Conservative QE and the zero bound.

It has been a while since we talked about QE, but we covered this substantially in the past (see for example ‘Sub Zero?’, ‘QE – quite extraordinary‘ and ‘Quantitative easing – walking on custard‘). It now appears, at least for the time being, to be a part of monetary history in the UK, and more recently the US. However, it is being reapplied in Japan and about to do a grand tour of Europe. Our earlier blogs were an attempt to analyse a new experiment. What do we think now we have had the practical implication of the theory?

Let’s go back to basics first. Monetary policy reaches the zero bound, so short term interest rates can no longer be cut. Therefore it is time to print money. Being prudent, the central bank needs to be able to tighten policy again at some point by destroying the printed money. So it favours purchasing large, liquid, risk free debt and buys government bonds in huge quantities.

This drives longer term interest rates down to the zero bound, and therefore should encourage long term borrowing, discourage long term saving, increase asset prices that are a function of long term rates (property and equity), and therefore via the wealth effect, stimulate growth.

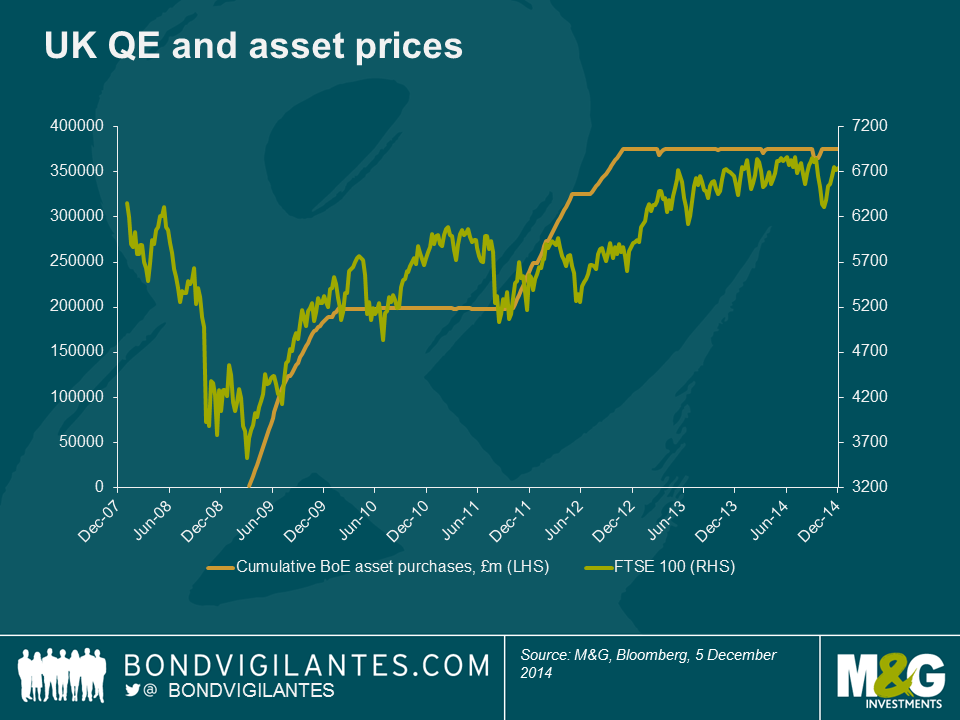

The above effects and especially the wealth effect are seen as proof by its supporters that QE has worked via higher asset prices and this chart is often used as evidence of the correlation between the two.

Asset prices have risen and growth has indeed returned, but where is the inflation?

Inflation has indeed been temporarily induced in countries where the exchange rate has collapsed (for example the UK and Japan). However, this has proved to be a blip in the UK, and will likely be the same in Japan once the yen, which is down more than 50 percent versus the dollar over the past three years, finds a new stable equilibrium.

There are principally two reasons inflation has not returned. Firstly, inflation is not just a monetary creation but is a function of other factors, ranging from the oil price, to productivity, technology, inflationary expectations and free markets. The first of these has been exceptionally volatile, creating cyclical inflation and disinflation spurts, whilst the last four have been a constant driver of structurally low inflation for many years.

Secondly, let’s look at what QE actually does from a monetary perspective. The central bank simply exchanges cash for near cash. Holders of government bonds now own cash having sold them, while the central bank now owns government bonds. Interest rates are lower along the yield curve, but there is no actual new money circulating in the economy. Cash that has been created has been exchanged for another form of cash – government bonds.

Central banks have printed money in a very conservative way, so its growth and inflation effects are limited to wealth effects, and a reduction in long term rates.

The interest rate effect of driving the whole yield curve towards zero will reach its own zero bound, and cease to be effective, like short rates at the zero bound. The wealth effect will diminish as it will reach the bounds of investors’ rational market expectations (like inflation expectations) and asset prices will cease to rise as strongly. The assets that do rise are held by individuals who will reduce their marginal consumption as their wealth increases, or those that can’t access them as they, for example, are in a pension fund. Therefore QE itself, in its current form, reaches a zero bound.

When we first discussed QE, the great fear was that it would result in an inflationary spiral as money is printed prolifically. However, QE has been done in a responsible fashion so far. If it were to return to its philosophical roots, as outlined by ‘helicopter Ben’ in his 2002 speech before the National Economists Club, then you would get inflation. Printing money with nothing in exchange for it is inflationary. Printing money and swapping it for near money (ie government debt) is not quite the same.

Fortunately, monetary and fiscal policy has been effective in restoring growth, though inflation remains low. Will the new member of the QE fan club that is the ECB generate any meaningful long term inflation with its traditional QE programme? I doubt it. No one else has.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox