Investment grade corporate bond market performance in 2015

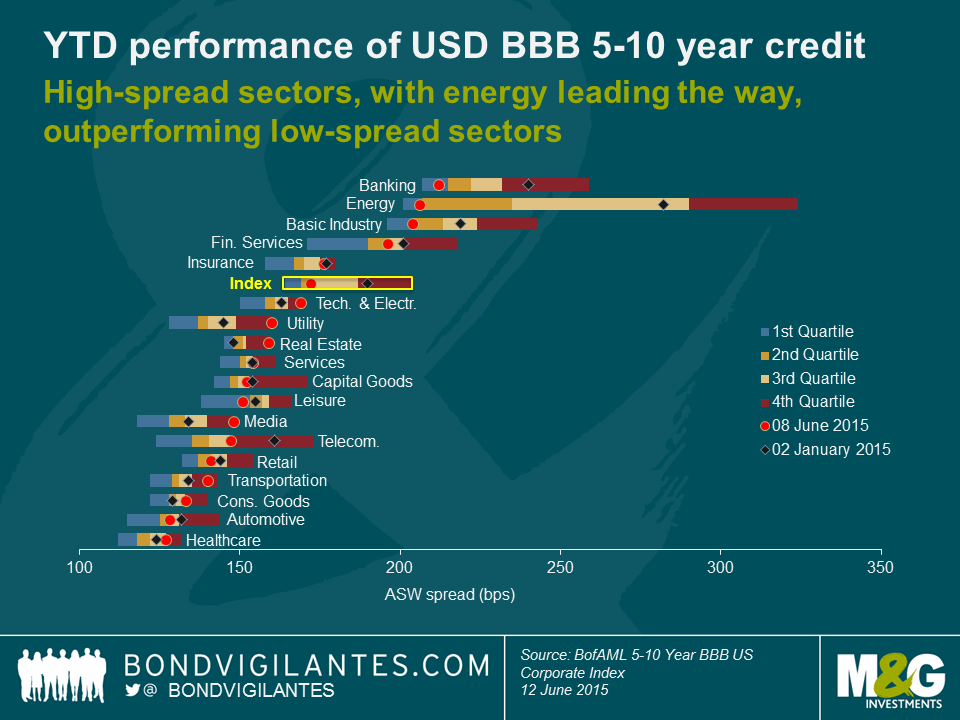

I’ve spent a bit of time in recent days looking at the performance of global investment grade (IG) credit. The chart below shows the year-to-date (YTD) ranges of asset swap (ASW) spreads for USD BBB 5-10 year corporate bond sectors.

Here are our three key takeaways:

- First, on the bright side, the spread of the USD BBB index as a whole has tightened by 18 bps YTD. Despite being modest in magnitude, this overall spread tightening has helped offset – at least partially – capital losses for corporate bond investors caused by rising US Treasury yields.

- Unsurprisingly, against the backdrop of rebounding oil price levels, energy has been the big outperformer (76 bps tighter YTD). Other “high-spread sectors” (i.e., sectors wider than index average) have performed well too, namely banking and basic industry, tightening by 28 and 15 bps YTD, respectively.

- The “low-spread sectors” (i.e., sectors tighter than index average) have fared distinctly worse; all of them underperforming the index. The majority remained pretty much flat YTD in spread terms, whereas some sectors have widened (real estate by 11 bps, media by 14 bps and utility by 15 bps). The notable outperformer amongst the low-spread sectors has been telecommunications, tightening by 14 bps YTD.

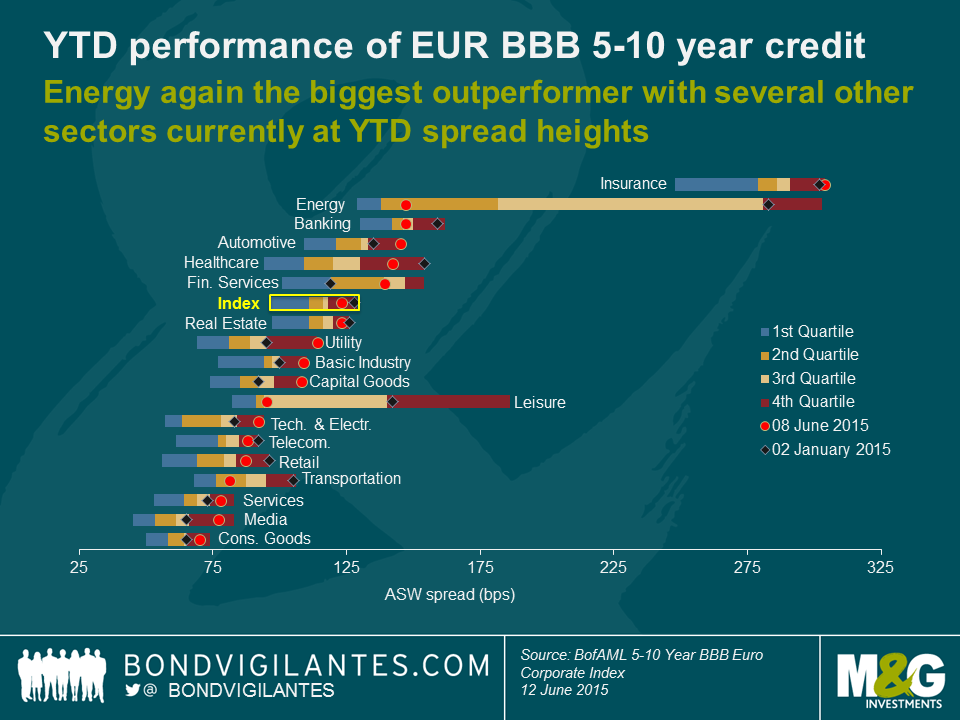

The below chart is a replication of the above, only this time I have focused on EUR BBB 5-10 year corporate bond sectors.

Our key conclusions on EUR market performance:

- The overall EUR BBB index spread has tightened YTD, if only marginally by 5 bps. Hence, in absolute terms the tightening has been distinctly less pronounced than for USD BBB credit. However, it should be noted that EUR BBB spreads started from a substantially lower base (128 bps) than USD BBB spreads (190 bps) at the beginning of the year.

- Just as in the case of USD BBB credit, the stellar outperformer has been the energy sector, tightening by 136 bps. The remaining EUR outperformers – retail (9 bps), banking (12 bps tighter), healthcare (12 bps tighter) and transportation (24 bps tighter) – are fairly evenly distributed across sector spread levels, in contrast to the high-spread sector concentration of outperformers in USD BBB credit. The 47 bps YTD tightening and the wide spread range of the leisure sector should not be overemphasised though. The EUR BBB index currently contains only a single bond (ACFP 2.625 21) in this category, and thus idiosyncratic risk factors overlay sector-specific dynamics.

- Nine EUR BBB sectors have exhibited YTD spread widening. Automotive (10 bps wider), media (12 bps wider), utility (19 bps wider) and financial services (20 bps wider) have shown the worst YTD spread performance. No particular overrepresentation of underperformers amongst the low-spread sectors can be found, in contrast to USD BBB sectors.

The above has implications for relative value investors. USD BBB credit high-spread sectors, with energy leading the way, have shown impressive YTD performance. Thus, the relative value argument for owning USD investment grade credit in these sectors is a lot less favourable for now than it had been at the beginning of the year. Banking, energy and basic industry spreads are currently located within the first quartile of their respective YTD spread ranges, indicating tight levels within the context of their most recent spread history. Furthermore, the gap between high- and low-spread sectors has been narrowing. For instance, at the start of the year USD bond investors could have earned a sizable spread pickup of 153 bps for switching from rather defensive consumer goods bonds into cyclical, volatile energy bonds. This spread difference has shrunk by more than 50% to only 73 bps by now. To us, this doesn’t look like particularly great compensation for the significantly higher level of spread volatility an owner of these types of bonds will likely experience.

Within the EUR BBB universe not a single sector is trading in the first quartile of its respective YTD spread range at the moment. In fact, several sectors are currently at their YTD spread wides (insurance, automotive, utility and capital goods) or very close (basic industry and technology & electronics). Hence, the argument can be made that these sectors are offering compelling relative value compared to their recent spread history. However, EUR YTD spread ranges might be skewed towards lower spread values due to quantitative easing euphoria in the first quarter and hence current values appear overly wide in comparison. In addition, growing fears of a disorderly Grexit and the potential fallout on the Eurozone have the potential to put upward pressure on EUR BBB spreads going forward. Finally, it should be highlighted that although USD BBB spreads have outperformed EUR BBB spreads by 13 bps YTD on an index level, there is still a decent average spread pickup of nearly 50 bps to be earned for switching from EUR into USD BBB corporate bonds.

In general we see decent relative value in IG credit spreads at current levels and remain constructive in terms of corporate bonds, particularly in the USD market. In times of still very low rates, credit spreads offer an additional source of yield for bond investors. Provided that the correlation between rates and credit spreads stays below 1.0, which has historically been the norm, this also gives rise to diversification benefits. In this context, IG credit spreads can help soften the blow for bond investors in a rising rates environment, like they have done in the first half of this year.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox