Duration, duration, duration – a review of bond market returns in 2014

This time last year many thought that duration management was going to be the key to success in 2014. Yields were expected to rise as the Fed weaned the market off QE and began to normalise rates. As a result, only the very brave would have been positioned long duration heading into 2014. To be positioned as such would presumably have taken some explaining, particularly when set against what seemed to be the more logical mantra of short duration/long credit risk.

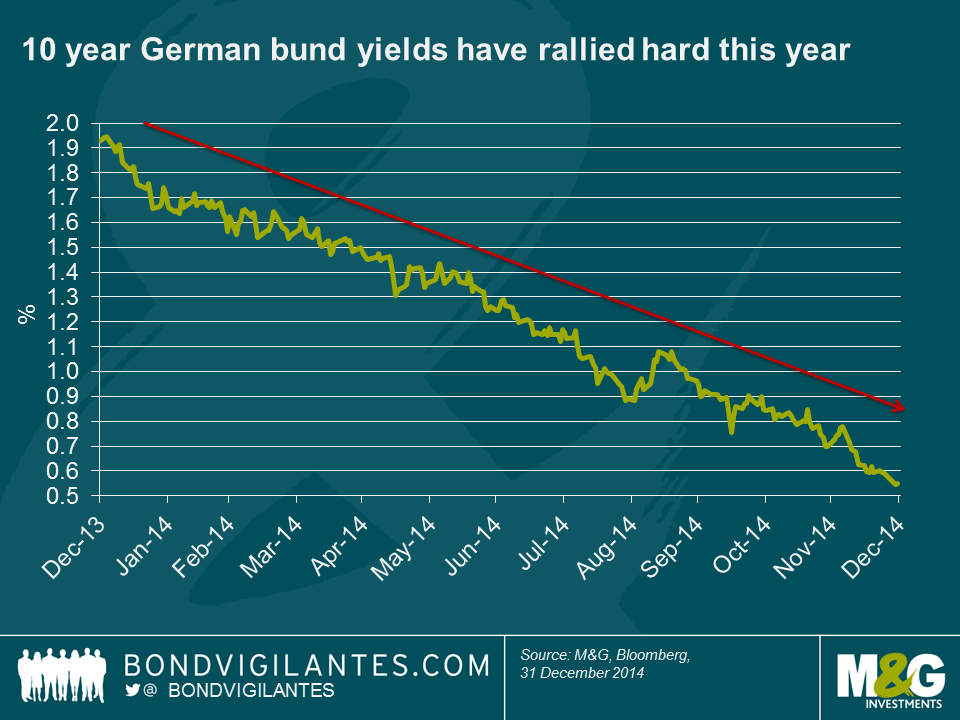

Taking a look back at the returns from selected parts of the bond market, it’s evident that duration was indeed important. But far from it being the short duration asset classes near the top of the tables, the opposite is actually true. Being long duration has paid off as core government bond yields have only really moved in one direction. Perhaps the starkest example of this is the 10y German bund yield, which as I write, is around 0.55%.

Similarly, ten year Treasury yields have fallen from 3% to 2.2% (having traded close to 2% earlier this month) and gilt yields have rallied from just over 3% to around 1.8%.

Yield curves have flattened in 2014.

Short dated Treasury yields bucked the trend, with the 2 year yield rising from 0.4% to 0.7% as the market priced in near-term interest rate rises, while medium and longer dated yields rallied the most across markets, driven by still abundant liquidity, expectations of a lower peak in interest rates and a significant shift in inflation expectations.

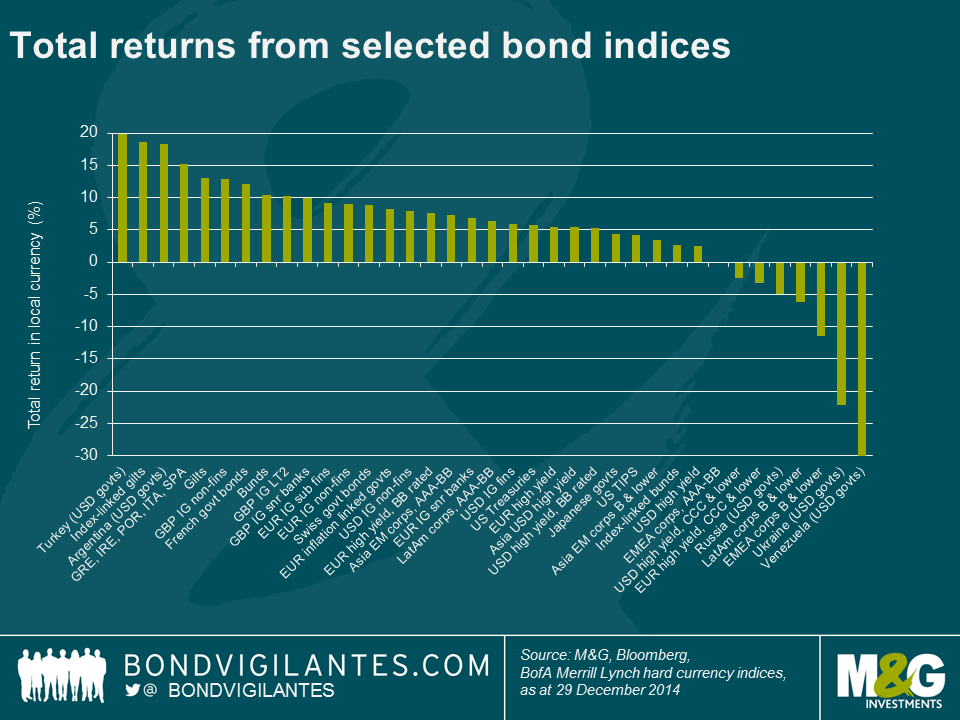

The stellar returns from longer dated assets helps to explain why sterling bond markets have been among the strongest performers of our selection of bond indices in 2014. Index-linked gilts for example, weighing in with a hefty average duration of 20 years or so, have returned a very impressive 18.7% (see Mike’s recent blog for further details) and conventional gilts (average duration just short of 10 years) are up there too, with total returns of 13%. Sterling investment grade credit has therefore also done very well and few would have predicted that GBP IG non-financials would have returned nearly 13% this year. Other investment grade credit markets have also performed well. Despite being significantly shorter duration than the sterling market, euro IG non-financials have returned 8.9%, thanks of course to lower government bond yields but also because European credit, unlike most markets, has seen spread compression continue in 2014.

What may be surprising is that in a year when the US economy has been a standout performer and Europe has been edging closer and closer to deflation, European inflation linked bonds (essentially French and Italian govies) have returned 8.3%, in contrast to US high yield, which has only just made it into positive territory, gaining 2.5%. This index level number masks disparate fortunes for different segments of the US high yield market though. The more rate sensitive BB portion returned a respectable 5.3%, whereas the more credit sensitive, lower rated end of the spectrum (which you might typically expect to perform better in a stronger domestic economy) was one of the few fixed income asset classes in our sample to produce negative returns, at -2.5% for the year. This theme was repeated elsewhere in high yield – for example euro denominated BBs returned 7.5% and CCC and lower rated credit was down -3.3%.

But what of emerging markets? It’s certainly been a very eventful year, with a host of elections, the crisis in Russia and Ukraine, partial default in Argentina, economic crisis in Venezuela, together with a precipitous fall in the oil price to throw into the mix. US dollar EM government bond indices came at the very top and bottom of our rankings for 2014, with Turkey (19.9%) taking top spot, Argentina (18.3%) not far behind, and unsurprisingly Ukraine (-22.2%) and Venezuela (-30.7%) at the bottom of the heap.

So 2014 has been another great year for bonds in the main, but with government bond yields much lower than at the start of the year and credit spreads having tightened significantly from the wides of a few years ago (albeit generally wider than the start of 2014), there’s no doubt it’s going to be difficult for core bond markets to generate such strong returns going forward. But then again it feels as though we’ve been here before…

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox