Pharma merger mania: The good, the bad and the ugly

In our recent Chicago video we touched upon the subject of recent mergers and acquisitions (M&A) activity in North America having surpassed pre-crisis volumes. Though hard to quantify, it’s safe to assume that the M&A surge has been one of the main driving forces behind the widening of credit spreads in the USD investment grade (IG) corporate bond universe this year. Numerous IG companies have made use of low interest rates and engaged in debt-funded takeovers, bringing leverage up and risking credit rating downgrades. New bond issues brought to market in order to finance these transactions have put additional upward pressures on credit spreads of outstanding bonds.

Healthcare firms in particular have embraced the M&A frenzy. According to Reuters, cumulative healthcare deal volumes are expected to exceed USD 600bn this year, dwarfing the previous annual record of c. USD 390bn set in 2014. Based on three case studies within the pharmaceutical sub-sector, we want to illustrate that M&A activity can produce the whole range of outcomes for IG corporate bond investors – the Good, the Bad and the Ugly.

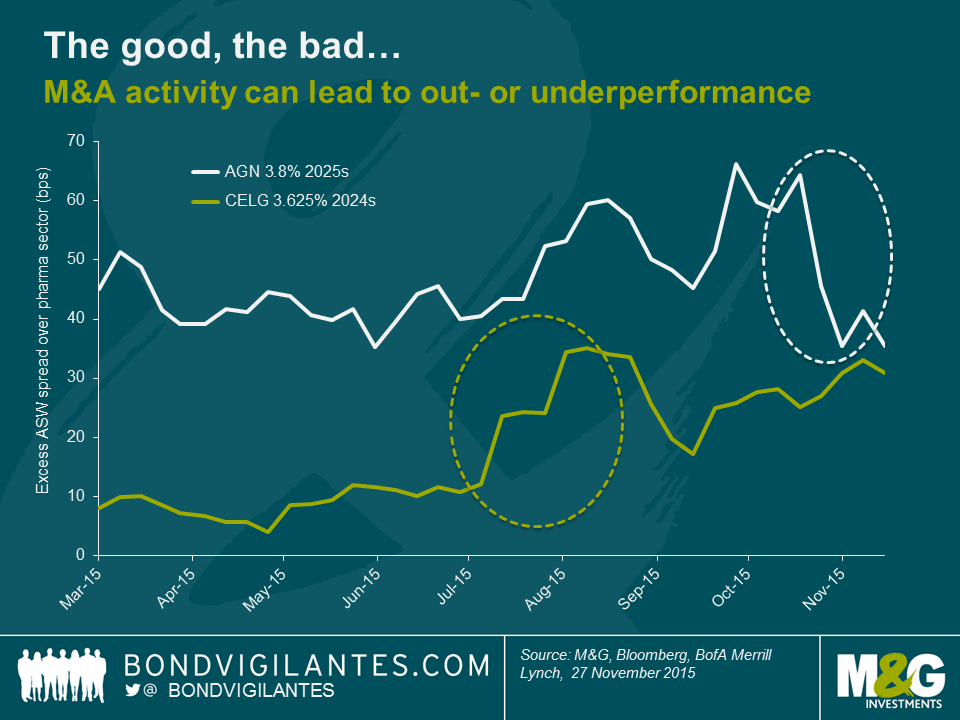

Let’s start on a positive note. IG bond investors are likely to lock in profits if they hold bonds of a company that is acquired in a friendly manner by a (markedly) higher-rated firm. Take, for example, the case of Allergan, Plc (AGN), best known for producing Botox. The company in its current form came into existence after a long series of mergers, the last one in March 2015, when Actavis, Plc acquired Allergan, Inc. for around USD 66bn. The deal financing package comprised one of the biggest USD corporate bond offerings on record (USD 21bn across several tranches), including AGN 3.8% 2025s. The bonds were issued at a higher asset swap (ASW) spread than the US IG pharmaceutical index and subsequently underperformed against the sector average – see the chart below. However, when in late October news broke that Pfizer and AGN had entered friendly M&A talks, AGN spreads tightened aggressively. The transaction, which is valued at around USD 160bn and would create the world’s biggest drug maker, has not been completed, but there is a very good chance that BBB- rated AGN will merge with AA/A+ rated Pfizer, which would be a big credit-positive event for AGN. Consequently, AGN 3.8% 2025s have outperformed relative to the pharma index by c. 30 bps in ASW spread terms over the past month.

M&A quick-wins like this are the exception, though. IG companies (typically well-established, sizeable firms) are more likely to be the acquirer, not the target, which often causes pain for their bondholders, at least in the short-run. This holds true for the case of then BBB+ rated Celgene (CELG) buying Receptos for more than USD 7bn to boost its inflammation and immunology drug portfolio. Upon announcement of the deal in mid-July, outstanding USD CELG bonds, e.g., CELG 3.625% 2024s, widened relative to the US IG pharma index. Having traded at a small excess spread of around 10 bps vs. the sector average over the first half of the year, the spread premium jumped to nearly 25 bps. The issuance of new USD bonds to finance the transaction in late July, combined with a rating downgrade to BBB due to the increasing leverage, led to a second surge in excess spread of the outstanding bonds to c. 35 bps above the sector. CELG bonds then briefly outperformed the pharma index before their spread premium started to widen yet again, not least because CELG officials expressed further M&A appetite.

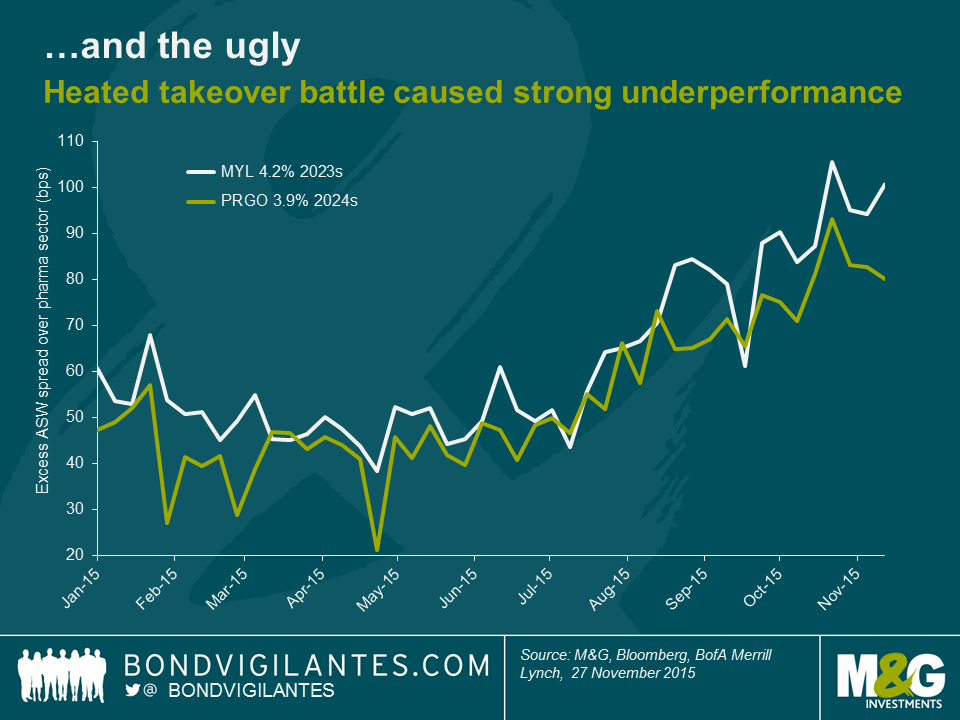

We’ve talked about the Good and the Bad – now on to the Ugly. It’s hard to find a more suitable example than the ultimately unsuccessful attempt of Mylan (MYL) to acquire Perrigo (PRGO) this year. A full account of the twists and turns in this M&A odyssey would go well beyond the scope of this blog. In a nutshell, MYL approached PRGO with an unsolicited takeover bid in spring 2015. MYL then tried to convince its own shareholders and those of PRGO of the benefits of the proposed transaction, while simultaneously fending off a hostile bid for its own business from generic drugs rival Teva. Using a poison pill defence strategy, MYL eventually succeeded in blocking Teva in July. In the meantime, the MYL-PRGO situation was turning increasingly hostile. Even after MYL raised its bid, PRGO executives fought tooth and nail against the takeover. In September Perrigo Chairman and CEO Joseph C. Papa sent an open letter to Mylan Chairman Robert J. Coury calling MYL’s offer “grossly inadequate” and “value destructive”, while highlighting in his view “some very troubling corporate governance values at Mylan”. The rating agencies expressed their concerns regarding the credit-negative effects of the transaction; S&P even questioned MYL’s IG status putting their BBB- rating on negative watch.

Unsurprisingly, credit markets did not take kindly to these developments, as shown in the chart below. USD bonds from both MYL and PRGO had been trading at a spread premium of around 50 bps over the US IG pharma index until June but the escalation of events drove excess spreads up to around 100 bps. In mid-November the takeover failed spectacularly as the majority of PRGO shareholders rejected MYL’s offer. Although the rating agencies improved their outlook for both companies upon this news, excess spreads still remain in elevated territory today. As scale and consolidation are key driving forces in the generics drug space, there is a good chance that there will be future M&A activity around MYL and PRGO. It’s hard to predict whether they will act as acquirers of assets or if they themselves might come into focus as takeover targets of larger pharma companies. Consequently, bond investors demand higher credit spreads as compensation for uncertainty and event risk.

Going forward, rate hikes, and thus increasing funding costs, in combination with sincere efforts by US authorities to impede tax inversion transactions (i.e., where US companies use M&A with the main goal of relocating their legal domicile to lower-tax jurisdictions), could slow down the deal flow. However, M&A activity is likely to remain a major market theme for the foreseeable future. Many deals are struck to advance the interests of shareholders, which can collide with those of bondholders. As bond investors we need to concern ourselves with downside protection and ultimately we have to decide on a case-by-case basis whether bond valuations provide adequate compensation for M&A event risk around a certain company or business sector. But it’s not all bad news. Apart from the occasional outright credit-positive transaction, mergers can improve the long-term prospects of businesses for the benefits of all investors (although the upside potential for bondholders tends to be far smaller than for shareholders). New bond issues launched as part of deal financing, often at decent spread premiums over outstanding bonds, can provide appealing investment opportunities, particularly when the involved entities are committed to deleveraging after the transaction.

Full Disclosure: M&G is a holder of corporate bonds issued by Allergan, Celgene, Mylan Perrigo, Pfizer and Teva.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox