Burrito Bonds – an example of the retail bond market

One of our local burrito vendors has been advertising a new 8% bond to its customer base. The company, Chilango, wants to raise up to £3m to fund expansion of its chain in central London. This will be done via a crowd sourced retail offering that’s already drawn some interesting coverage in the financial press. Having performed some extensive due diligence on the company’s products as a team, we can safely say they make a pretty good burrito. However, when we compare the bond to the traditional institutional high yield market, we have some concerns that investors should be aware of.

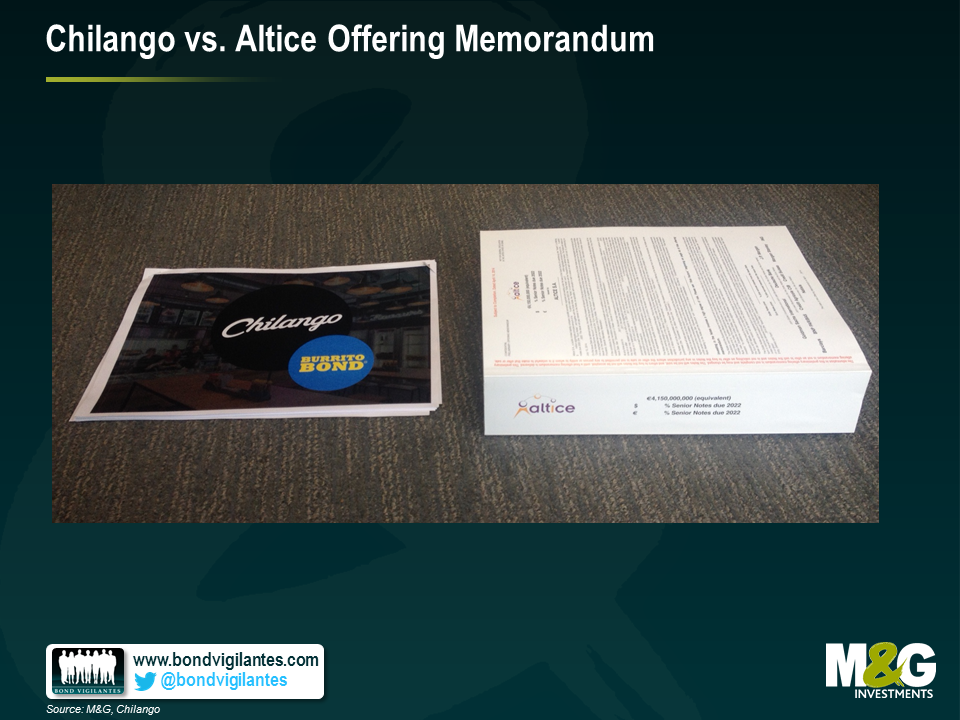

- Disclosure – a typical high yield bond offering memorandum (the document that sets out the rules of the issue, its risk and all the necessary historical financial disclosure) can be several hundred pages long. Producing this is a very time intensive and expensive process, but a valuable one for producing a host of useful information for potential investors. Additionally, a law firm and an accounting firm typically sign off on this document, effectively staking their reputation and incurring litigation risk based on the veracity of the information disclosed.

In contrast, the Chilango’s document is 33 pages long, with some fairly superficial financial disclosure. The photo below illustrates this comparative informational disadvantage and the relative lack of depth in financial information compared to a recent institutional high yield bond offering from Altice.

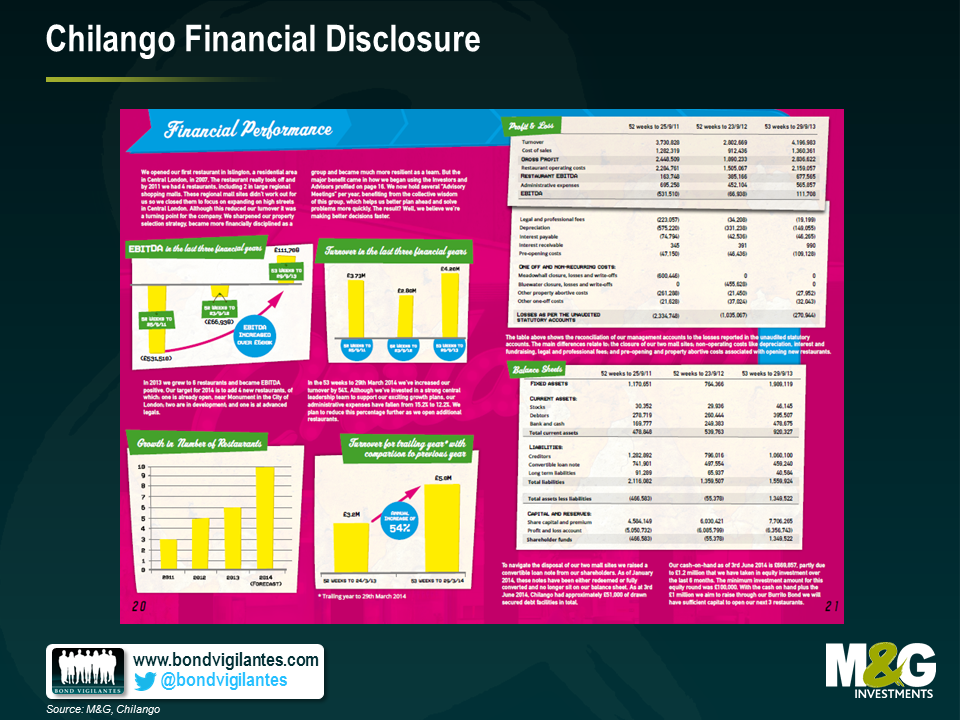

- Financial Risk – there are two big potential concerns here. Firstly, the starting leverage for the bonds is potentially quite high. Using some admittedly finger in the air assumptions regarding the potential cash flow of each new outlet opened (a necessary approach given poor disclosure), leverage could be around 6.0x Net Debt/EBITDA in 2015. This is certainly at the riskier end of the high yield spectrum. The second major concern is that we don’t know for certain how much debt the company will raise. Chilango state that they target at least £1m in this issue, but are willing to raise up to £3m, leverage is likely to be north of 10x (again this is a best guess). All this means the bonds would in our opinion get at best a CCC rating, right at the riskiest end of the credit rating spectrum for sub-investment grade bonds.

- Security – Chilango state very clearly that these bonds will be unsecured instruments. This means that in the event of a default, the creditors will rank behind any secured creditors. There appears to be limited existing secured creditors, but we see nothing in the documentation to prevent a layer of new secured debt being raised ahead of these notes (something that is a common covenant in institutional bonds deals). Consequently, it’s prudent to assume that in a default situation the recovery value of the bonds is likely to be significantly below face value. This equity-like downside means investors should demand an equity-like return in our view.

- Call Protection – these bonds are redeemable at the option of the issuer at any time. Consequently, investor returns could be materially curtailed due to the lack of call protection. Call protection is the premium over face value the investors get when the issuing company redeems the debt early (their call option). Thus some of the benefit also accrues to the bondholder. Take the following return profile:

8% Bond, Callable at Par Years Outstanding Total Return 1 8% 2 17% 3 26% 4 36% If the plan to open new branches goes well, the bond investor should be happy right? Wrong. If this happens, the company may well look like a less risky prospect and will be able to raise debt finance more cheaply. Let’s say a bank offers them a loan at 5%, they could then redeem the 8% bond early, diminishing the total return to bondholders (as per above), and save £90,000 a year on interest costs per year (assuming they issued £3m bonds). Again, call protection is a common feature of the institutional high yield market which protects investors in these situations.

- Liquidity – these are non-transferrable bonds. This means that a) the company does not have to file a full offering memorandum hence the lack of disclosure and b) it will not be possible to buy or sell the bonds in a secondary market. This is more akin to a bilateral loan between an individual investor and the company, with the investor in it for the long haul. Consequently, an investor will neither be able to easily manage their risk exposure nor will they be able to take profits should they so wish before the bond is redeemed.

- Value – we can see that there are many risks – but to be fair that is the nature of high yield investing. So the real question is, “is 8% sufficient compensation for this risk”. The good news is that this bond has a unique bonus coupon in the form of a free burrito a week for anyone prepared to invest £10,000. At current prices, this equates to 3.63% additional coupon (a steak, prawn or pork burrito with extra guacamole is £6.99), so an all-in coupon of 11.63% (8% cash + 3.63% burrito).We’d argue that a “burrito fatigue factor” should be applied, simply because you may not want a burrito every week and you will probably not be physically near a Chilango every week to cash in this extra coupon. A 75% factor feels about right, which reduces the burrito coupon to 2.72% and the all-in return to 10.72%. So is 10.72% a fair price? To get a sense of this we can look at some GBP dominated CCC rated institutional bonds in other asset light industries

Bond Price Yield Phones 4 U 10% 2019 90.5 12.7% Towergate 10.5% 2019 98.5 10.9% Matalan 8.875% 2020 101.5 8.5% Average: 10.7% By coincidence, the all in coupon of 10.7% is bang in line with the average of this (very limited) group of comparable bonds. However, I’d argue that the Chilango bonds should be significantly cheaper than the bonds above due to higher leverage, no liquidity, no call protection and the lack of disclosure. What should this differential be? Again, there is no scientific answer, but our starting point would probably be in the 15-20% range, and only then with some more certainty around the potential maturity of the bond and the ability to share in the future success of the company.

So, much as though we would all enjoy the tasty weekly coupons, our view is that like many of the so-called “retail” or “mini” bond offerings, the Chilango burrito bonds stack up poorly against some of the current opportunities in the institutional high yield market.

M&G has no financial interest in seeing this issue succeed or fail, either directly or indirectly.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox