Japan hikes consumption tax in April – will retail sales spike in March, only to collapse afterwards?

Next month, Japan will raise its consumption tax from 5% to 8% as a step towards reducing the nation’s 200%+ debt to GDP ratio by moving towards a budget surplus in 2020. This may be the first of two hikes in the sales tax, with a further rise to 10% planned for October 2015. Prime Minister Abe has said that the second hike will be dependent on an economic recovery, rightly realising that only a significant increase in Japan’s growth rate will make any impact on the national debt. He’s said that the data from July to September 2014 will determine whether or not the second VAT hike goes ahead.

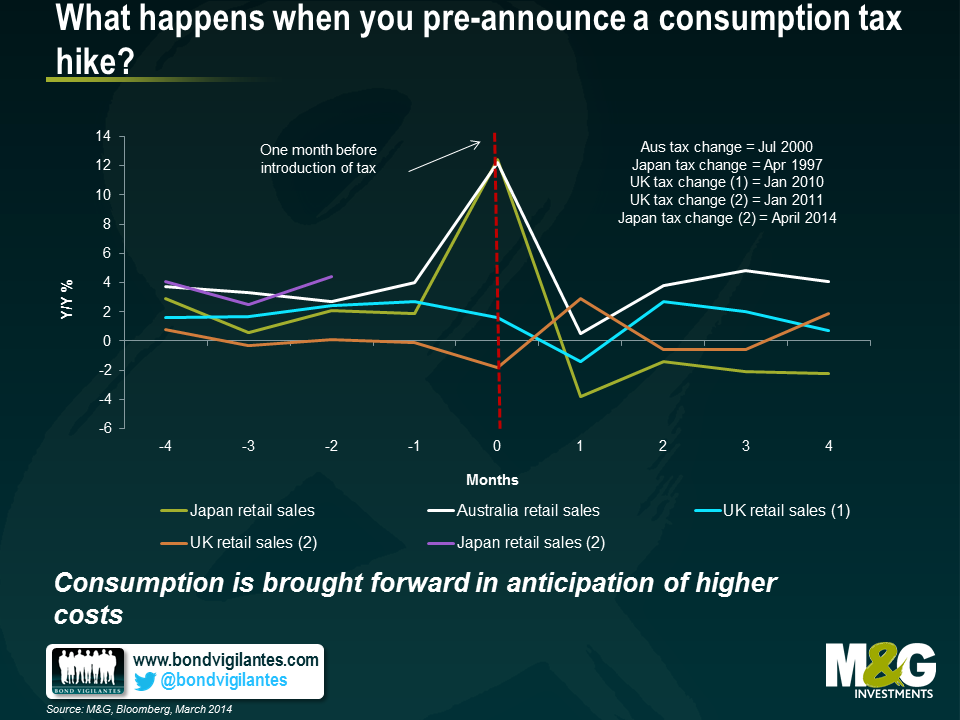

We’ve looked at the impact of pre-announced sales tax hikes before when I wondered whether the UK’s rises from 15% to 17.5% (at the start of 2010), and then again from 17.5% to 20% (at the start of 2011) would impact retail sales. History had shown us that when Japan raised consumption tax in 1997, and when Australia did the same in 2000, retailers saw a huge boost to sales in the month before the hike (12% year on year rises in both cases) but when the higher prices came in retail sales collapsed to near, or below zero. Rational consumers front loaded consumption ahead of the known price rises.

I thought that we would see something similar in the UK, but there is little sign of it in the data – after the 2010 VAT hike, sales did turn negative, but in neither case did we see any of the “rational frontloading” that Japan and Australia saw. Perhaps the very weak period of GDP growth (averaging below 1.5%, and at times as low as 0.5% year on year over 2010 and 2011), and the UK’s famous squeeze on real incomes through higher inflation than wage growth meant that there was no ability to frontload consumption. Or perhaps we are not as rational as the Japanese and Australians.

So the implications for Japan in 2014 are not clear cut. But I was surprised to see that Japanese retail sales growth is already running much higher than in any of the historical examples at the same stage of the VAT hiking cycle, with a 4.4% year on year increase. Cars and machinery equipment led the way – the big ticket items that you might expect to make most sense for consumers to buy in advance of higher prices. Economists have attributed this to front loading, but it is also worth exploring alternative explanations. Today’s release of Japanese wage data showed the first rise in base pay for nearly two years, so perhaps the recent improvement in some economic data, and the psychological impact of Abenomics are producing a real increase in consumer sentiment. But pay is still only growing at 0.1% on an annual basis, and including bonuses and overtime it is negative. Also the recent exit from deflation is squeezing real incomes. The Japanese economy, and consumer, remains fragile – Abe will be hoping that this doesn’t end up being a replay of 1997.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox