The cost of quality: spread differentials between IG credit rating bands

We have frequently written about investment grade (IG) credit spreads over the course of the past year. Today I’m going to dissect the IG universe further and take a look at quality spreads, i.e., the additional risk premium investors can earn when switching from one credit rating band into the next lower band.

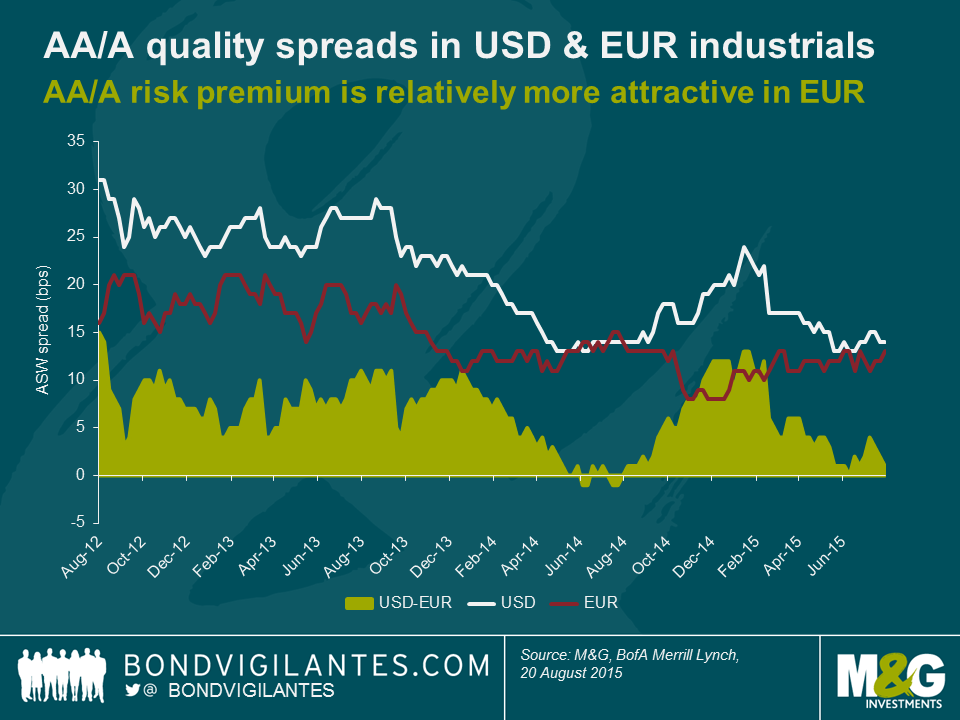

The chart below shows how the differential in asset swap (ASW) spread between AA and single A rated industrials, both in USD and in EUR, has evolved over the past three years. In addition, the difference between AA/A quality spreads in USD and EUR is given.

Here are our three key takeaways:

- USD single A industrials seem relatively expensive vs. USD AA industrials. Over the past three years, the AA/A risk premium has been trending down. Currently, an investor is compensated with a spread pick-up of only 14 basis points (bps) for switching from USD AA into USD single A bonds, which is less than half the AA/A quality spread offered three years ago (31bps).

- In EUR, single A and AA industrials appear to more fairly priced relative to each other. The AA/A risk premium has declined in general, but only moderately. The differential has essentially been bouncing between 15 and 20bps until late 2013 and between 10 and 15 bps thereafter.

- Apart from a couple of weeks in mid-2014, the AA/A quality spread in USD has been higher than in EUR with a maximum gap of 15bps and a median difference of 7bps. At this point in time, the USD/EUR differential in AA/A quality spread has basically disappeared (1bp). Therefore, from a relative value point of view, it is relatively more attractive at the moment to take exposure to the AA/A quality risk premium in EUR than in USD.

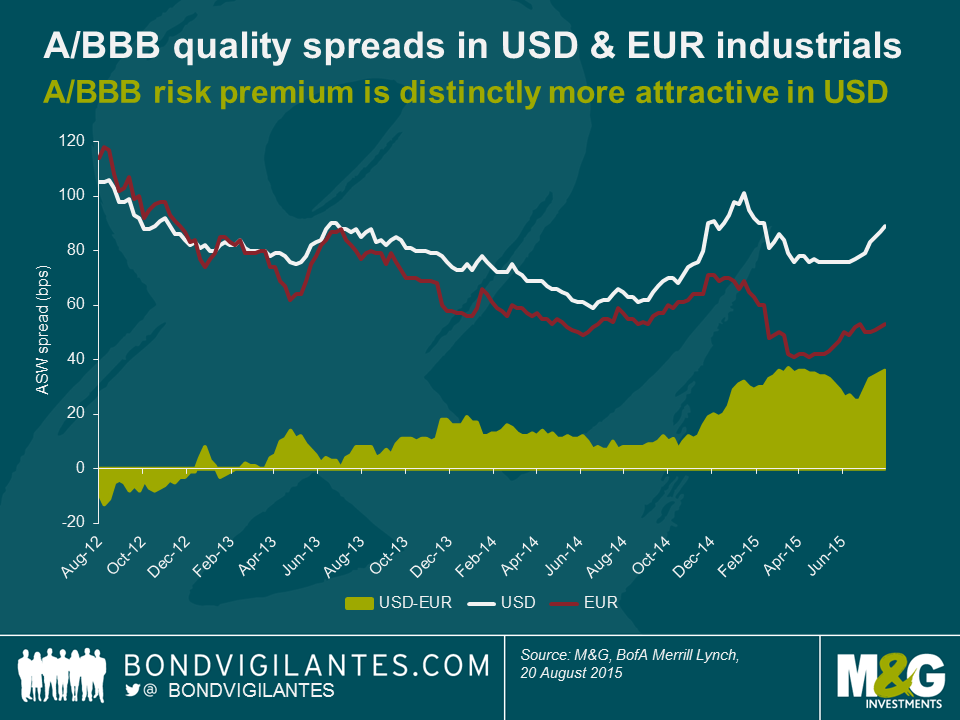

The chart below illustrates a very similar analysis compared to the one above. Only this time we have focused on A/BBB quality spreads in USD and EUR.

These are our three main conclusions:

- USD BBB industrials offer good relative value vs. USD single A industrials. After falling to its low-point of 59bps in mid-2014, the A/BBB quality spread has rebounded strongly. Currently, investors can earn an additional 89bps in ASW spread when switching from USD single A into USD BBB industrials.

- There is significantly less value in the EUR A/BBB quality spread. Despite a moderate rebound since April this year, the current value of 53bps is still substantially below levels above 100 bps in 2012 or around 70bps in late 2014.

- The differential between the A/BBB quality spread in USD and EUR has come a long way. Whereas investors were offered a slightly higher spread pick-up in EUR than in USD three years ago, this relationship has reversed. The current USD A/BBB quality spread exceeds the EUR equivalent by 36bps, just one basis point shy of its three-year maximum, which indicates that it is relatively more appealing at the moment to take exposure to the A/BBB quality risk premium in USD than in EUR.

There are some caveats to this analysis, though. First, we have only been looking at broad credit rating bands. This approach ignores the profound disparity of risk exposures within these bands, particularly between strong BBB+ and weak BBB- corporate bonds. Second, there are duration mismatches between the EUR industrials indices used to calculate quality spreads. In terms of effective duration, the EUR AA index is 0.9 years longer than the single A index, which in turn is 0.4 years longer than the BBB index. Therefore, both the EUR AA/A and the EUR A/BBB quality spread figures above are slightly understated as differences in term premium are ignored. In contrast, the USD industrials indices differ only marginally in their effective duration levels.

General limitations like these aside, how are quality spreads going to evolve in the future? Let’s take a look at two key factors.

- Sector composition: Sector weights differ greatly between rating bands, which of course has implications for quality spreads. For instance, the EUR single A industrials universe exhibits a significantly higher exposure to the automotive sector (17.1%) than EUR AA (3.1%) and BBB industrials (7.8%). Thus, all else equal, if the Chinese economy continues to deteriorate and car sales of European manufacturers drop, the EUR AA/A quality spread should widen and the EUR A/BBB quality spread should tighten, and vice versa. Similarly, it is important to be aware of the high exposures to healthcare in USD single A industrials (17.3%) and to energy in USD AA (33.6%) and BBB industrials (22.1%) when contemplating the future path of USD quality spreads.

- Core / periphery dynamics: With regard to EUR industrials, the AA index does not contain any bonds from peripheral European issuers, whereas the periphery content steps up to 5.4% (all Italy) for EUR single A and to 13.8% (8.0% Spain, 1.3% Ireland, 4.2% Italy and 0.3% Portugal) for EUR BBB industrials. Therefore, EUR quality spreads reflect in part investor sentiment towards the state of the Eurozone. All else equal, if the periphery gets under pressure going forward, both the AA/A and the A/BBB quality spread should widen, and vice versa.

In conclusion, we see good relative value in IG credit spreads at the moment. In terms of credit rating bands, although it is of course always a case-by-case decision, we believe that in general the AA/A quality risk premium is relatively more appealing in EUR, whereas the A/BBB quality risk premium is currently distinctly more attractive in USD.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox