Are wages at the tipping point in the US labour market?

Five years into the US recovery, the labour market is quickly returning to full health. Hiring activity is picking up, employers have added a robust 1.3 million jobs over the past 6 months and the unemployment rate is rapidly approaching a level that could prompt the Fed to start thinking about raising interest rates. All labour market indicators seem to have improved except for the one that workers should care most about: wages.

Indeed wage inflation has been the key missing piece of the recovery puzzle, and the lack of it appears somehow contradictory in the context of a rapidly improving economy. A valid reason could be that wages are widely known to be a pro-cyclical lagging indicator. An alternative, as Federal Reserve chairwoman Janet Yellen recently pointed out, is that wages didn’t quite adjust enough during the deep recession and will only rise once employers catch up for the “overpayments”.

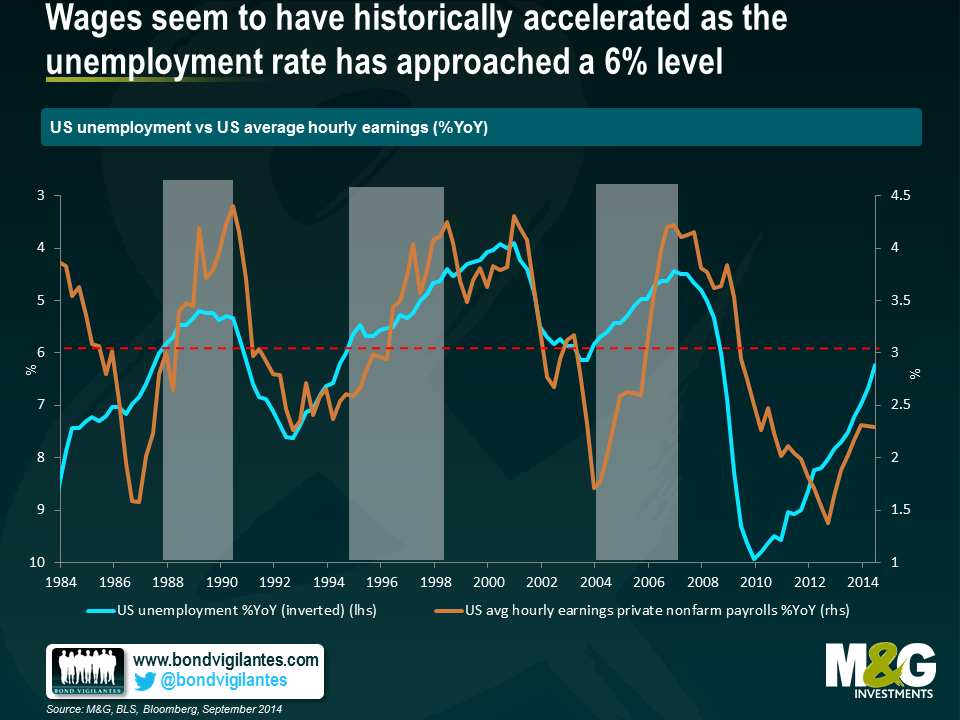

As the US economic recovery marches on and corporates continue strengthening, the labour market could soon see wage growth begin to accelerate. Economic history has always been a great place to search for clues to future economic performance with the added benefit of hindsight. A look into 30 years’ worth of US labour market data reveals an interesting relationship between headline unemployment and wages, measured by hourly earnings of all employees on private nonfarm payrolls. As is shown in the chart below, wages seem to have historically accelerated whenever the US unemployment rate has touched, or come close to, a 6% level. History may not repeat itself, but it could well rhyme.

With unemployment sinking to 6.1% and nominal wages heading upwards, the US economy could be approaching full employment faster than the Fed may think. What unemployment rate is consistent with full employment is a subject very much open to debate. The Federal Open Market Committee (FOMC) estimates the current non-accelerating inflation rate of unemployment(NAIRU i.e. the level unemployment can fall to without causing capacity problems and demand pull inflation) to be at around 5.4% with concerns around labour underutilisation, but rising wages would suggest it is higher.

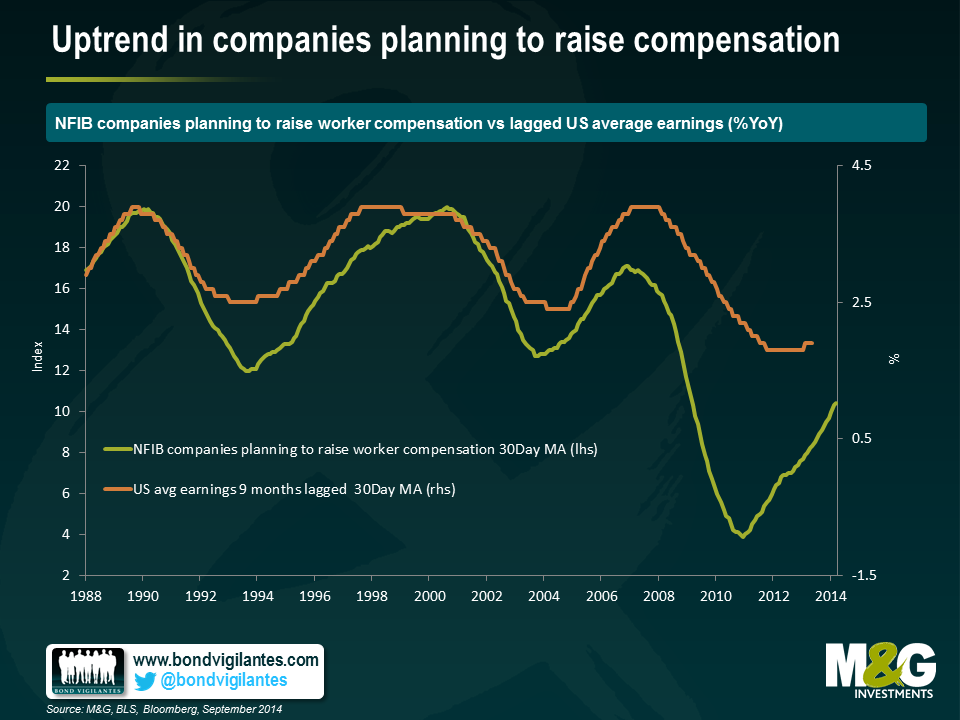

A further sign of emerging wage pressure can be found in the forward-looking National Federation of Independent Business(NFIB) compensation plans index, which is best known for anticipating wage increases to small businesses over the next 12 months. This index seems particularly relevant given SMEs (i.e. those with fewer than 500 employees) are the true backbone of the American economy– responsible for creating two out of three net new jobs. The chart below shows the NFIB index has been gaining momentum over the past year and is now at levels last seen prior to the recession.

The most recent Job Openings and Labour Turnover Survey (JOLTS) report conducted by the Labour Department shows job vacancies have risen back to pre-crisis levels as a high percentage of employers are having trouble finding skilled workers. To attract the needed candidates, employers are having to raise compensation. Interestingly, comparing the NFIB index with lagged earnings data reveals a strong correlation over time. With the number of firms expecting to raise compensation on a strong upward trend, wages are likely to follow through.

As the labour market continues to tighten, it will not be surprising to see further wage growth build up. Most wage measures (including the widely followed Employment Cost Index and Unit labour costs) are on a clear uptrend today which is likely to continue unless economic growth slows or we were to see a sudden leap in productivity. Back in 1994, when the Fed had just started a series of aggressive rate hikes, US wage growth was only 2.4% YoY. Today, wage growth is 2.5%. Yet, Fed speakers have argued some slack remains in the labour market, hence the need to maintain a very patient policy stance – but could the prospect of rising wages in an economy rapidly approaching full employment be the tipping point that prompts the Fed to change rhetoric?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox