Oil price fall failing to pump deflation

One of the major factors that has enabled inflation to stay low despite the economic strength in major western economies has been the fall in the price of oil. Given the huge price volatility over the past 18 months it is interesting to depict the falling influence of oil on actual end inflation.

In the UK, the most direct way that changes in the oil price affect inflation is through petrol prices. Falls in the input cost translate into a fall in the price at the pump. The price at the pump is however not just a function of the price of oil, but includes costs of transportation, retail margin, and most significantly tax and duty. According to petrolprices.com, the cost of a litre of petrol can be broken down as follows:

Duty: 57.95p

Product: variable

Retailer/delivery: 5p

VAT: 20%

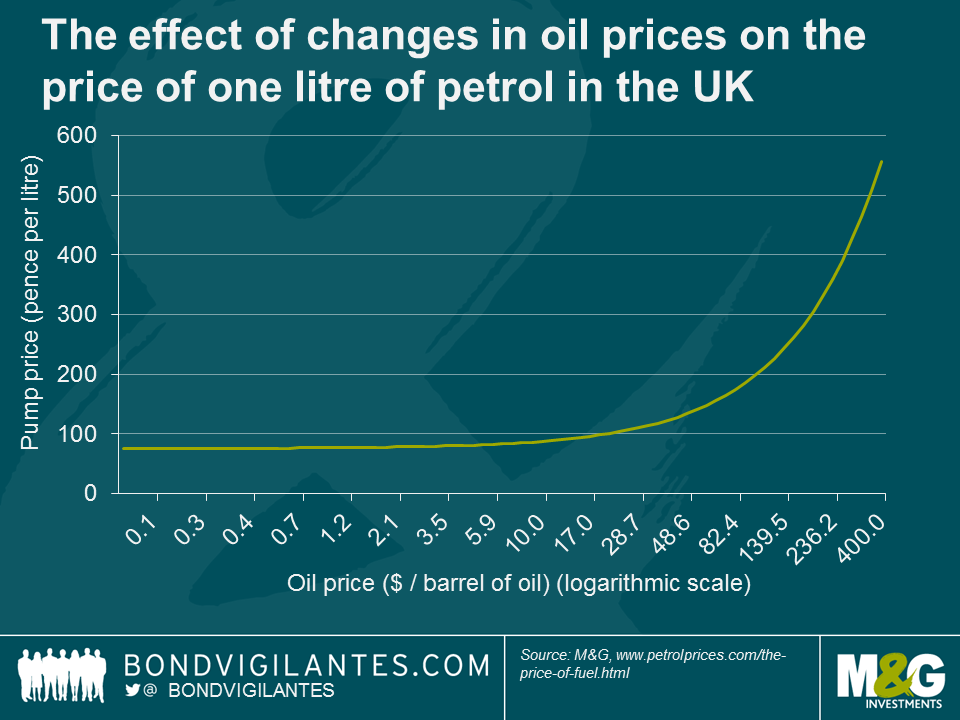

If we use the above as a guide we can examine how changes in the price of oil (product) can affect headline inflation. The chart below shows how changes in the oil price feed through to the price of petrol at the pump.

As you might expect, it is not a one for one relationship. As the price of oil falls, its effect on the price of petrol becomes less significant because it makes up a smaller and smaller portion of the total price at the pump. So a 50% fall in the price of oil from $160 to $80 creates approximately a 35% fall in the price of petrol from 267p to 172p. A further 50% fall in the price of oil from $80 to $40 creates a 28% fall in the petrol price and a 50% fall from $40 to $20 translates to only a 19% fall in the petrol price. Although the GBP/USD exchange rate is another factor in determining the pump price given that oil is priced in dollars, the above illustrates that as the oil price falls it has a weaker and weaker effect on inflation.

There is also a secondary effect of weak oil prices, because as prices fall, the percentage in the inflation basket will fall. Thus, energy price falls become less significant with regard to headline inflation.

The down draft in oil prices is coming closer and closer to an end, with its effect on inflation reducing the further it falls. Given other areas of scarcity, such as in the labour market, we would be surprised to see inflation stay this low over 2016. The downward impetus of falling oil prices on inflation will continue to become less meaningful as the bear market in oil progresses.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox