High Yield Liquidity: 5 ways to help deal with it

Following the closure of the Third Avenue fund earlier this month, liquidity issues are once again at the forefront of investor’s minds when it comes to the high yield market. Ultimately, conditions will only improve with structural changes to the market but in the meantime we think there are several steps that can be taken to help improve the underlying liquidity profile of a high yield portfolio.

Buy and Hold – by keeping portfolio churn low and buying securities with a view to a long term holding period and accepting that there will be some price volatility, the liquidity needs of a portfolio are automatically curtailed. This also means corporate fundamentals and the underlying credit worthiness of an issuer over the long term are bought more sharply into focus at the point any purchase is made. The question “Would I be happy to hold this bond through periods of market distress” is a good one to ask. If the answer is “yes”, then the chances of finding a buyer during such periods are greatly enhanced.

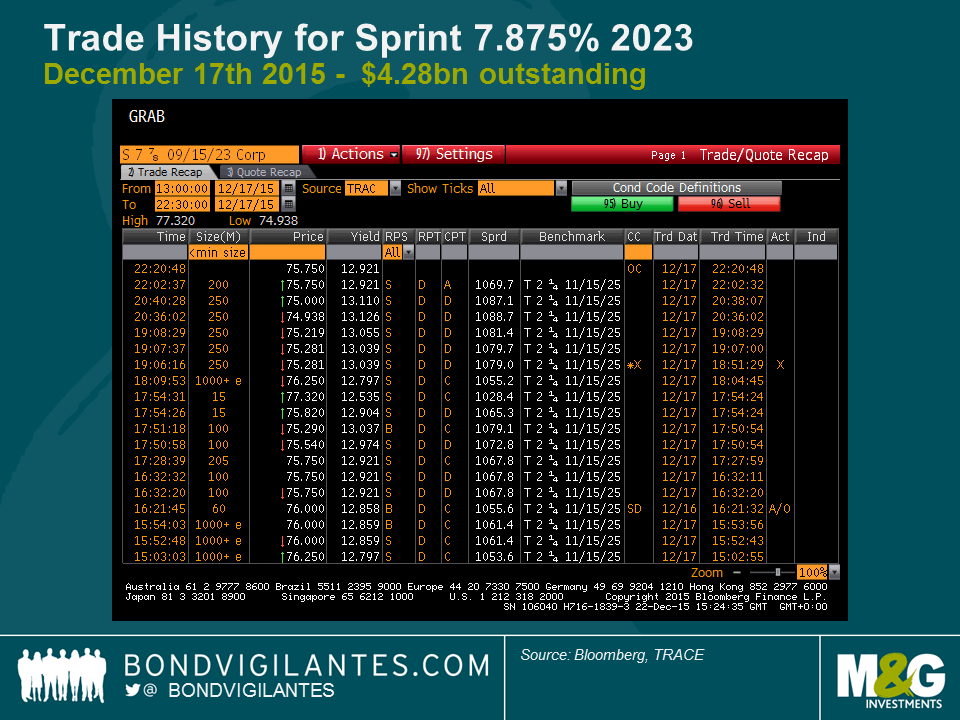

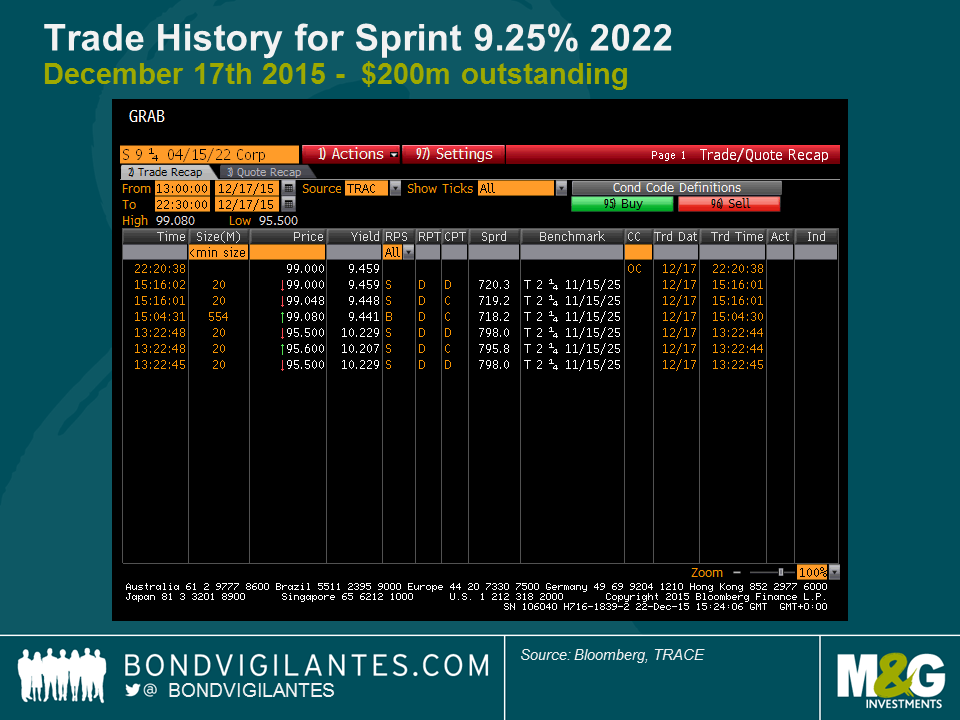

Stick to larger bond issues – The bigger the bond issue, the greater the investor base and the greater chance of being able to match a buyer and a seller (we illustrate this below by comparing the recorded activity trade activity for a $4.28bn bond, and a $200m bond issued by the same company). However, this can be a double-edged sword. The larger a bond issue, the more likely it is to be a constituent of an ETF portfolio which can be disadvantageous during periods of large redemptions.

December 17th 2015 Trade History for Sprint 7.875% 2023, $4.28bn outstanding:

December 17th 2015 Trade History for Sprint 9.25% 2022, $200m outstanding:

Diversify by market – Trading environments can and often do differ in different markets. A portfolio that can invest across the range of ABS, financials, corporate, sovereigns, emerging markets, fixed rate or floating rate, Europe or the US can often exploit better liquidity conditions in one market when another is facing difficulty.

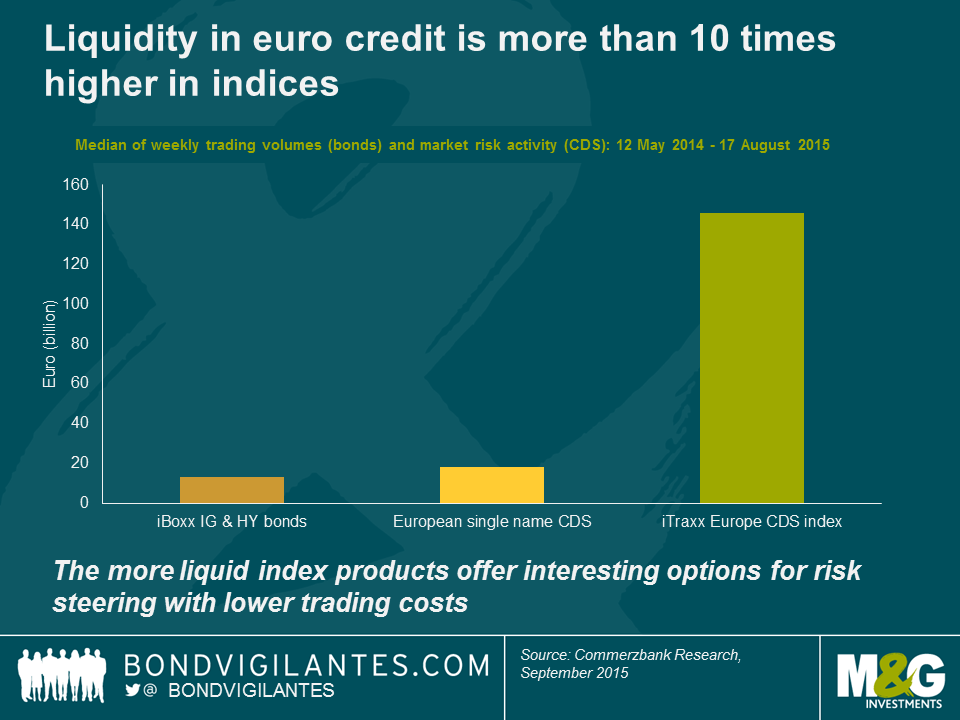

Use liquid proxies – The daily volume that trades in the synthetic CDS index market is an order of magnitude greater than the physical cash market. Keeping part of a portfolio in such instruments provides access to a deeper pool of liquidity and can provide a useful buffer in periods when the physical market conditions worsen. However, there is an opportunity cost in terms of stock selection that needs to be considered.

Keep cash balances higher – The most effective way to boost liquidity in a portfolio is the simplest: hold more cash. 5% is the new 2%. Again, there are opportunity costs in terms of market exposure and stock selection, but the benefits in terms of liquidity are immediate and tangible.

It’s important to stress that none of these measures are a silver bullet, but they are mitigants. They can buy time and help investors tap liquidity. In today’s high yield markets, the question of how a portfolio’s liquidity is managed has become just as important (if not more so) than its investment position.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox