Exceptional measures: Eurozone yields to stay low for quite some time

Richard recently wrote about the exceptional times in bond markets. Despite bond yields at multi-century lows and central banks across the developed world undertaking massive balance sheet expansions the global recovery remains uneven.

Whilst the macro data in the US and UK continues to point to a decent if unspectacular recovery, the same cannot be said for the Eurozone. Indeed finding data to be overly optimistic about is no easy task. Both consumer and business confidence indicators continue to point to a subdued recovery; parts of Europe are technically back in recession and inflation readings continues to disappoint to the downside. The most recent CPI reading came in at a mere 0.4%, German breakevens currently price five year inflation at 0.6% and longer term expectations have shown signs of questioning the ECB’s ability to deliver on the inflation mandate.

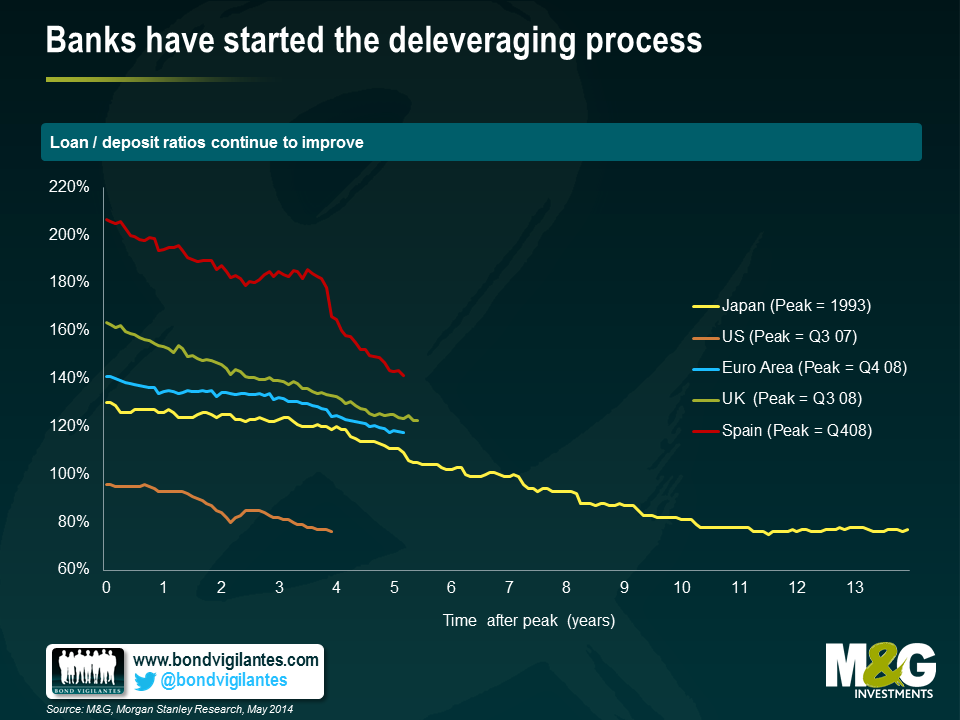

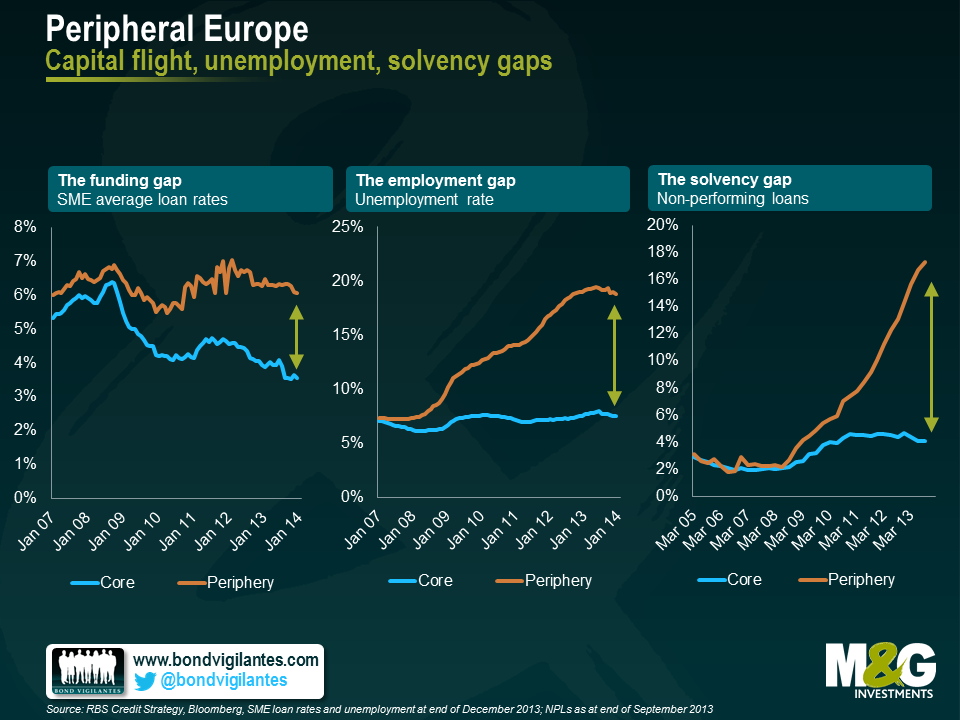

Recognising the sheer size of the Eurozone banking system remains key to understanding the challenge Eurozone policymakers face. With a banking system over three times larger than the US (relative to GDP); significantly higher non-performing loans and massive pressure to deleverage as shown in the first chart below, it is unsurprising that the so called transmission mechanism appears damaged. The failure to pump credit into the Eurozone economy, especially into the periphery, continues to weigh on funding costs for SMEs & promote exceptionally high levels of unemployment. These are only now beginning to stabilise at elevated levels as shown in the second chart below.

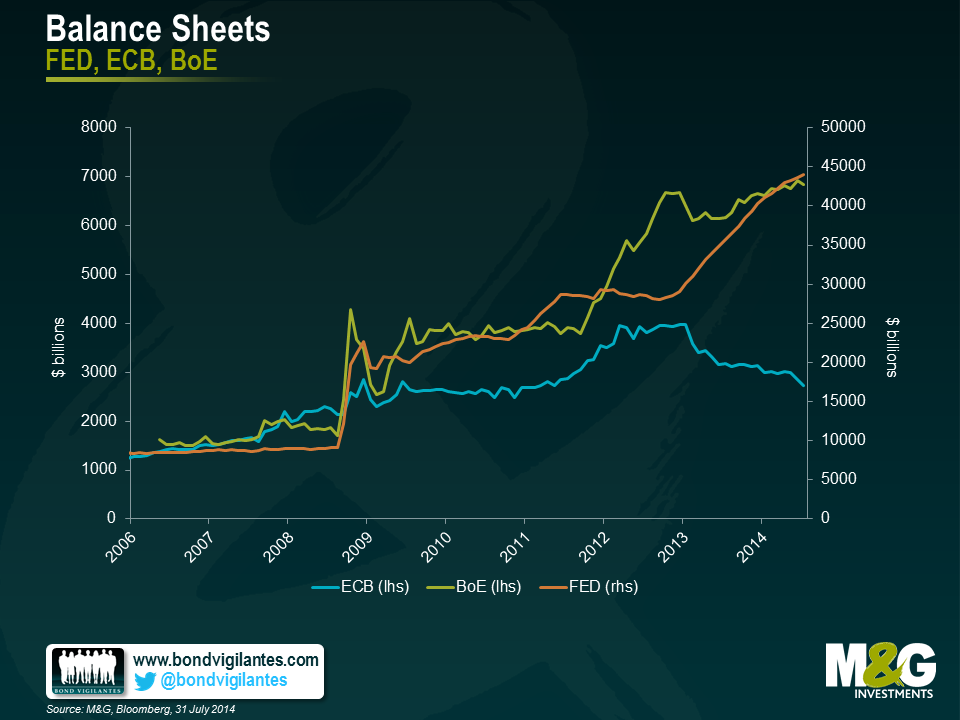

With previous demands for austerity in Europe preventing economies from running counter-cyclical fiscal policies and uneven progress in structural reform, the onus continues to fall on monetary policy and the ECB. And yet for a variety of reasons the response has fallen considerably short of that from the FED, BoE & BoJ, who have been happy to expand their balance sheets considerably.

The result has been, an overvalued Euro, imported disinflation and a lack of investment. Having offered re-financing cuts, forward guidance, massive liquidity in the form of the LTRO & TLTRO, the ECB will ultimately be forced to follow other central banks in undertaking broad asset purchases.

Whilst these broad asset purchases or QE are unlikely to be unveiled today, they are the only likely means in the near term, of ensuring that the banking system in Europe is able to extend significantly more credit to the real economy. This in turn should help to raise inflation expectations, boost potential growth and allow the ECB to fulfil its mandate.

In Europe exceptional times call for exceptional measures. The ECB isn’t done, even if certain members will have to be dragged kicking and screaming to the QE party. I expect European bond yields to stay low for quite some time.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.