Hybrid debt – another beneficiary in the hunt for yield

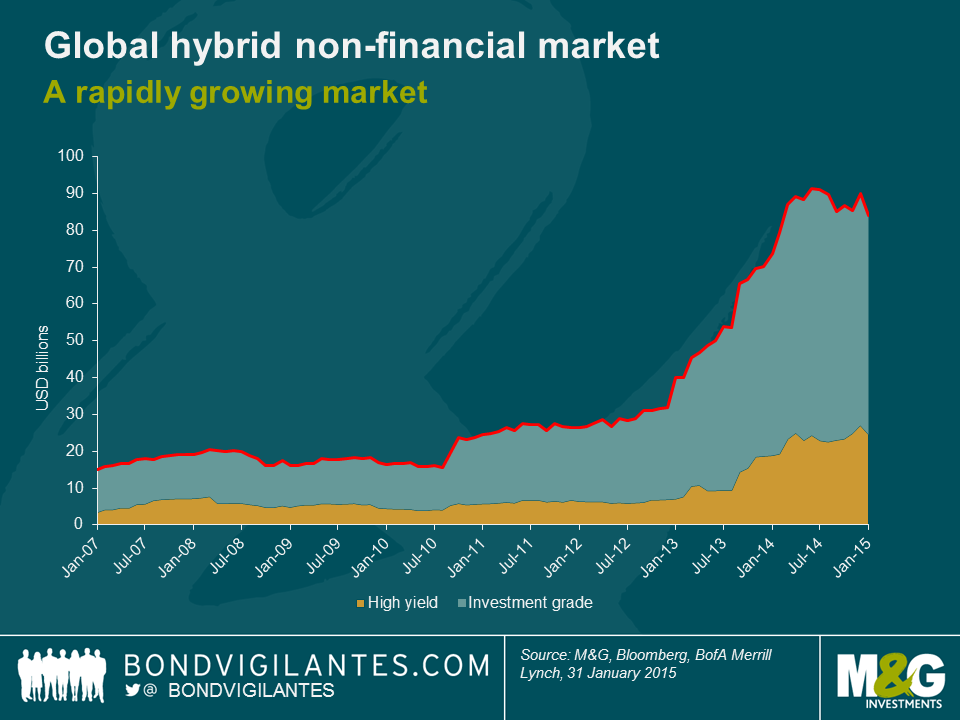

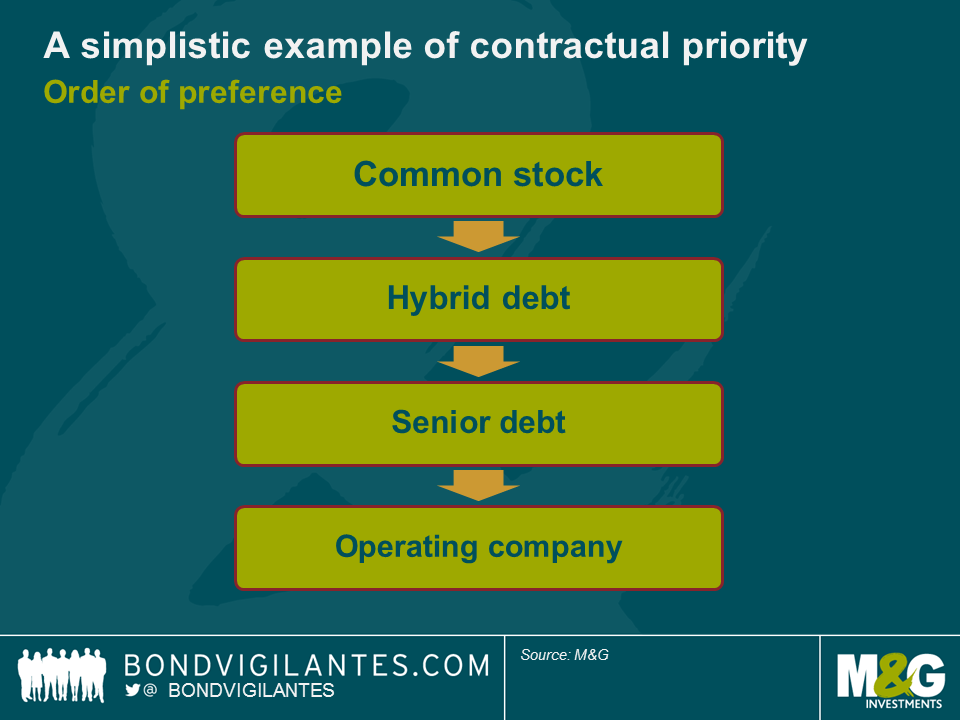

The rapid growth of the hybrid corporate capital market (non-financial) over the last few years has provided fixed income investors with an opportunity to access a quasi-equity income stream. Much like equities, hybrid bonds are perpetual in nature (though an option to call exists), and allow the issuer a degree of discretion over coupon payments. And, whilst they rank ahead of common equity in the event of liquidation, they are contractually subordinate to the more commonly issued senior debt.

As we wrote in 2010, the incentive to issue hybrid capital is clear. The credit rating agencies assume a degree of equity benefit for the hybrid capital that is dependent upon the issuer and structure in question – this enables support for an issuer’s credit rating that would typically otherwise have to come from good old-fashioned equity. Hybrids don’t require existing owners to be diluted nor are any voting rights sacrificed. Furthermore, issuers are also able to treat hybrids as debt for tax purposes, deducting coupons from taxable income.

The economics from an issuer’s perspective may look something like the following. Let’s make a few basic assumptions: a European company can on average issue equity at 7% and senior debt at 1.5%, which translates to 1% after tax. Let’s also assume that the rating agencies allow 50% equity credit for hybrid capital.

So, to achieve a 50/50 equity/debt mix a company treasurer can either issue a hybrid at, say, 3% whose true cost is 2% after tax; or issue a mix of 50% equity at 7% and 50% senior debt at 1% after tax. The blended cost of the latter is 4%, which is approximately 2% more expensive than issuing a hybrid.

Thus the argument for issuing hybrid capital is a fairly compelling one and is likely to feature for years to come in fixed income markets. However, from an investor’s perspective, the case is perhaps a little more nuanced.

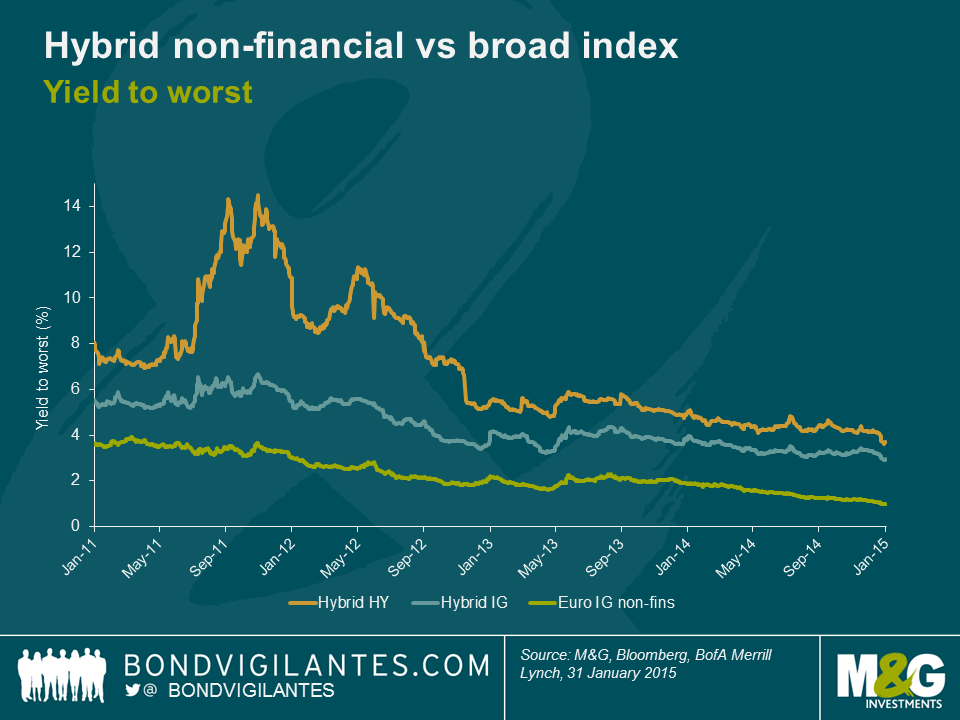

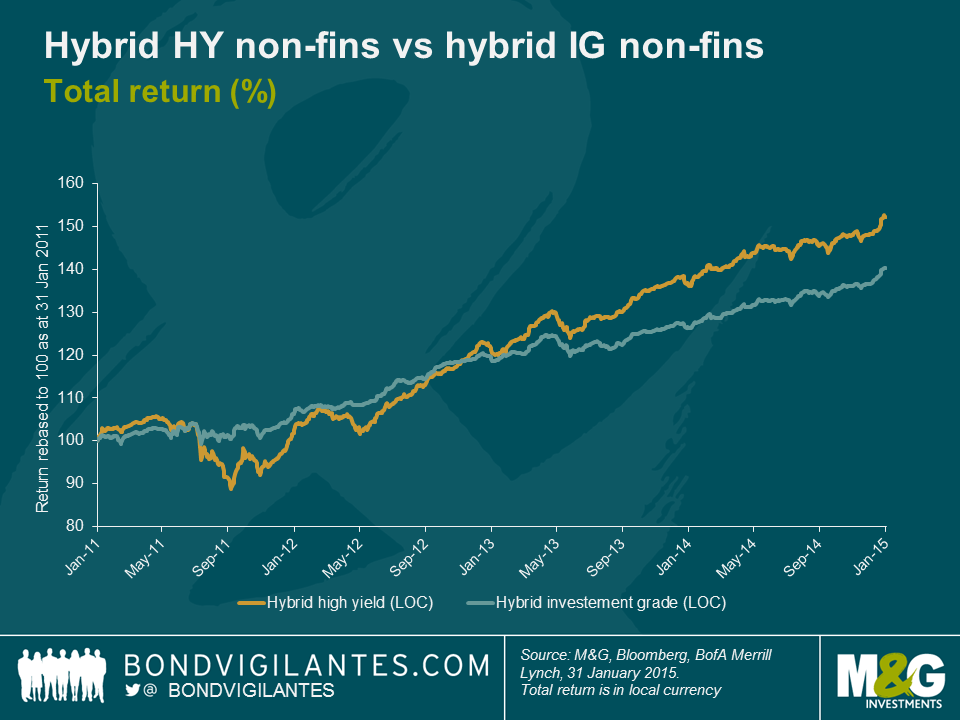

Like all financial market assets the hybrid capital market has been supported by an extremely benign discount rate in recent years. In a world of scarce yield and a desire for exposure to large, multi-national corporates the hybrid market ticks many boxes. In fact, to replicate the average yield available from corporate hybrids with an average rating BBB/BBB- , an investor would need to invest in the senior debt of BB-/B+ rated companies – essentially giving up four notches, not forgetting that hybrid notes are already rated several notches lower than their parent ratings due to the contractual subordination.

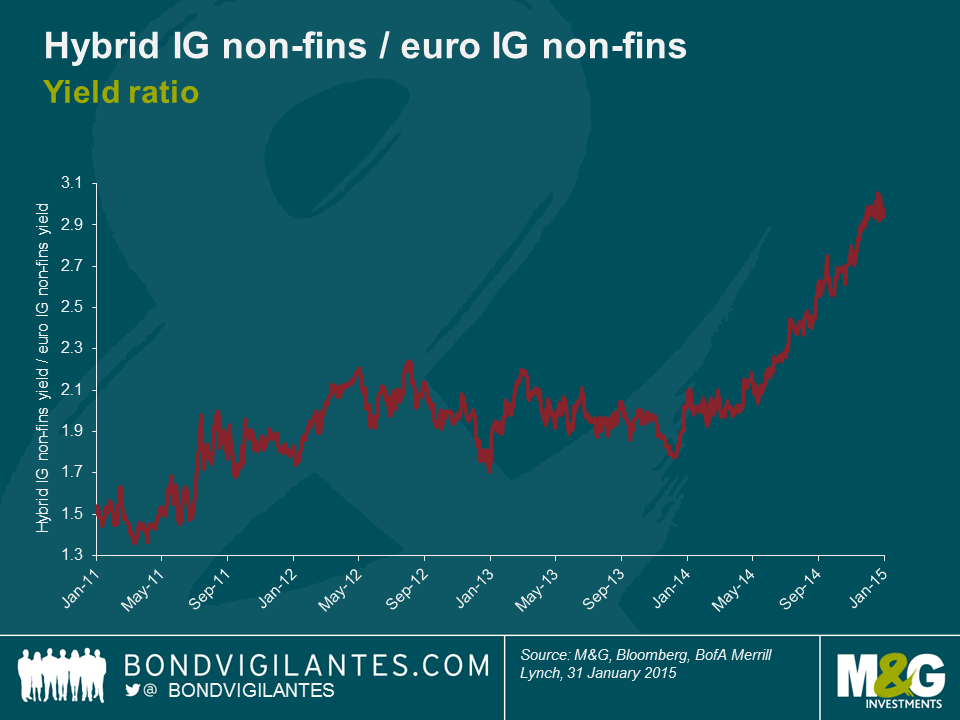

Hybrid capital has already been one of the principal beneficiaries of central bank balance sheet expansion in recent years. In January alone, the universe returned 2.73% after the ECB’s QE announcement. And with high-quality industrial corporate bond yields practically at zero, the ratio between hybrid capital and senior debt looks as attractive as ever, though some caution should be applied given that the denominator is so close to zero.

With European investors as keen as ever to own quality yield we can continue to expect both issuers and investors to look upon the market favourably. Whether both sides of the equation will look back on these securities with the same fondness in several years’ time is anyone’s guess.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox