Explaining the collapse in global inflation rates – step forward China

We’ve been worried for years about the prospect of a sharp slowdown in China and the knock on implications for those countries and companies that have grown reliant on a strong China over the last decade, namely commodity exporters, some emerging markets, and particularly emerging market commodity exporters (eg see If China’s economy rebalances and growth slows, as it surely must, then who’s screwed?). Weak trade data over the weekend, together with mixed readings on loan growth and FX reserves earlier this morning, have done little to alleviate these fears.

But potentially the biggest effect that a China slowdown is having on the rest of the world may be in the collapsing inflation rates we’re seeing almost everywhere. It was only a few years ago that most strategists were arguing that an overheating China with its rocketing wages and strengthening Renminbi was set to export inflation to the rest of the world. These forecasts have turned out to be entirely wrong, and instead China seems to be exporting substantial deflation, and that’s over and above the effect that a slowing China is having on commodity prices.

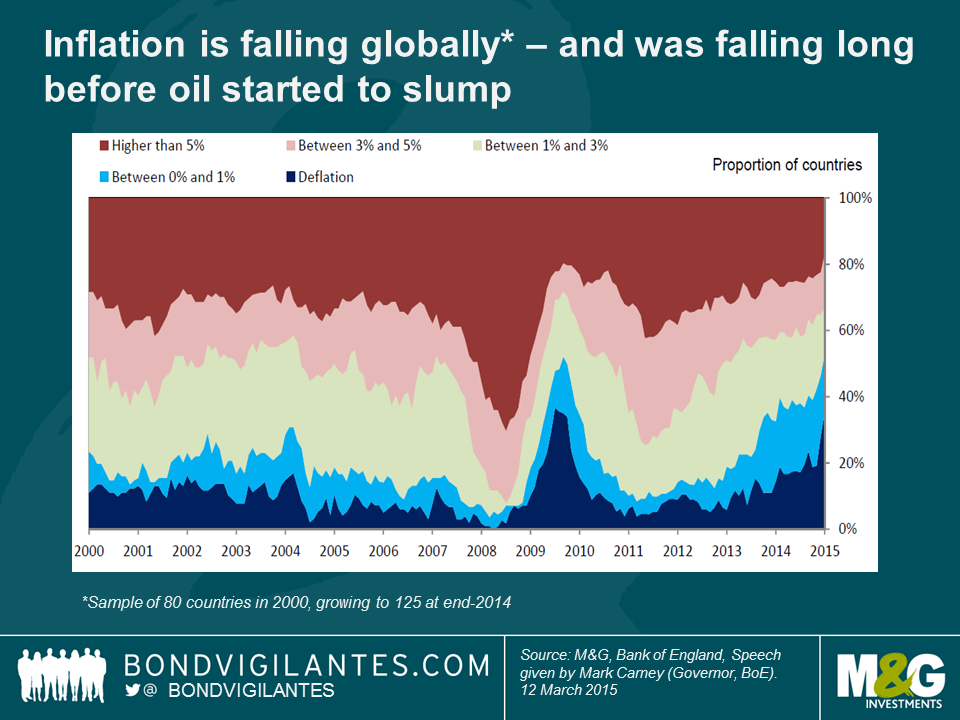

Before getting onto China specifically, the first point to make on global inflation is that, as everyone is aware, global inflation rates have slumped. This has accelerated since commodities fell off a cliff last summer, but inflation rates were already on a downward trend well before this point, as was nicely illustrated in a chart accompanying Bank of England governor Mark Carney’s speech last month (chart reproduced below).

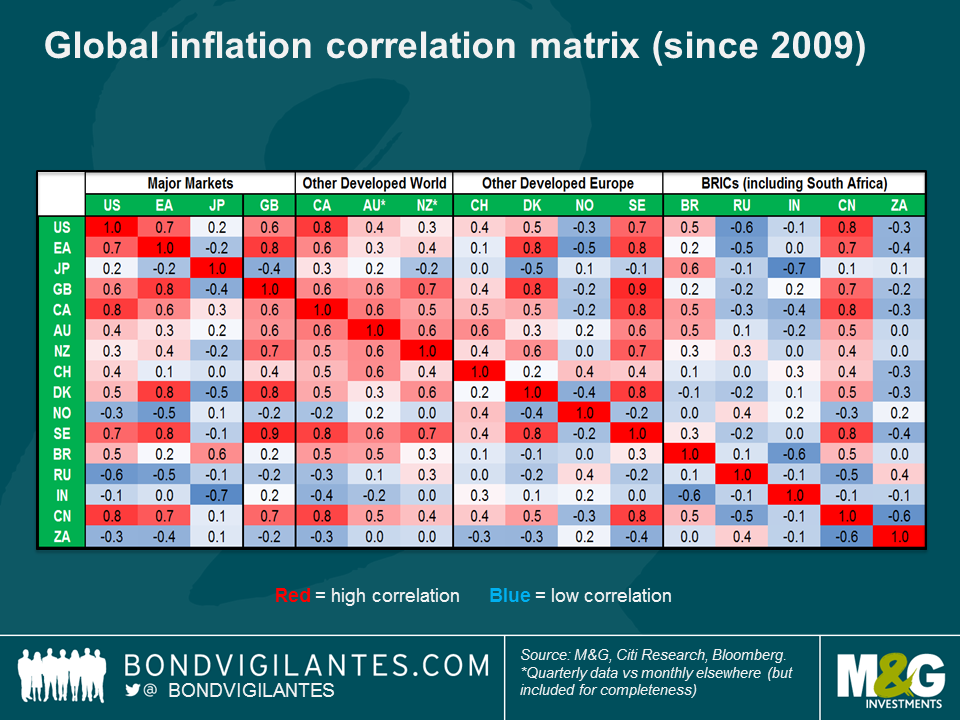

The second thing to note is just how synchronous plunging inflation rates have been. Globalisation, and the economic interconnectedness that this has brought, has meant that domestic factors have withered in importance in determining countries’ domestic inflation rates (for more on this see the appendix to Carney’s speech linked in previous paragraph). Falling inflation rates are not solely a Eurozone or developed market phenomenon either – China’s inflation rate has been highly correlated to all major countries bar the BRICS and Japan, although the lack of correlation of the BRICS and Japan to anyone else probably has a lot to do with the extreme volatility in these countries’ currencies. Jamie Searle and team at Citi Research have elaborated on Carney’s final appendix chart and split out correlations across countries, and as shown in the chart below, Chinese headline inflation has had a correlation of +0.8 with the US, and +0.7 with the UK and the Eurozone since 2009.

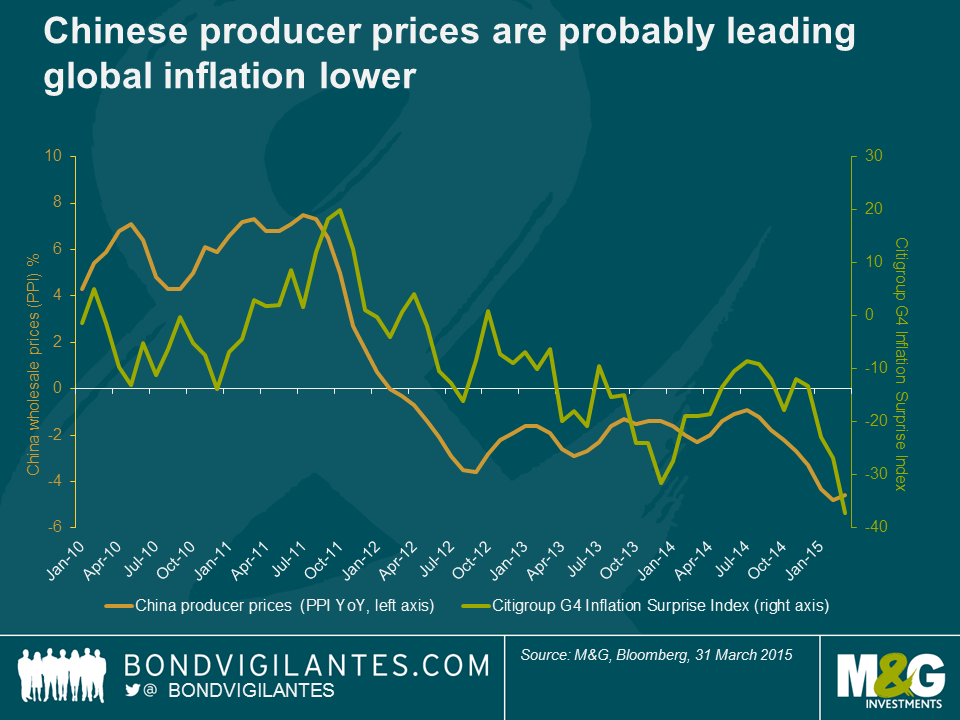

So it’s pretty clear that there is a correlation between China’s inflation rate and those of other countries around the world, but is there causation? Chinese Premier Li Keqiang argued last month that there isn’t, but a study by the Bank for International Settlements (BIS) in 2014 suggested that there is, where they found that a common factor lay behind a bulk of the variation in inflation of a selection of developed economies, and this is statistically mostly explained by Chinese non-commodity export prices (see p54-55) .

The BIS’s findings are supported in the chart below, where I have compared annualised China producer prices (PPI) to Citigroup’s G4 Inflation surprise index, which measures how far above or below inflation data in the main developed countries has come in versus forecasters’ prior expectations. Chinese producer prices are in rampant deflation, with PPI falling 4.6% in the year to March, the 37th consecutive negative month (orange line, left axis). Meanwhile, Citigroup’s inflation surprise index slumped to the lowest level last month since data began in 1999 (green line, right axis). Eyeballing the chart below suggests that China PPI slightly leads developed country inflation surprises, and this chart will understate causality if you consider that PPI is a year on year release and is therefore incorporating data that is up to a year old, whereas Citi’s inflation surprise index is a monthly calculation*.

Why are Chinese inflation rates so low and will this trend continue? The deflationary forces leaking out of China stem from the Chinese authorities’ response to the 2008 crisis, where they embarked on huge infrastructure and investment spending. As previously argued on this blog, the investment bubble has become frighteningly inefficient. The consequence of China’s overinvestment was to create excess supply and overcapacity, which has proven disinflationary, but now China has to also contend with stagnating domestic demand. It’s tricky to see how this dynamic can be reversed over the short to medium term – indeed the Chinese authorities still seem addicted to falling back on infrastructure and investment spending in the face of weaker growth, which is unlikely to help. And if China resorts to depreciating its currency, then global deflation will get a whole lot worse.

In the long term, China needs to substantially boost consumer demand, but people have being saying that for years and it’s proving very difficult to change its economic model. And it is not just China that needs a new policy prescription – the developed world needs to do the opposite, i.e. more investment and infrastructure spending, and probably less consumption, but here too it is proving tricky to change economic models. These problems, in a nutshell, lie at the heart of the stubborn ongoing global imbalances, which while reduced are very far from being eliminated.

* Citi G4 Inflation Surprise Index is an equally weighted measure of headline CPI, PPI and wage shocks in the US, Eurozone, UK and Japan. Interestingly, Citi have found that lagged commodity prices have been an important factor in predicting inflation surprises, with energy and agricultural commodity prices explaining more than half the volatility in the index. This suggests that the consensus forecasts that markets so heavily rely upon have been hopeless in correctly factoring in changes in commodity prices to subsequent changes in headline inflation rates.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox