A look at the Swiss economy a year after the currency peg break

A year ago today the Swiss National Bank (SNB) unexpectedly discontinued its CHF peg against the euro, causing huge moves in the FX markets. On the anniversary of the peg removal I thought it would be interesting to see how the Swiss economy has developed over the past twelve months.

Swiss economy robust, but not immune during 2015

The Swiss economy actually proved to be quite resilient in 2015 with steady growth and low unemployment despite deflation and a strong CHF, which would typically be a major drag for an exporting nation. As the SNB stated in its latest monetary policy assessment, this is also thanks to further strength in foreign demand for Swiss goods and services and ongoing robust domestic demand, which would no doubt have been helped by an increase in real wages.

Looking at Swiss economic data on my Bloomberg screen, not all the numbers show a rosy picture. Whilst we have to be careful to not read too much into the data over such a short time period, some data show signs of weakness since the removal of the peg, indicating potential downside risk to the economy.

Whilst the ECB is doing its utmost to revive inflation in Switzerland’s neighbouring economies, Switzerland itself has been in deflation for much of the past four years. The removal of the peg has compounded the situation by further increasing the purchasing power of the CHF and helping to pull consumer price inflation down lower to -1.3%. Whilst the unemployment rate continues to fall in the eurozone, it has started to pick up in Switzerland, albeit from very low levels, after remaining stable for two years. This was also reflected in the latest consumer confidence survey from the State Secretariat for Economic Affairs (SECO), which indicates lower confidence in job safety. Interestingly, since the currency cap has been removed, confidence has fallen from -6 early last year to -18, and is well below its historic average of -9 points.

Recently published tourism numbers for last summer show a direct impact of the stronger CHF as well. According to the Swiss Federal Statistical Office, overnight stays from European travellers fell by 741,000 or -10.9% compared to 2014. German tourists were responsible for much of the drop, declining by 358,000, or -15.1%. Increased demand from Asia and the US was not enough to offset this fall from closer to home.

The appreciation of the Swiss franc vs the euro in January 2015 didn’t just make it more difficult to attract visitors from the Eurozone – it also meant that the Swiss started to spend more of their money abroad. Switzerland is well connected with its surrounding countries, not just in terms of a strong relationship, but also thanks to open borders, and traveling to neighbouring countries often takes less than an hour, and can be done comfortably by train. Not surprisingly, the stronger currency made shopping abroad more attractive, leading to an 8% increase in foreign purchases, according to Credit Suisse. Domestically, real retail sales fell by -2.1% for the year to November 2015.

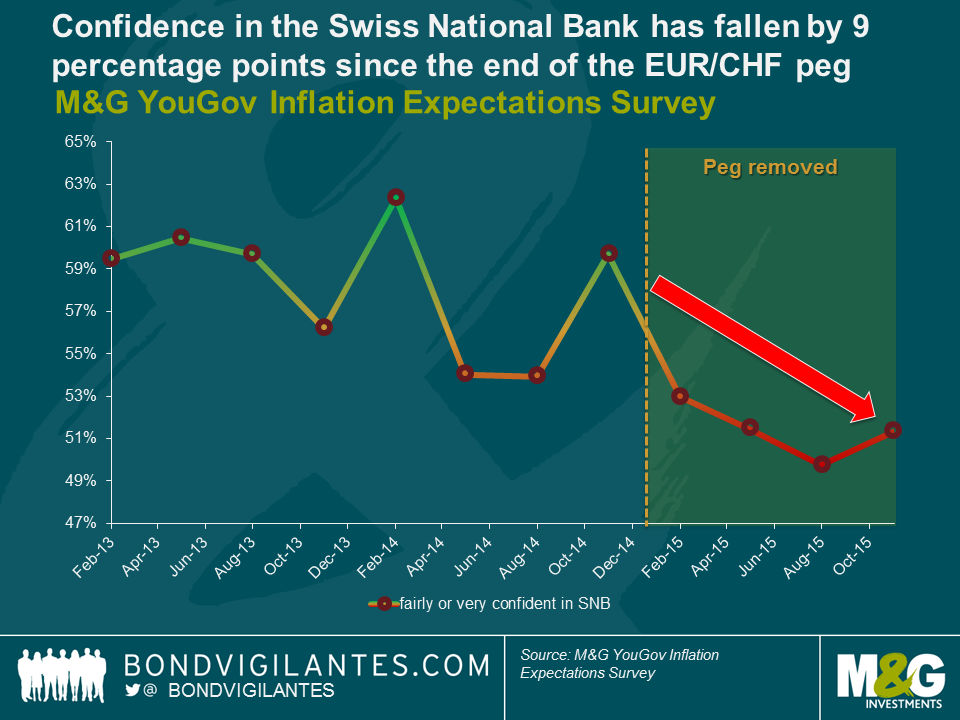

Lower confidence in the SNB

The latest results from the M&G YouGov M&G Inflation Expectations Survey in which we also ask consumers about their confidence in central banks, indicates deteriorating confidence in the SNB. Confidence in the SNB’s policy is 9 percentage points lower than it was a year ago, a clear sign that Swiss consumers are realising the pressure on the shoulders of SNB president Thomas Jordan and his team.

The recently posted record loss of CHF 23bn, almost entirely due to losses on the bank’s foreign currency positions, won’t help boost confidence either. Still, the SNB was able to pay a dividend and a CHF 1bn profit distribution to the Confederation and the cantons thanks to accumulated reserves. Going forward, there is a big question mark around these profit distributions as the bank’s reserves are almost depleted, and further losses as a result of market interventions are certainly possible. Given that roughly 90% of the SNB’s balance sheet is foreign currency investments, even small currency moves can cause considerable impacts on its profits.

Pressure remains

Johann Schneider-Ammann, the newly elected Federal President has addressed the importance of strong Swiss companies in his New Year speech. In my view this can only be achieved with a competitive Swiss franc. As I wrote in a recent blog, achieving that will be challenging, as I expect ongoing pressure and further stimulus from the ECB in 2016, particularly if oil prices continue to drag inflation numbers down.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox