UK inflation: are transient and volatile items masking an improving domestically generated inflation picture?

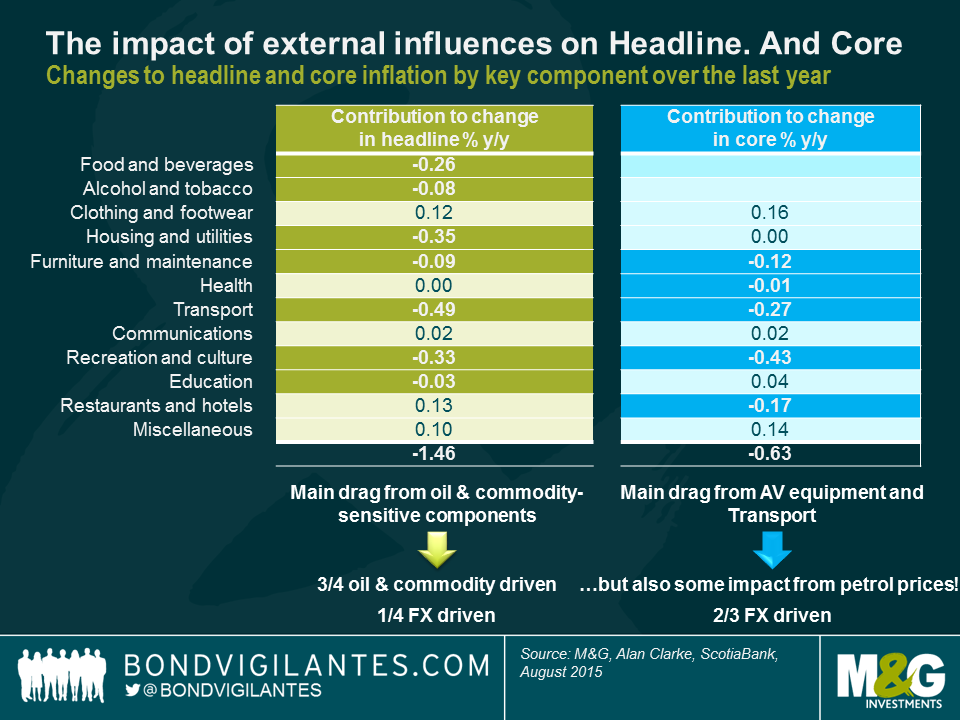

This morning CPI in the UK has fallen from 0.1% in July to 0% in August, both in year-over-year terms. Continuing deflationary trends observed in transport (largely petrol) and food (supermarket price wars), which have together taken 0.7% off CPI over the last year, were dragged back up to the zero bound by alcohol and tobacco (these always go up!), education and restaurants and hotels, with smaller positive contributions from most other categories.

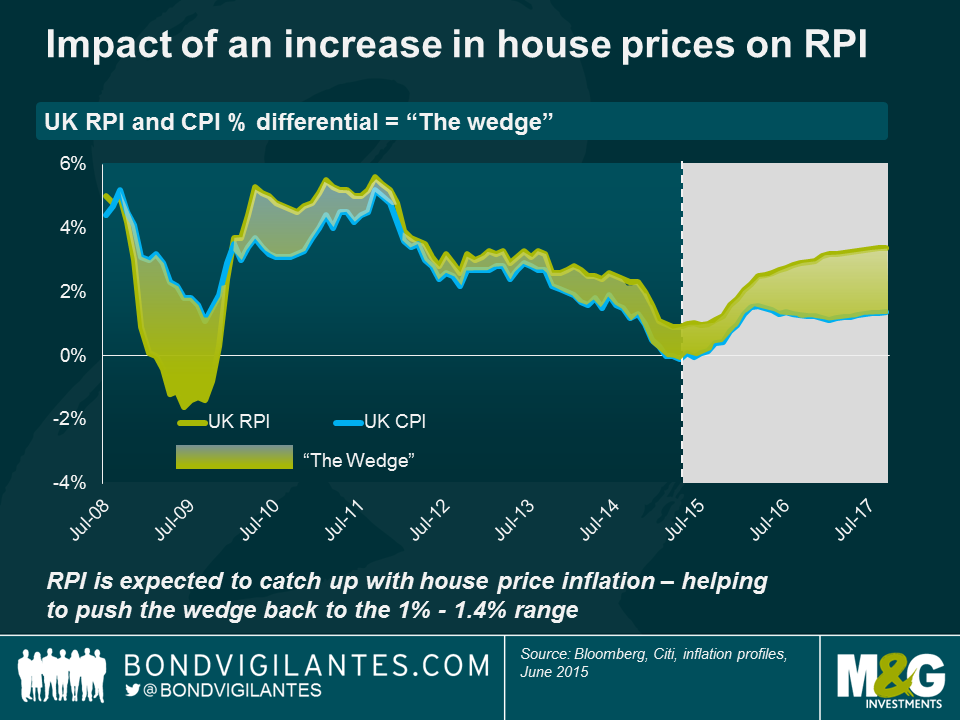

RPI, though, increased from 1.0% to 1.1%, and with CPI at 0%, this sees the ‘wedge’ increase to 1.1%, above the widely perceived fair value of 0.8% to 1%. UK index linked bonds pay inflation linked to RPI, and so holders of linkers are not experiencing noflation or deflation. In fact, several commentators are forecasting this wedge to grow to 1.5% next year, owing to the usual suspects of the formula effect (arithmetic vs geometric mean calculations), the constituent effect (the baskets contain different weights of different items), and in particular the housing market effect. RPI includes house prices and mortgage interest payments, which CPI does not. With house prices seemingly on the up, and with interests surely more likely to go up than down, these two factors could push the wedge beyond fair value, a positive for holders of UK linkers.

Over the last 12 months CPI has fallen by 1.5%, again largely driven by food, utility bills and transport. Core CPI has fallen by 0.6%, largely driven by used car prices and recreation and culture, particularly audio visual equipment. Essentially, headline CPI is being hit by energy and commodity prices (c.75%) as well as the strong pound (c.25%), whilst core CPI is being mainly dragged down by the strength of sterling. Core CPI strips out the volatile items of energy, commodities and food. But is the strength of sterling to be viewed as a non-transient and non-volatile driver of core inflation?

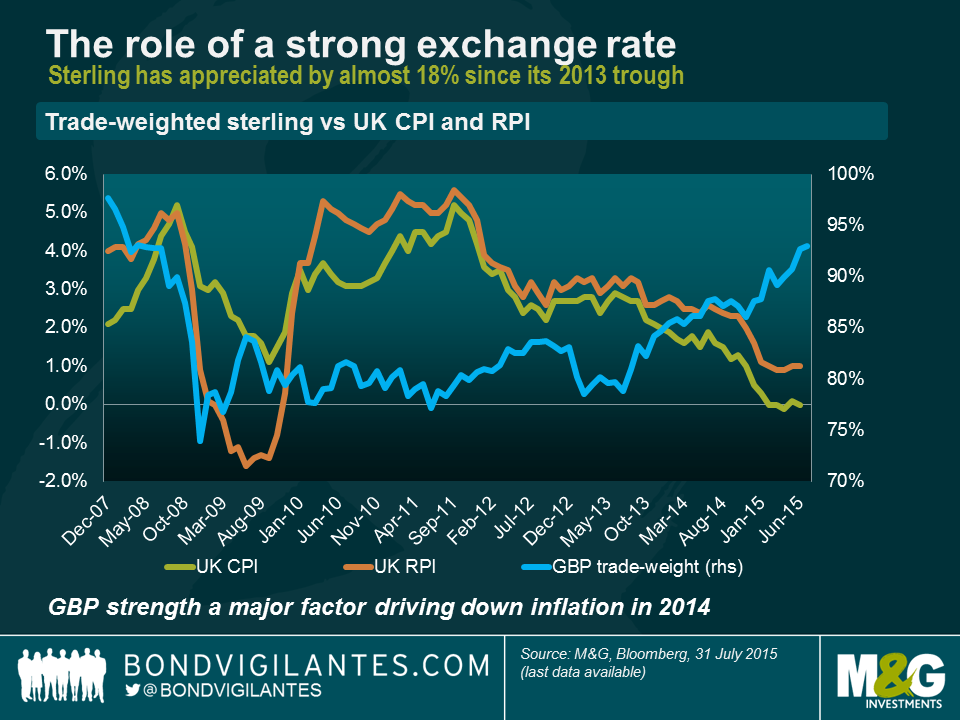

In actual fact, every good, wherever it’s made, needs to get from its point of manufacture to the shop shelf, so transport costs are going to be a major driver of the prices of goods that make it into core inflation numbers. In other words, core inflation is not as core as we may think. But on top of that, sterling’s 20% appreciation in trade weighted terms over the last two years has impacted the prices of the goods that we import. If you look at inflation numbers and trade weighted sterling since the on-set of the financial crisis, one could make a convincing argument that the currency is a volatile, non-core driver. Speaking to Alan Clarke of Scotiabank recently, he stated that there is a 10:1 passthrough from £ into CPI, so this has contributed -2% to CPI over the last 2 years.

If, like me, you treat the currency with caution, then you could make the case that true core CPI has been meaningfully higher over the last two years. Goods make up c.50% of CPI, so perhaps core CPI today is closer to 2% than the 1% we saw in today’s numbers? If you disagree with the notion that the currency is a volatile non-core item, then perhaps you should ask yourself whether you think the pound is likely to remain as strong as it is today. The UK’s current account deficit is greater today than it was before the IMF bailout in the 1970s and before the exit of the ERM in the early 1990s. That’s worth thinking about, in my mind.

So, inflation numbers are being battered by global energy and commodity prices at the headline level, and by the strength of the pound, particularly in core terms. But perhaps core CPI is not truly stating the underlying, domestically generated inflation picture in the UK. Services inflation is running at 2.3%, and the UK is a services driven economy. The labour market has tightened significantly, and wages are showing solid signs of being on an upward path, albeit from a low base. Ultimately, the medium term outlook for UK inflation is going to be determined by the interplay between the negative and transient forces of food and energy prices on the one hand, against the improving backdrop for UK consumption that will be set by employment and wages. And for those that don’t think sterling is a volatile non-core driver of inflation, the outlook doesn’t look too rosy there anyway.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox