Sell in May and go away – does it work for European fixed income?

As is usually the case on 1 May, there was a plethora of articles and commentary on the “sell in May and go away” effect. If you are unfamiliar with this highly sophisticated trading strategy, it involves closing out any equity exposure you may have on 30 April and re-investing on 1 November. Historically, U.S. equities have underperformed in the six-month period commencing May and ending in October, compared to the six-month period from November to April. No one knows why this seasonal pattern exists, but some theories include lower trading volumes in the summer holiday months and increased investment flows when investors come back from holidays.

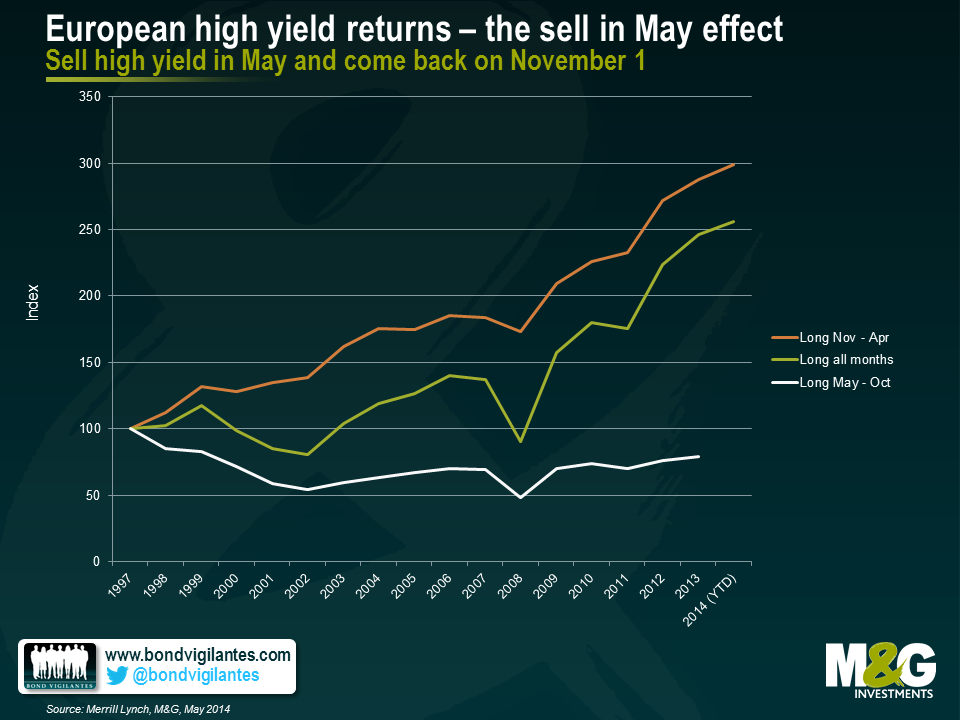

With this in mind, we thought it might be interesting to see if the same effect exists in European fixed income markets. In order to identify the sell in May effect, we generated total returns on a monthly basis for a portfolio of European government, investment grade and high yield bonds. We then generated a total return for a portfolio that was invested between the months of November and April and compared this with a portfolio that was invested between the months of May and October. In order to generate the maximum number of observations possible, we went back to the inception of the respective Merrill Lynch Bank of America indices. The results are below.

There appears to be a seasonal effect in European high yield markets. This is the fixed income asset class that is most correlated to equity markets, and the analysis shows that a superior return was generated by only being invested between the months of November and April (199% total return). In fact, this strategy substantially outperformed a strategy of being invested over the whole period (1997 – April 2014). If an investor chose to only invest between the months of May and October, they would have suffered a 21% loss over the past 16 years.

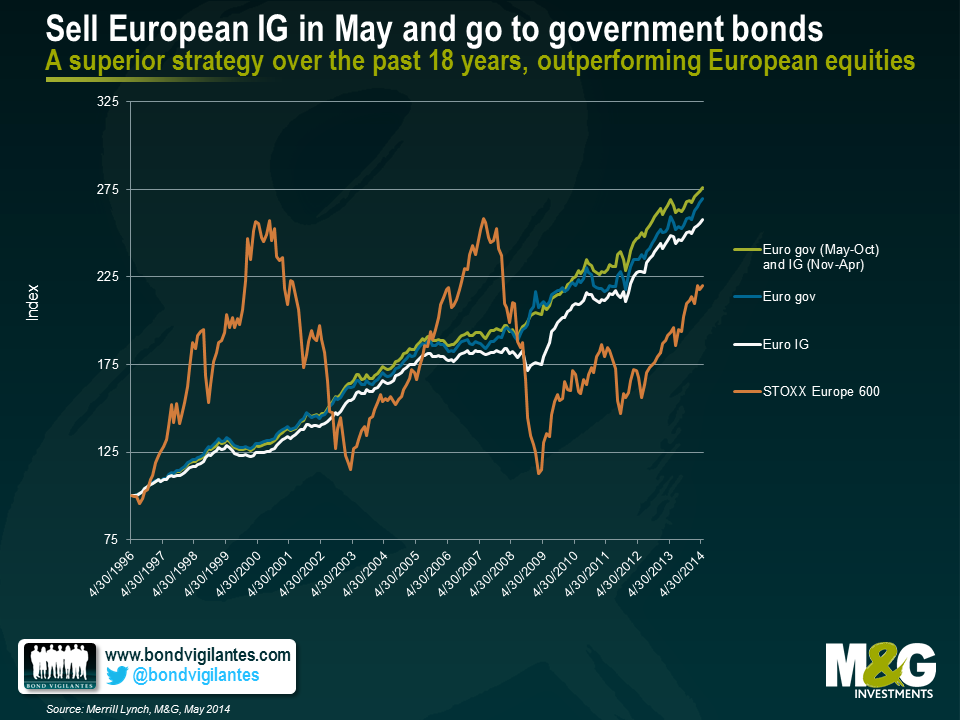

The natural extension of this analysis is to gauge how a trading strategy that was fully invested in European government bonds between the months of May and October and fully invested in European investment grade between November and April would have performed over the past 18 years. We can then assess how this strategy would have performed relative to portfolios that were fully invested in European government bonds, European investment grade corporate bonds and European equities only. The results show that a strategy of selling investment grade assets in May and buying government bonds has produced superior returns equal to 5.9% per annum, outperforming European equities by 56% in total or 2.5% p.a.

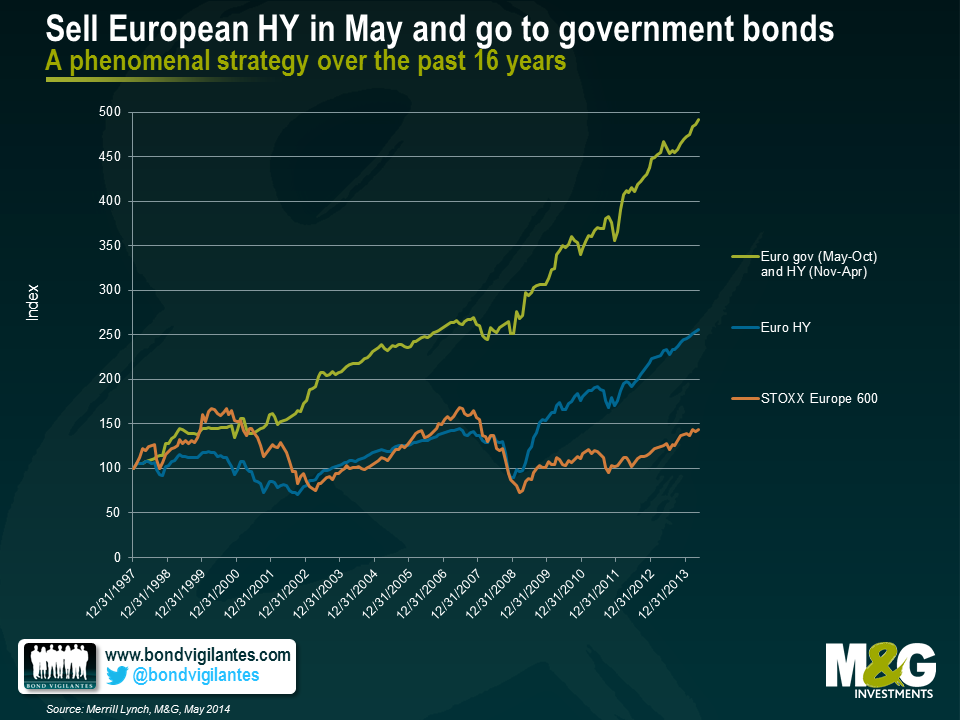

The above chart shows the same analysis, this time looking at how the strategy would have performed in total return terms but we have replaced European investment grade exposure with European high yield. Following this strategy would have generated an annualised return of around 10.5% or 391% over 16 and a bit years. This is far superior to the returns on offer in the European high yield and European equity markets over the same time period, which were 155% and 43% respectively.

Our analysis shows that there is a strong seasonal effect evident in European high yield markets, where returns are more volatile and there can be large upside and downside contributions due to fluctuations in the capital value of high yield bonds. However, it should be acknowledged that the results have been biased by the fact that major risk-off events (like Lehman Brothers, the Asian financial crisis and the Russian financial crisis for example) have generally occurred between the months of May and October. Nonetheless, historical total returns suggest that there is a seasonal effect in European high yield markets that investors should probably be aware of. Ignoring transaction costs or tax implications which would eat into any total returns, a strategy of selling investment grade or high yield corporate bonds in May and buying government bonds until November would have produced superior returns relative to European government bonds, investment grade corporate bonds, high yield corporate bonds and European equities.

Whilst it is always dangerous to base a trading strategy around a nursery rhyme, based on historical total returns there does appear to be a bit of sense in selling risk assets in May, retreating into government bonds which would likely benefit most in a risk-off event, and adding risk back into fixed income portfolios in November. But of course, another old saying still rings true – past performance is not a guide to future performance.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox