Should the Bank of England hike rates?

Many of us have become accustomed to a world of ultra-low interest rates and quantitative easing (QE). Taking into account inflation, real short-term interest rates are negative in most of the developed world. Of course, these historically low interest rates were a central bank response –co-ordinated on some occasions – to the Great Financial Crisis of 2008. Whilst we are still waiting for the official data, it appears increasingly likely that 2013 marked the start of a synchronised recovery in the advanced economies. So is it now time for the Bank of England to consider hiking the base rate? Perhaps good – and not awesome – economic growth is more appropriate to avoid a bust down the line.

Economic theory and real world experience tells us that interest rates that are kept too low for too long will distort investment decisions and lead to excessive risk-taking. They may also result in the formation of asset price bubbles that ultimately collapse. With parts of the UK housing market (including London and the south-east) posting double-digit returns in 2013, the FTSE 100 within arm’s reach of an all-time high last seen during the tech bubble (and up over 60% since 2009), and UK non-financial corporate bond spreads 45 basis points away from 2007 lows; it is clear that ultra-low interest rates have had a great effect on both financial markets and the real economy.

At the risk of being called a party pooper, here are 5 reasons why I think we could see an interest rate hike before year end (the market is pricing in around February/March 2015), and certainly before the third quarter of 2016 (the time when the BoE think the unemployment rate will fall to 7%).

- Asset price bubbles are forming

- Unemployment is falling quickly towards 7%

- Inflation risks should not be forgotten

- The Taylor rule suggests interest rates are way below neutral

- The risk of Euro area break-up appears to have fallen

Asset prices bubbles are forming

There has been a significant run-up in UK financial assets over the course of the past five years, particularly since QE became a feature of the financial landscape. Investors in equity and bond markets alike have been enjoying the fruits of QE. Those that own financial assets have seen their net wealth increase substantially from the post-crisis lows. Consensus forecasts for 2014 suggests that most market forecasters expect another robust year for risk assets, fuelled by easy money and the search for positive real returns.

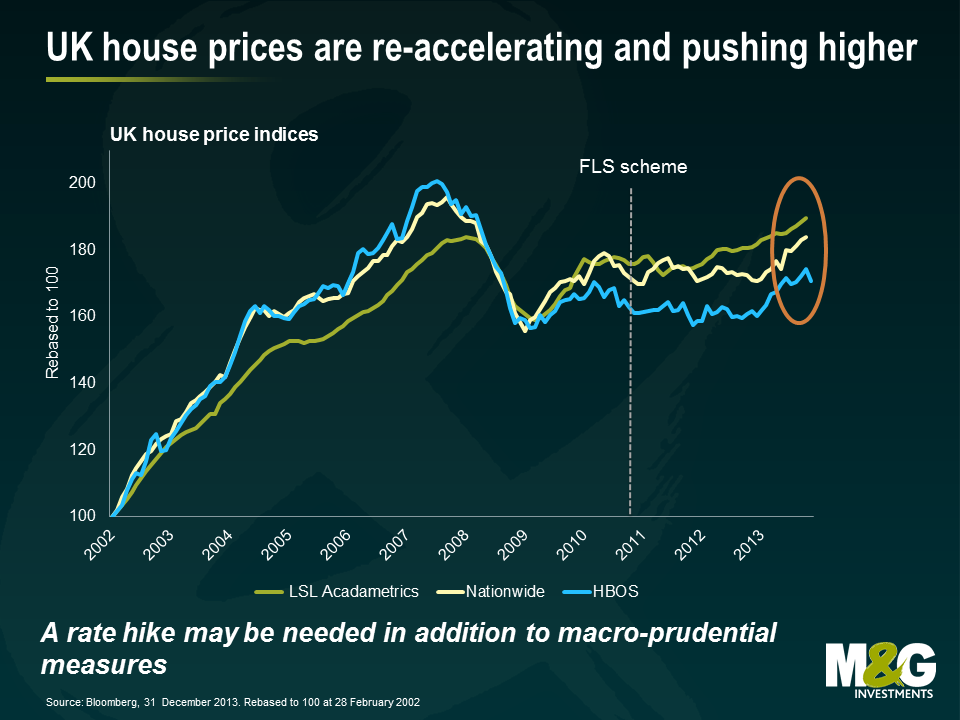

Of course, the greatest financial asset that the average UK household own is their own house. In 2011, it was estimated that around 15 million households are owner-occupied (a rate of around 65% of total households). Thus it is unsurprising that newspaper readers are usually hit with a headline about rising house prices on a daily basis. House prices, on a number of measures, have begun to accelerate again with low interest rates and tight housing supply a key contributor to the price increase. Low interest rates have given UK consumers the incentive to accumulate high levels of household debt compared to their incomes. The average house price is now 5.4 times earnings, the highest level since July 2010 and well above the long-run average of 4.1.

The Help-To-Buy scheme is contributing to the run-up in this highly leveraged and interest-rate sensitive sector (a topic I covered back in July here). By hiking the base rate this year, the BoE would hopefully achieve a reduction in speculation and debt accumulation in the housing sector. This would not be a popular action to take – it never is – but we should all be wary about the damage a rampant housing market can have on an economy. BoE Governor Mark Carney – as head of the Financial Policy Committee – has already moved to stop the Funding for Lending Scheme and mentioned that placing restrictions on the terms of mortgage credit may be a tool that can be used to reign in house prices.

Whether macro-prudential policy tools will work or not remains open to debate. Ultimately, central banks are trying to focus in on one element of the economy by raising interest rates or restricting credit. We do have a real-life macroeconomic example currently taking place though. On October 1, the Reserve Bank of New Zealand imposed a limit on how much banks could devote to low-deposit loans and required major banks to hold more capital to back loans. It’s very early days but for the month of November, the Real Estate Institute of New Zealand reported a 1.2% increase in New Zealand house prices and 9.6% over the year. The RBNZ and BoE might find that trying to slow the housing market using macro-prudential measures is a bit like trying to stop a car by opening the doors and hoping that wind-resistance does the rest. You really need to put your foot on the brake.

The longer the boom lasts, the greater the pain when it inevitably ends.

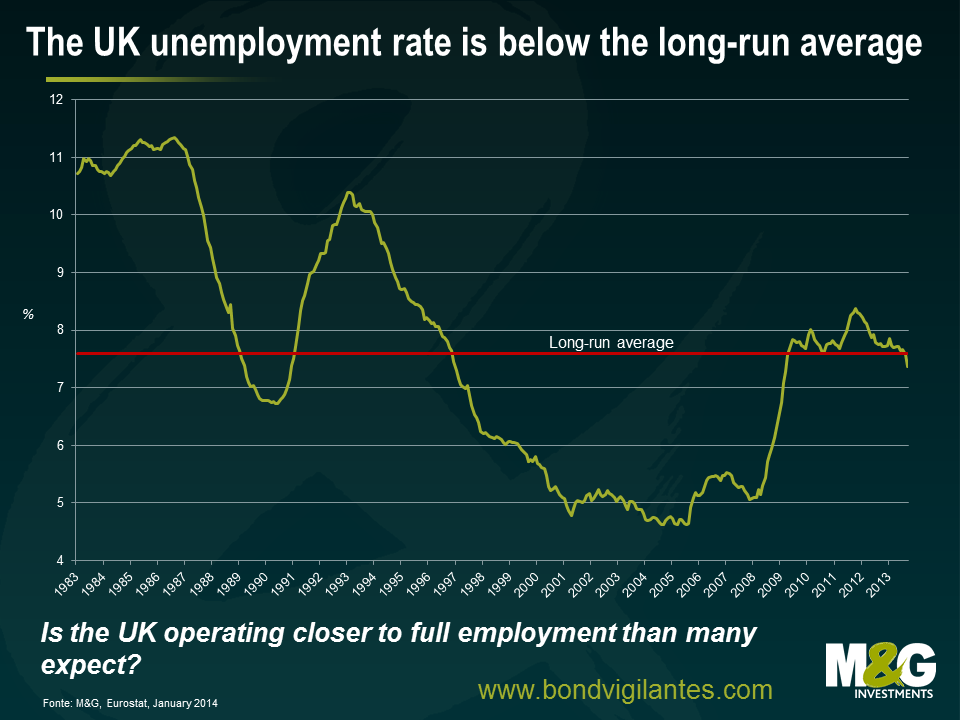

Unemployment is falling quickly towards 7%

The unemployment rate has fallen from 7.9 to 7.4% over the past nine months and is a key tenet of the BoE’s forward guidance. The fast decline has seen some speculation amongst economists that the BoE may lower the unemployment threshold from 7.0 to 6.5%. Of course, the 7.0% threshold that it has set it is not a trigger to hike interest rates, rather it is a point at which the BoE would consider hiking rates. However, the labour market has improved much quicker than the BoE has been expecting with the unemployment rate now sitting at the lowest rate since March 2009. We are still well above the average unemployment rate seen during the period between 2000 and 2008, but I would argue that this was an abnormal period for the UK economy. It was a NICE period – non-inflationary, constantly expanding – and is unlikely to be repeated. Arguably the UK’s natural rate of unemployment is now a percentage point or two higher than that of the noughties, suggesting less spare capacity in the UK economy than many expect. It may not be long before we start to see wage demands start to pick up, leading to rising inflationary pressures. Higher wage growth in 2014 would bode well for consumption and household net wealth given the increase in house prices and investment portfolios.

As it is generally accepted that monetary policy operates with a lag, (the BoE estimate a lag time of around two years), and the unemployment rate itself is a lagging indicator of economic activity. If the BoE waits until the unemployment rate hits 7%, or for confirmation that economic growth is strong, then it may be too late. A slight tap on the breaks by hiking the base rate may be appropriate.

Inflation risks should not be forgotten

Ben wrote an excellent piece on the UK’s inflation outlook last month. To quote:

Current inflation levels may seem benign. However, potential demand-side shocks coupled with a build-up in growth momentum and the difficulty of removing the huge wall of money created by QE will pose material risks to inflation in the medium term. Markets have become short-sightedly focused on the near term picture as commodity prices have weakened and inflation expectations have been tamed by the lack of growth.

In addition, central banks have a nasty habit of keeping monetary policy too loose for too long. It even has a name – “The [insert FOMC Chairperson Name] Put”. The easy-money policies of the FOMC in the 1970s are seen as a key contributor to the runaway inflation seen during the period. Eventually, the FOMC reversed its own policies, hiking rates to 19% in 1981.

Of course, what central bankers really fear is that ultra-easy monetary policy and the great experiment of QE will lead to an increase in inflation. A return of inflation will only be tamed by hiking rates. Whilst the inflation rate has been moderating in the UK and is close to the Bank of England’s target at 2.1%, it follows almost 5 years of above target inflation. Whist it is not a clear and present danger, the experience of the 1970s suggests that we cannot ignore the threat that inflation poses to the UK economy, especially as rising inflationary expectations are often difficult to contain.

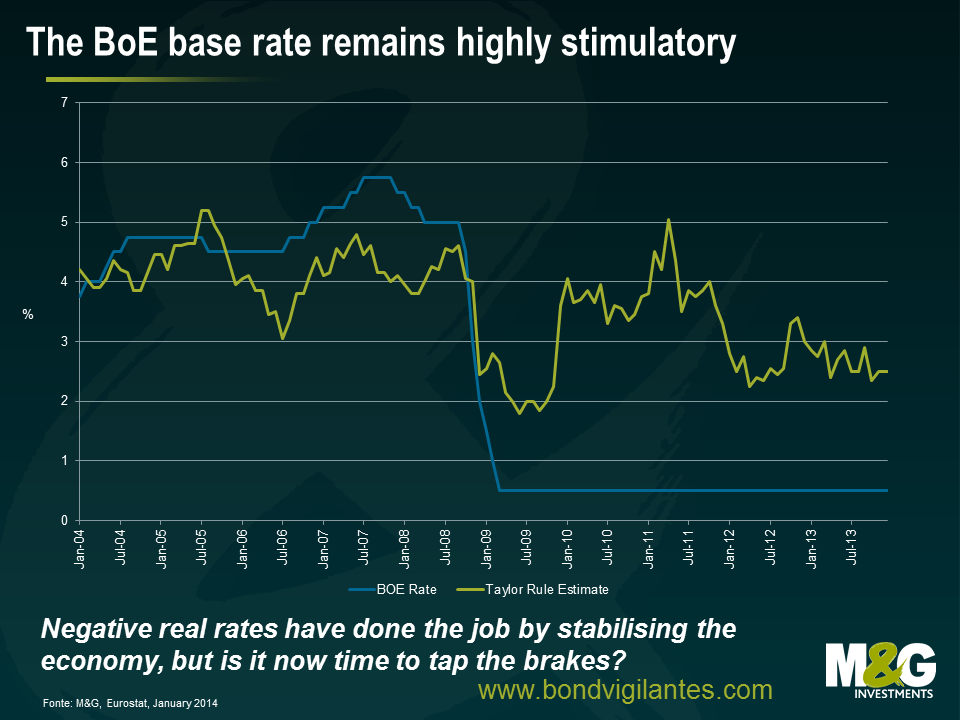

The Taylor rule suggests interest rates are way below neutral

The Taylor rule provides a rough benchmark of the normal reaction to economic conditions as it relates interest rates to deviations of inflation from target and the output gap. According to the Taylor rule for the UK, a base rate of 0.5% is around 2.0% below where it should be given current rates of growth and inflation.

Negative real interest rates have done the job by stabilising the economy, but is it now time to tap the brakes? With the UK economy growing at an annualised rate of more than 3% in the second and third quarters of 2013 (above the long-term average of 2%), the UK may be operating much closer to full employment than many currently estimate. Forward looking survey indicators and economic data suggest the UK economy is growing strongly, with business confidence at a 20 year high and the UK Services PMI for December suggesting a strong broad-based upturn. Of course, the BoE would like the other components of GDP like exports and investment to contribute more to economic growth. A rising currency wouldn’t help this. But sometimes it is difficult to have your cake and eat it too, especially if you are a central banker.

The risk of Euro area breakup appears to have fallen

Now it’s time for the “Draghi Put”. Draghi’s famous “whatever it takes” speech is probably the most important speech ever given by a central banker. The speech has had a fantastic effect on assets from government bonds to European equity markets and everything in between. More importantly, as I wrote here back in July 2013, despite the problems that Europe faces – the concerning outlook, the record levels of unemployment and debt, the proposed tax on savers in Cyprus – no country has left the EMU. The EMU has in fact added new members (Slovakia in 2009, Estonia in 2011, Latvia in 2014). European countries remain open for trade, have continued to enforce EU policies and have not resorted to protectionist policies. EU banking regulation has become stronger, the financial system has stabilised, and new bank capital requirements are in place.

This bodes well for the UK, as stabilisation in the Eurozone suggests stronger export demand, increased confidence, and higher investment in the UK from European firms. Perversely, an interest rate hike might actually improve confidence in the UK economy, signalling that the central bank is confident that economic growth is self-sustaining.

The BoE must walk the tightrope between raising rates slightly now to avoid higher inflation and financial instability or risk having to do a lot more monetary policy “heavy-lifting” down the line. A base rate at 0.5% is way below a neutral level and the BoE has a long way to go before getting anywhere near this level. It could act this year and gradually start raising interest rates to lessen the continued build-up of financial imbalances. The difficult action in the short-run to raise the base rate will help to support “healthy” economic growth in the long-run.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox