The Euro, confidence and consumption will drive European GDP

It has been difficult to filter through the noise of the Greece situation these past few months. But when you stop and have a look at the economic backdrop, things don’t look as bad as some of the alarming headlines might have you believe. Some significant economic headwinds have turned into tailwinds, which will likely drive European growth for the next 18 months.

1. The Euro

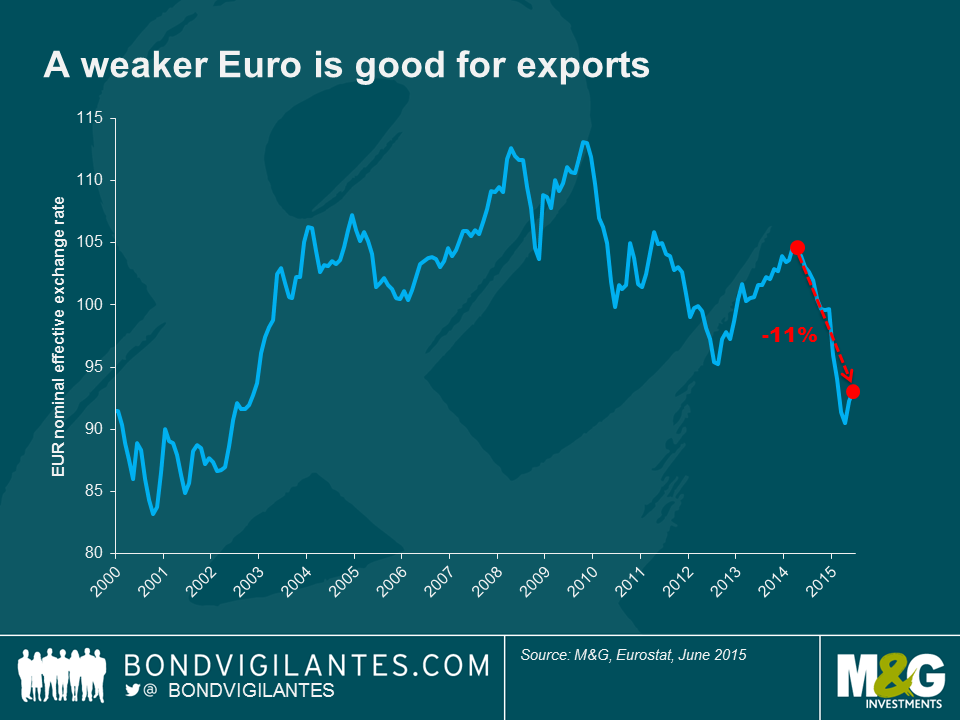

In April, the Euro had fallen to its weakest level in 12 years. Today it remains 11% weaker on a nominal effective exchange rate basis compared to its most recent high point in March 2014. The move higher in the US dollar, caused by expectations that the FOMC could hike interest rates in September has been a big factor in the move. Equally important has been the ECBs commitment to maintain quantitative easing until September 2016. With two of the world’s major central banks maintaining opposite monetary policy stances, it is likely that the Euro could continue to weaken over the medium term. At this stage, there is no reason why the US dollar couldn’t reach parity with the Euro.

This weakening represents a significant easing in monetary conditions and would be extremely welcomed by the European Central Bank. A weaker Euro means stronger export growth, an increase in earnings for European companies, stronger labour markets and rising inflation. This is a major advantage the European economy has at the moment.

2. Confidence

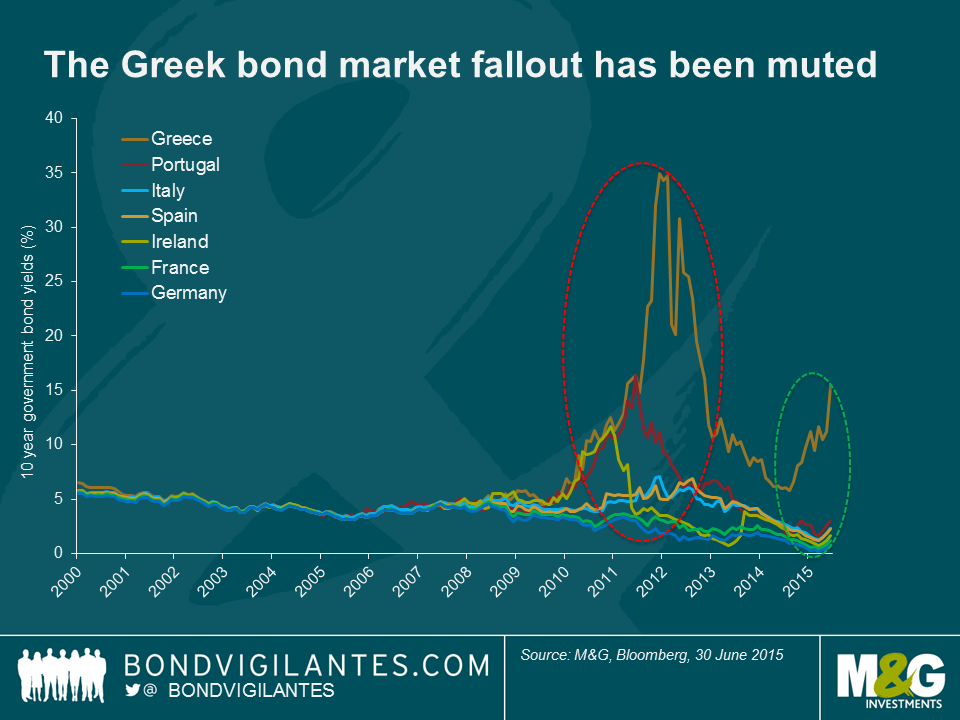

The periods of January 2010-January 2012 and September 2014-January 2015 show how market thinking on Greece and the peripheral nations has evolved in a relatively short amount of time. Between 2010 and 2012, European sovereign bond yields (and particularly those of peripheral issuers) were highly correlated and absolute yield movements were of a similar magnitude. This is in stark contrast to government bond yield movements more recently, where the market treated Greece as an isolated example and bond yields for other European nations fell. It is not a rash statement to say that bond investors today are much less concerned about the Euro falling apart and have faith in the European authorities and their mission to complete Europe’s Economic and Monetary Union.

Whilst yields have risen across the Euro area from the lows visited in April, this is likely the result of rising inflation expectations and economic growth rather than a rise in credit risk premia. The stability witnessed in the bond markets for Ireland, Portugal, Spain and Italy is encouraging to households and corporations alike who will be more likely to consume or invest based on a stable outlook. Indeed, we have seen a large number of European companies issuing debt, locking in low interest rates, terming out their debt and looking to invest in growing their operations.

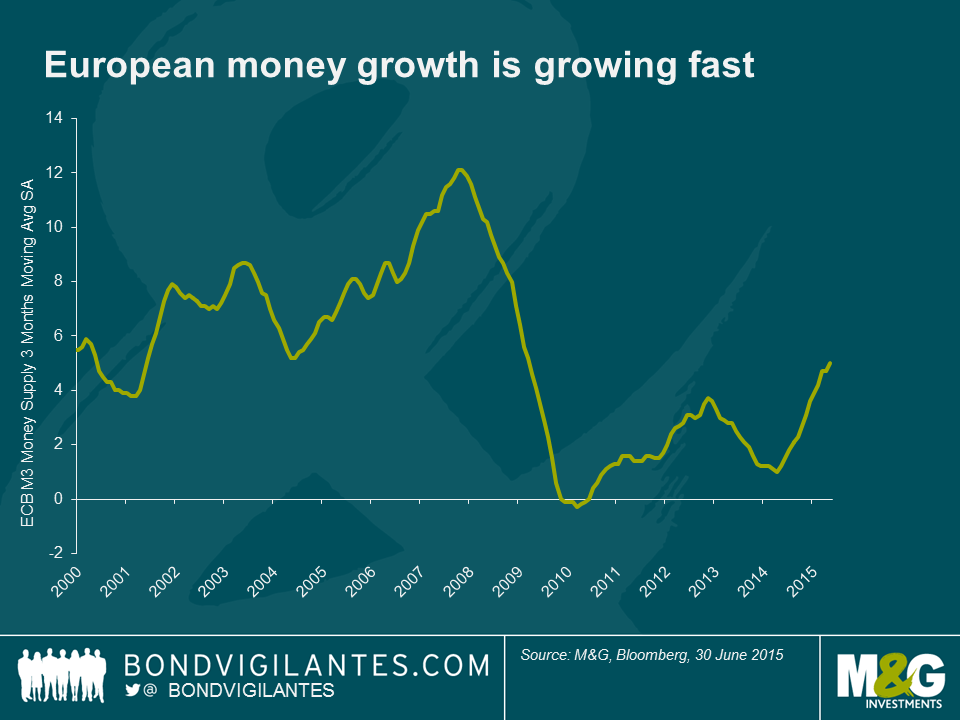

3. Consumption

The outlook for the European consumer is undeniably strong. Low interest rates, falling unemployment (the Spanish economy created over 411,000 jobs in Q2 2015, the highest number since 2005), rising household net wealth through higher asset prices, record real wage growth in Germany and the fall in oil prices all bode well for the consumer.

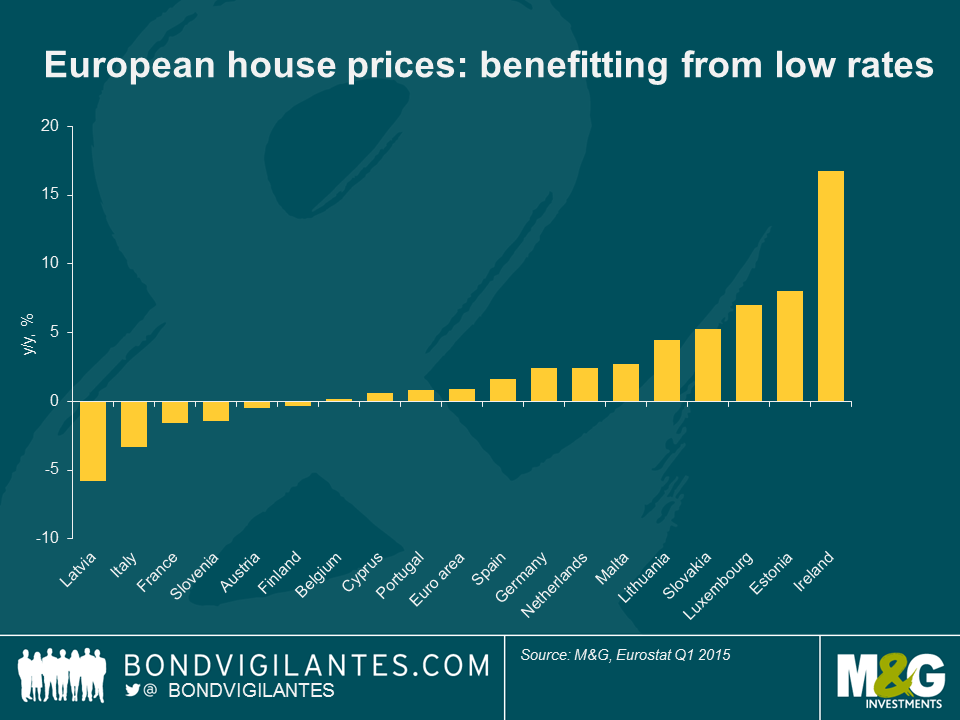

As well as making it easier to borrow, ultra-low interest rates boost asset prices by reducing the discount rate on cash flows from assets, such as dividends and rents. In addition, house prices are on the rise across much of Europe helping to boost household wealth. This is helping to increase the feel-good factor and confidence across Europe, something that is an intended consequence of QE.

Beware those that think the Eurozone project is doomed to failure. As I have argued previously, there are a number of strong arguments in favour of the euro surviving, not least the fact that no country within the European Economic and Monetary Union has left. With all the talk around politics, one thing that is regularly overlooked by markets is the political desire to maintain the euro area and single currency is extremely strong. Of course, there is still a significant amount of work to do in order to achieve a full economic and monetary union and the situation with Greece is not fully resolved. Despite this, the three “C’s” of currency, confidence and consumption will boost the European economy in the short-term and should ensure a self-sustaining economic growth profile for the largest economy in the world.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox