The new wedge in US inflation linked bonds

There has long been a well-known ‘wedge’ in the UK index linked bond market, since the bonds pay RPI and the Bank of England targets CPI. The wedge is the difference between these two price indices, and over the long term is thought to be approximately 1%. So over the long term, and with all sorts of caveats, RPI will be around 1% higher than CPI. The reasons for the wedge are essentially that they are different baskets of goods and services, calculated differently. It is worth pointing out in passing, though, that given the significantly higher proportion of housing related costs in RPI (both prices and mortgage interest payments), the wedge should perhaps be expected to go higher still if house prices continue to rise and / or if interest rate rises do indeed ever come.

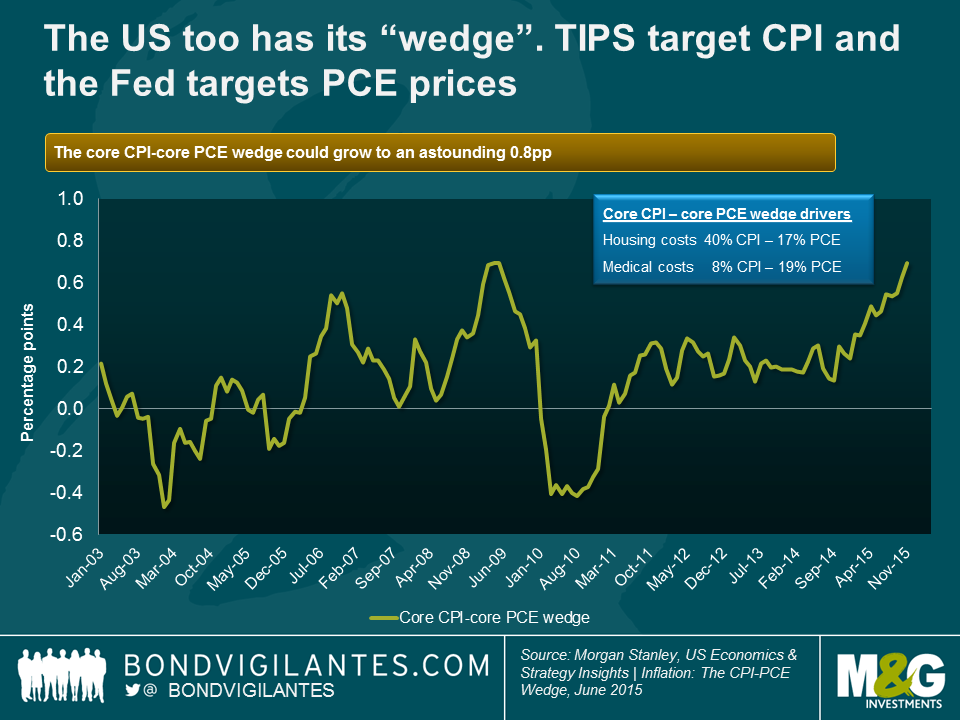

In the US, there is the similar risk of a wedge developing. This owes to the same feature of the UK market, namely that TIPS pay CPI as the inflation compensation index, and yet monetary policy makers target 2% not in CPI, but in PCE. Once again, these are different baskets, calculated differently, with different weights, and so they will seldom give you the same inflation number. Historically, the wedge has been approximately a quarter of a percent. It is worth keeping in mind that PCE measures spending by and on behalf of the personal sector, whilst CPI attempts to measure out of pocket spending by households.

Housing costs and medical care costs look set to see the wedge between CPI and PCE rise above today’s 0.1% in the not-too-distant future. These relate in part to the formula effect, but also to the differences in weights in the two indices. Housing makes up 42% of CPI and 27% of PCE. Thus, when the housing market is strong and vacancies are low, CPI should be expected to increase at a faster pace than PCE. Medical care costs (6% of CPI and 22% of PCE) are also going to drive the wedge upwards, but in a different way. Medical inflation is set to be kept extremely low for at least the next 10 years given the prices being fixed for these costs by the government with regards to Medicare and Medicaid. CPI medical costs are not being state administered and so will not be held so low.

The chart shows how significant the wedge could become in terms of core prices, where it looks like the wedge could reach 0.8% and possibly go further. But as bond investors, we are most interested in the headline numbers as they define our inflation compensation in TIPS and the inflation target the Fed is striving towards. Morgan Stanley estimates that the headline wedge could become 0.5%, on account of the housing and medical cost differences. So if you believe, as I do, that the Fed is serious about its inflation target, then if PCE is 2%, CPI could be 2.5%. As a holder of TIPS, that extra 25% inflation compensation is only a good thing.

The labour market appears to be tighter in the US than in the UK or Europe at the moment, with less spare capacity and a greater likelihood of wage growth coming through this year. That is one reason an investor could prefer TIPS to index linked gilts or European linkers. Another reason for preferring TIPS is that the base effects from oil have been more severe on the way down in prices in the US than in the UK and Europe, and so will be more positive if the oil price stabilises or even rises. To these two positive reasons for investing in TIPS we can now add a third, that for the Fed to hit its 2% inflation target, CPI is going to be significantly higher.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox