Default case study: “Ave Caesar, morturi te salutant”

“Hail Caesar, those who are about to die salute you” may well have been the gladiatorial epitaph of choice two millennia ago, but the junior creditors of Caesar’s Entertainment Operating Co are unlikely to feel the same way.

In 2008, TPG and Apollo Global Management, two powerhouses of the private equity industry, led a $30.7bn buyout of Harrah’s Entertainment Inc, the US gaming business. This was one of a wave of large LBOs at the time that was fuelled by the availability of cheap financing. Almost immediately, the debt-laden group began to struggle as the US economy stuttered and with a high debt burden, the group was unable to invest in new growth areas such as Macao. Seven years later, the group’s principal shareholders and secured creditors have bowed to the inevitable, agreeing to implement a large debt restructuring sometime early in 2015*.

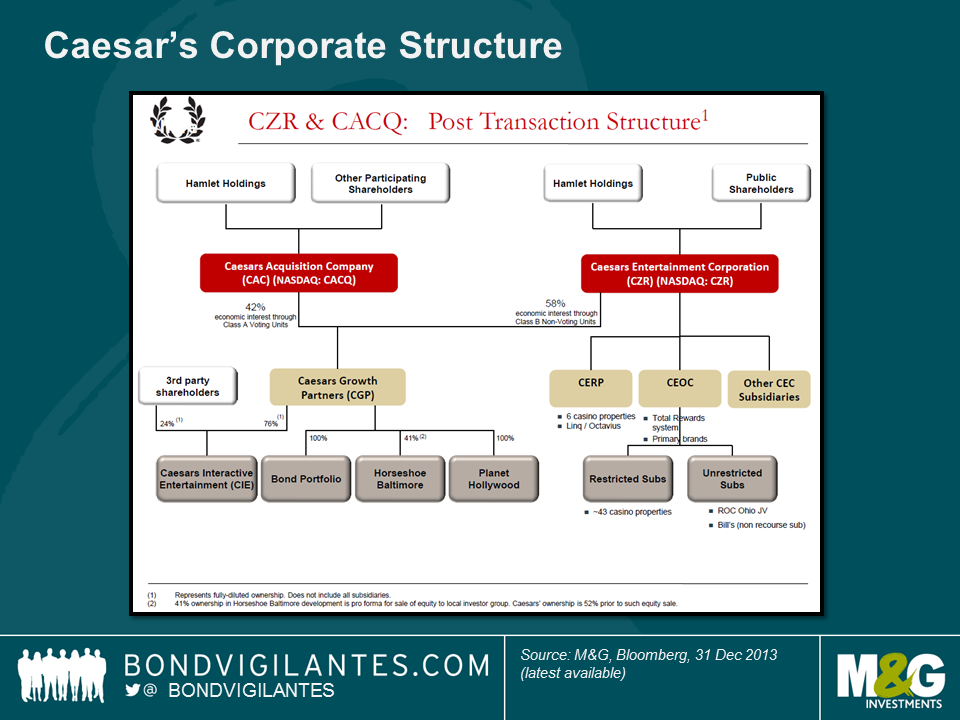

Much like the TXU bankruptcy in 2014, the Caesar’s restructuring will see a wide range of outcomes for its bondholders. Partly, this is due to the inherent complexity of the capital structure (see chart below). There are 3 main issuing entities (Caesar’s Entertainment Operating Co, Caesar’s Entertainment Resort Properties, and Caesar’s Growth Properties) and it should be noted the proposed restructuring will focus on only one of the entities (Caesar’s Entertainment Operating Co). The capital structure is a product of a range of re-financings, asset swaps, equity issues and other layers of financial engineering over the years.

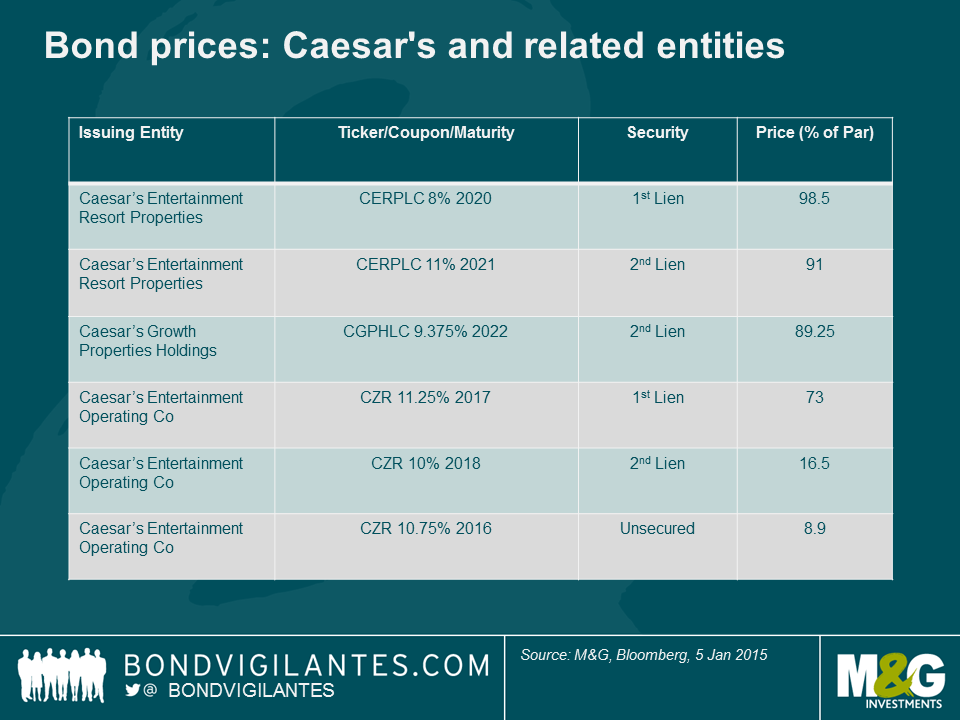

Also, within each issuing entity, there are distinct layers of seniority for various bonds, ranging from 1st lien through to unsecured claims. If we look at where a few of the more liquid bond issues are trading, we can see that the expected recoveries vary from close to par (i.e. next to no impact) for some bonds backed by direct senior claims over a range of properties, to around 12 cents in the dollar for some of the unsecured bonds.

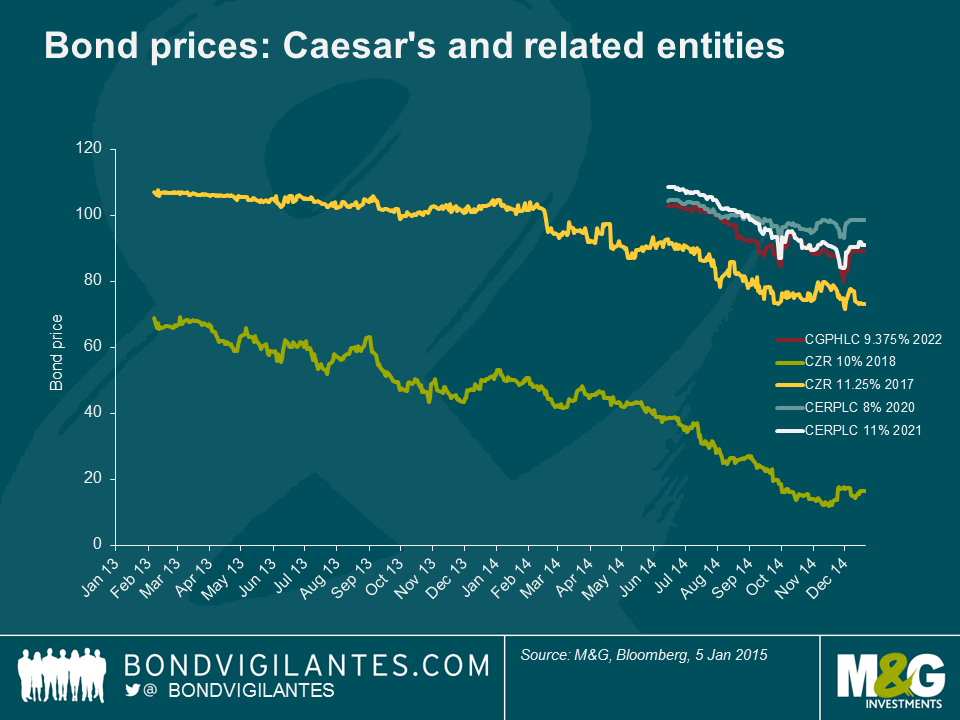

As the restructuring end-game came closer in 2014, the different position in the capital structure was also reflected in the price performance of the bonds. The unsecured claims, whilst already trading at distressed levels at the start of 2013, saw a further market-to-market loss of around 75% over the following 2 years.

This is another default that illustrates the potential downside risk of investing in a highly levered company. However, what the Caesar’s case also shows us is how some of the inherent asymmetry of corporate bond investing (big downside risk to capital with limited upside) can be mitigated by focusing on the more senior instruments within a capital structure. Consequently, the important question bond investors should ask themselves is not necessarily “if” they should lend to a company, but “where” in a capital structure they should put their money at risk.

Full Disclosure: M&G is a holder of Caesar’s Entertainment Resort Properties bonds.

*NB – this is still subject to gaining approval from other creditors and the US courts.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox