The M&G YouGov Inflation Expectations Survey – Q1 2015

Economic policy hawks love inflation expectation surveys. As do bond fund managers, who like to keep a close eye on inflation to ensure that fixed income returns aren’t being eroded away. Provided that inflation expectations are close to target, we tend to argue expectations are well anchored and thus central bankers can rest easy. However, the monetary policy actions undertaken by many central banks this year suggests some have had a few restless nights pondering the future of their respective economies. Given the nature of the policy moves which have been largely easing in nature, it suggests that central bankers are concerned that price stability is under threat.

Of course, price stability is not under threat to the upside. This would have had the hawks screaming. Rather, the spectre of deflation haunts central bankers in 2015. The collapse in oil prices (which are not only a function of excess supply, but also deficient demand) has quickly fed through into official inflation numbers. Deflation is a reality for many consumers across the euro area, prompting the European Central Bank to embark upon an aggressive quantitative easing programme. Deflation in the UK is a distinct possibility, with the CPI unchanged in the year to February. Interest rate hikes in the UK now appear further away and may not happen this year at all.

The results of the M&G YouGov Inflation Expectations Survey carried out in February 2015 reveal that consumers’ short-term (one year ahead) inflation expectations continue to moderate across most regions. In the UK, short-term inflation expectations fell to 1.5%, down from 2.0% recorded in November last year. Over the long term (five years ahead), median expectations remain stable at 3.0%. In Europe, inflation expectations have generally remained flat or fallen over the short and long term. Similarly in Asia, households’ expectations for price increases have moderated across the board.

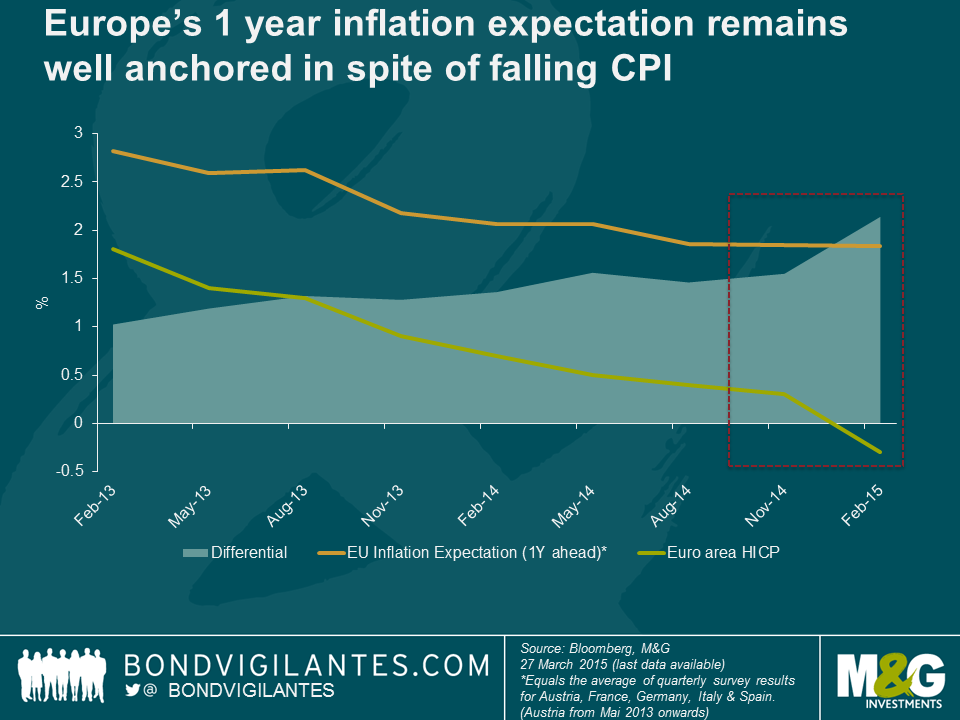

Despite inflation expectations being well anchored in the euro area, it is interesting that the differential between inflation expectation and realised inflation has been widening since the inception of the survey. This will comfort Mario Draghi and the ECB. Despite deflation in the euro area, short-term inflation expectations remain firmly around the ECB’s price stability target of close to 2%.

Central bankers should be encouraged by these results. Whilst our results show a moderation in expectations, they remain at or close to central bank targets over the longer term. In the UK, Mark Carney will be happy that confidence in the Bank of England is at an all-time high with one out of every two consumers confident that the BoE can deliver price stability. Consumers retain a high degree of confidence in the Swiss National Bank as well, despite the collapse of the peg between the Swiss franc and the euro in mid-January.

The full report and data from our Q1 2015 survey is available here. In addition to short-term and long-term inflation expectations, it contains details on central bank price stability, government economic confidence (only 36% of UK respondents think the government is following the right economic policies – up from 23% in Feb 2013), family finances and net incomes.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox