What are index-linked corporate bonds telling us at the moment?

When in past years I have fielded calls from bankers faintly like Chad ‘Ace’ Jefferson III (A Brave New World: Zero Yield Corporate Bonds) requesting any potential interest in new index-linked corporate bond issues, I have often begun my feedback by pointing to an old maxim. This well-known dogma posits that an index-linked corporate bond should price 25 basis points or so wider than a comparable nominal corporate bond.

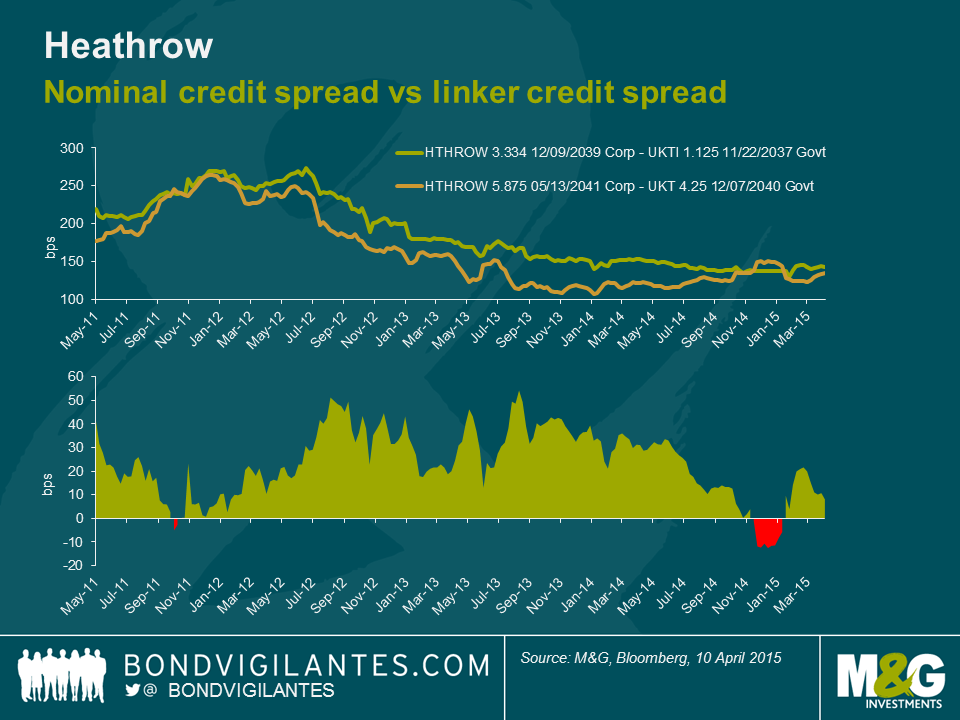

So, for instance, were I to have been shown an offer by Ace in the Heathrow 3.334% 2039 index-linked corporate bond at, for example, the beginning of 2012, I would have looked for a comparable Heathrow nominal corporate bond spread, and as a first step checked that we were being paid at least 25bps more for the linker. At this time, the comparison I would have looked at would have been Heathrow’s 5.875% 2041 nominal bond. The spread at this point in time was approximately 255 basis points over the gilt, and Ace was probably showing me the offer at around 270 basis points over for the Heathrow linker. At only a 15 basis point pick up into the linker, the conversation would very likely have ended there with no purchase made.

Had I got a subsequent offer in the same Heathrow linker at the end of 2013 though, on comparison of spreads between the same bonds I would have been offered the linker on a spread of 150 basis points, when the nominal 2041 bond was offered at about 110 basis points over the gilt. So I was being offered an additional 40 basis points of spread for owning the Heathrow linker versus the nominal. This time, through applying the mentioned dogmatic valuation framework, I would have been much more likely to buy the index linked bond.

Why might investors seek a higher credit spread for buying the linker over a corporate? First and foremost the additional spread compensates for the relative illiquidity of index-linked corporate bonds compared to nominal corporate bonds. Issue sizes tend to be smaller, owned by a more limited pool of investors, with the majority of corporate bond funds’ major investment types being nominal bonds rather than index-linked ones. It is this liquidity premium that gave rise to the desire to receive 25 basis points more than for nominal bonds when buying index-linked corporates, over the long term. Another important factor that could be cited could be that corporate linkers often carry greater default risk, or in particular loss given default risk (the probability of default of the Heathrow linker is identical to the nominal Heathrow bond). As inflation is accrued in the corporate bond, the price rises or the inflation compensation amount grows. But in a default, the investor’s claim is the same as a nominal corporate bond investor’s – a claim on par. This additional risk needs compensating through additional spread.

So, I am unlikely to buy linkers when I am not being compensated for the relative illiquidity compared to nominal bonds, and I am more likely to buy when the spread over nominal bonds is wider than 25 basis points, such as when the Heathrow linker was paying as much as 50 basis points more than the 2041 nominal. The above chart also shows, if the pricing history is to be believed, that earlier this year the linkers were trading with tighter spreads than the nominal. In episodes like this, we should be more inclined to sell. After all, investors were effectively paying a premium for illiquidity!

However, secondary factors can drive this premium up or down over time, such as inflation expectations and the related headline levels of inflation, and perhaps this explains the relative tightness in the comparison in early 2012 compared to the divergence in spreads in late 2013. After all, in early 2012 RPI was close to 4% and had only a few months earlier been close to 6%. Wind the clocks forward to late 2013 and RPI was back down to 2.7%, and investors were less concerned about the threat of inflation.

This week, on 14th April 2015, High Speed Rail Finance, which runs the concession on the high speed rail link between St Pancras and The Eurotunnel, brought a tap of its index-linked corporate bond. In February 2013 the entity issued its first corporate and index-linked corporate bonds. Its £610m nominal bond came at 150 basis points over the gilt, and its £150m index-linked bond came at 175 basis points over the index linked gilt. So, the linker was 25 basis points back of its larger nominal comparable: ring any bells? Yesterday’s tap, though, of the linker came at a credit spread of 107 basis points. And as the chart below shows, this is actually pretty much in line with the spread of the larger nominal bond, and so is close to the extreme tights of the linker-nominal relationship.

So what might we learn from all this?

Firstly, as the Heathrow chart showed, the spread pick up from selling nominal corporates into linker corporates has been coming down since the start of 2014. And yesterday’s tap also suggests that investors are eager to add long inflation protection. One could also cite record lows on long dated index-linked gilts as further evidence of strong demand for inflation protection, even at low yields. This could be driven by fears of higher inflation in the future, but it could also be driven by expectations that index-linked bonds will do better than nominal bonds, on a relative basis (or in other words, that UK breakevens are too low).

Secondly, it could also be that investors want to remove the uncertainty of higher inflation in the future: if you buy and hold the 30 year gilt linker until maturity, you will get RPI-1% (so you will receive CPI, near enough); whereas if you buy the 30 year gilt, your yield will worsen (improve) if inflation rises (falls) over the next 30 years.

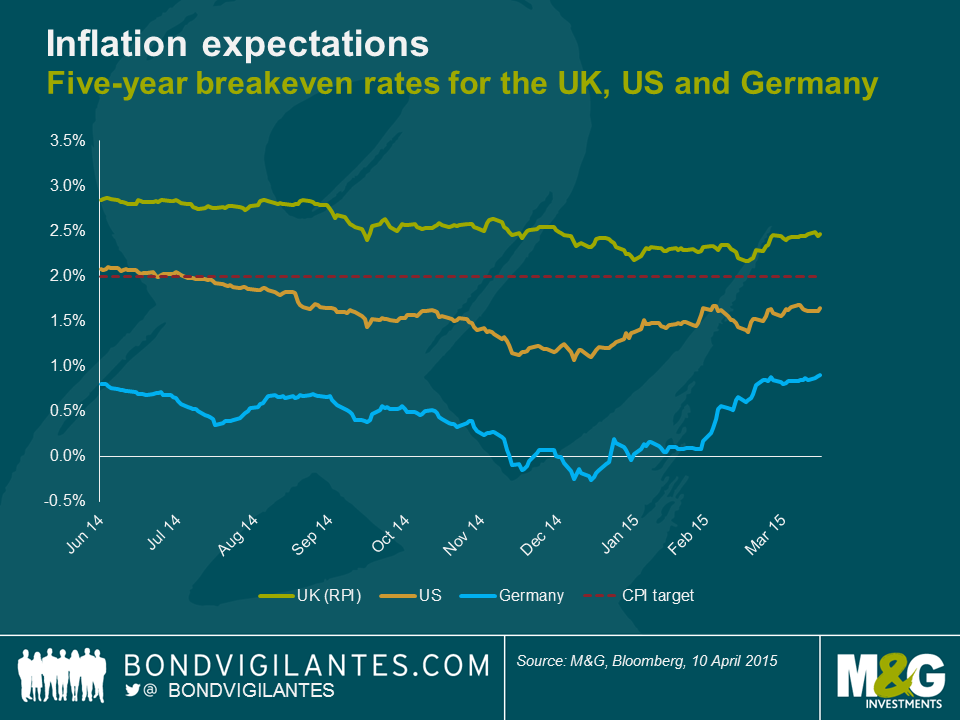

Finally, it could be that investors have taken notice of significant reflation moves in breakevens in the US and in Europe so far in 2015, and are looking for UK linkers to stop lagging and play catch up. 5 year bund breakevens have rallied 100bps more and 5 year TIP breakevens have rallied 60bps more than UK RPI breakevens in 2015 so far.

One should mention the possibility that the strength of the inflation-linked bond market, across both gilts and corporates, could be being driven by liability driven investing strategies, who are relatively price insensitive. LDI is certainly playing a part in driving the inflation market in the UK. However, this just adds a technical tailwind to the already supportive arguments I have made. In my opinion, breakevens in the UK look relatively good value, and would justify the early evidence of improving demand for inflation protection.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox