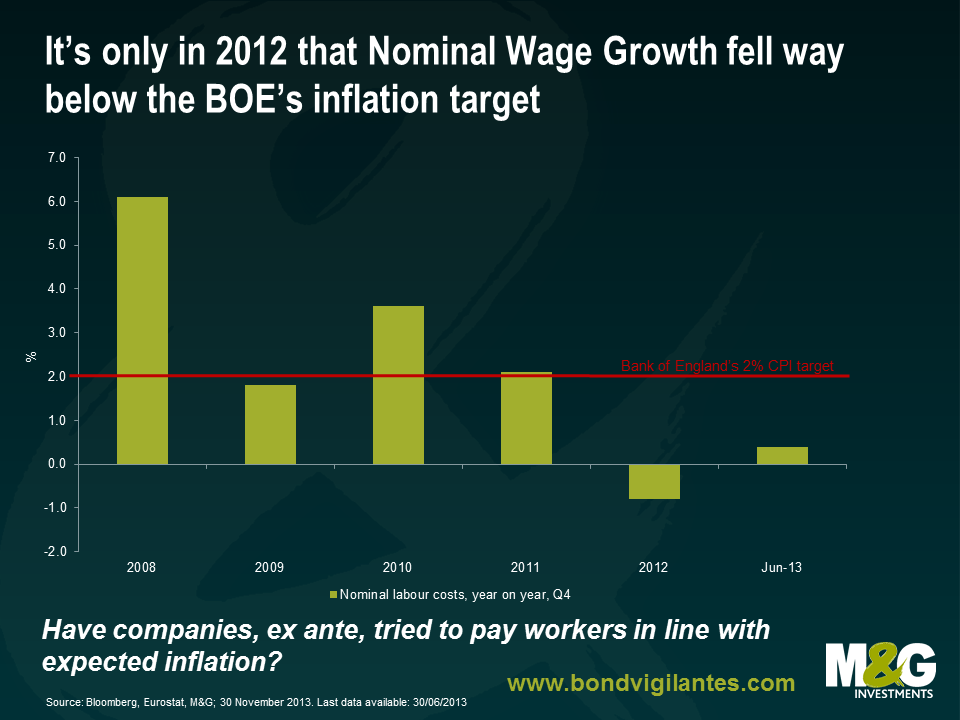

If we look at Eurostat’s nominal wage growth series in the UK since the credit crisis, it’s only in the last couple of years that nominal wage growth has been well below the Bank of England’s inflation target of 2%. In 2008 nominal wage growth was 6.1%, 2009 1.8%, 2010 3.6%, and 2011 2.1%.

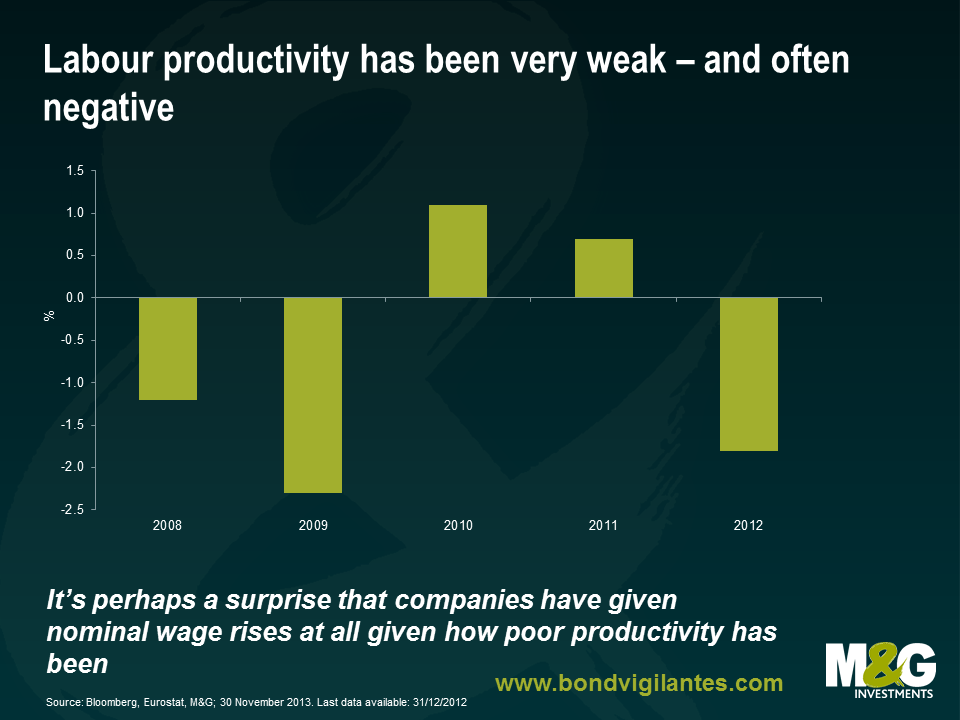

And yet over those same years, Labour Productivity per Hour Worked (again Eurostat) was awful. -1.2% in 2008, -2.3% in 2009, +1.1% in 2010, and +0.7% in 2011. In other words companies appear to have, ex ante, attempted to compensate their workers for expected inflation, assuming that the Bank of England hit its inflation target, and have overcompensated them, ex post, for improvements in productivity.

So has the problem for earnings been the unexpected inflation overshoot (since the credit crisis started CPI has been above the Bank’s 2% target in all but 6 months, in 2009), not the wage setting behaviour of companies? Had inflation come in at, or above target, workers would have been better off in real terms until 2012, and certainly better off than you might expect given the historically strong relationship between wage growth and productivity. I’m not sure I’m blaming the Bank of England here either – to achieve the 2% inflation target, rates would have had to have been inappropriately high for the domestic demand conditions and the distressed balance sheet of the UK public and private sectors. And productivity is weak in part because employment has been unexpectedly strong relative to the weakness of the economy. So a low inflation, high productivity UK economy sounds nice – but in the circumstances would likely have only have been possible with a much deeper recession and higher unemployment rate.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox