Growth fears, deflation, rising defaults, tricky markets – a good time to buy US high yield?

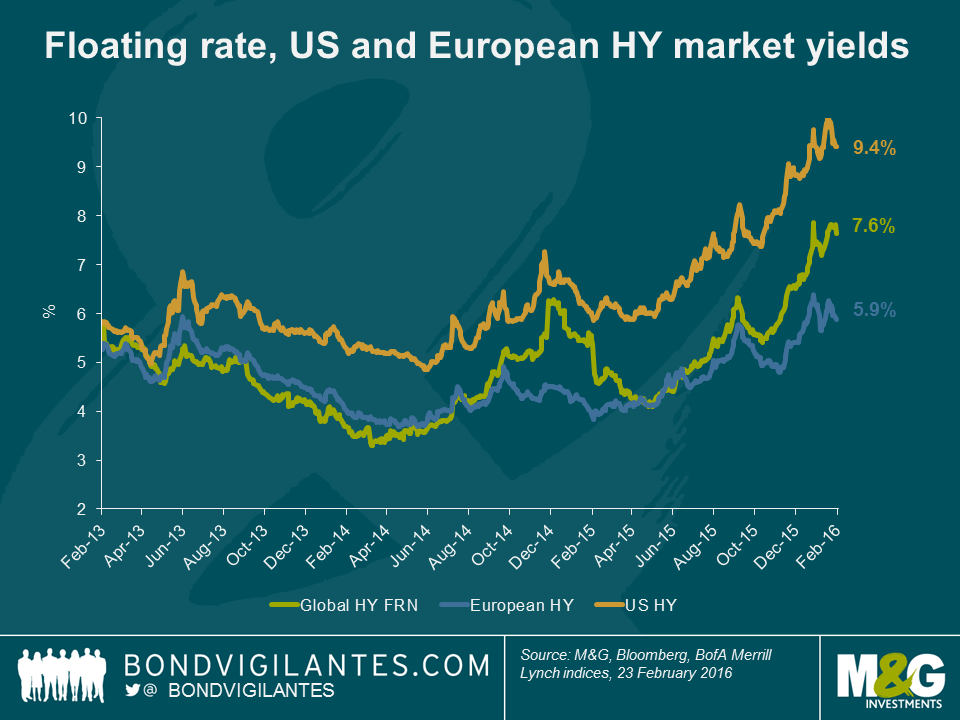

It’s been a difficult past few months for all risk assets, including the high yield markets. Weakest of all has been the US, with negative returns of almost 10% over the past year. As part of this re-pricing, spreads have widened significantly, with the US high yield market touching almost 900bps over treasuries. All-in yields also briefly peaked above 10% last month.

Underlying this has been a major and well publicised sell off in energy credits. The dispersion of returns within the market has been immense. It’s interesting to note that despite more than a 10% sell-off in January and February, the weakness in subordinated bank paper (the AT1/COCO index lost 3% for the year to 23rd February) has been dwarfed by the loss of around 37% in US Energy bonds over the same period. With the increasing prospect of further defaults, getting the sector call right last year was crucial.

So we have widening credit spreads, fears about a general slow-down in growth and deep concerns about capital destruction in a major part of the market. So a terrible time to get into the asset class then? Perhaps not.

Why do we say this? First of all, there could be some interesting parallels to the high yield market in 2001. The similarities are there – it feels like we are listening to an echo from bond market history.

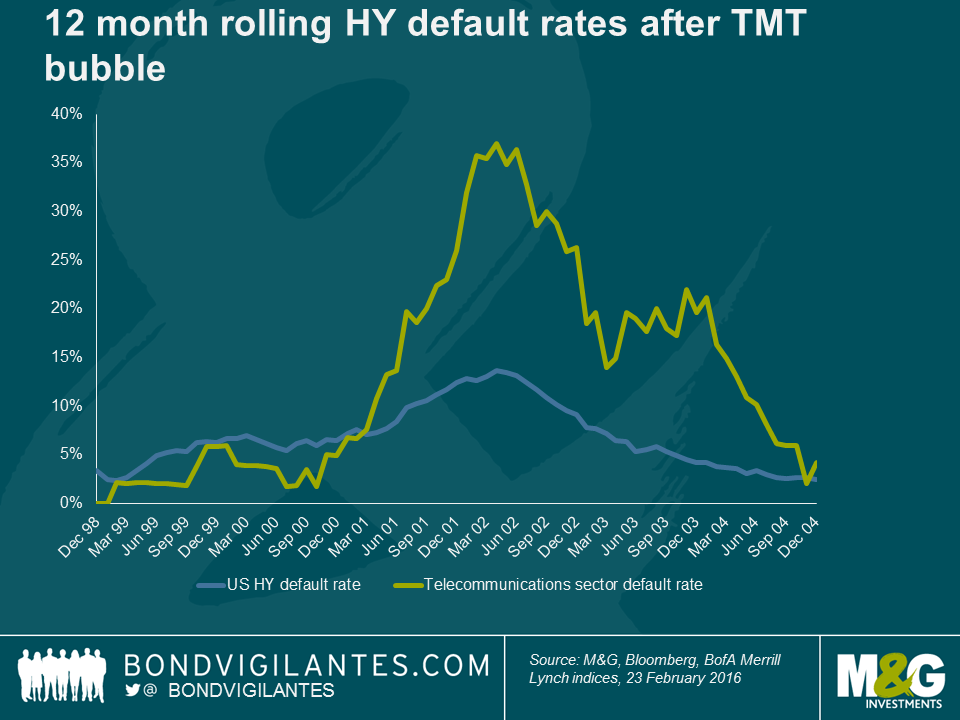

a) Then as now, one sector is the focus of concerns. In 2001 it was the bursting of the TMT bubble and the fallout from the capex splurge of telecommunications businesses, funded by an over-eager high yield market. This led to a spike in defaults and a painful few years for creditors. Now it’s the bursting of a commodity price bubble and the fallout from the capex splurge of energy businesses, funded by an over-eager high yield market.

b) As a result of this corporate overspending and loose credit discipline, there were concerns that this could adversely affect growth in the wider economy. Recessionary fears were being factored into risk premia towards the end of 2000 as they are now.

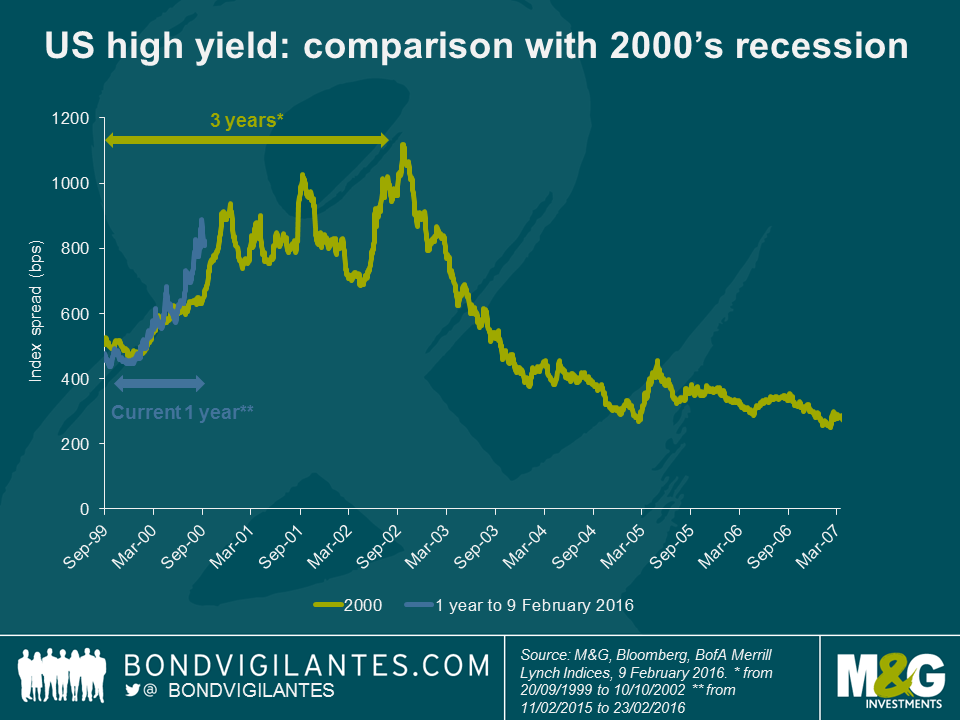

c) The initial repricing of spreads was fairly rapid over the course of 2000, but spreads remained elevated for an extended period. There was no quick snap back in risk premia. This is relevant because unlike the cycles we saw in 2009 and 2011, which saw a rapid tightening in spreads helped by government and central bank actions, the ability for policy makers to affect the same kind of move seems less apparent today. The contemporary cupboard of policy tools is looking pretty sparse. If we are entering a cycle of market weakness, there is a decent chance that this time it could last a while as it did in the early 2000’s.

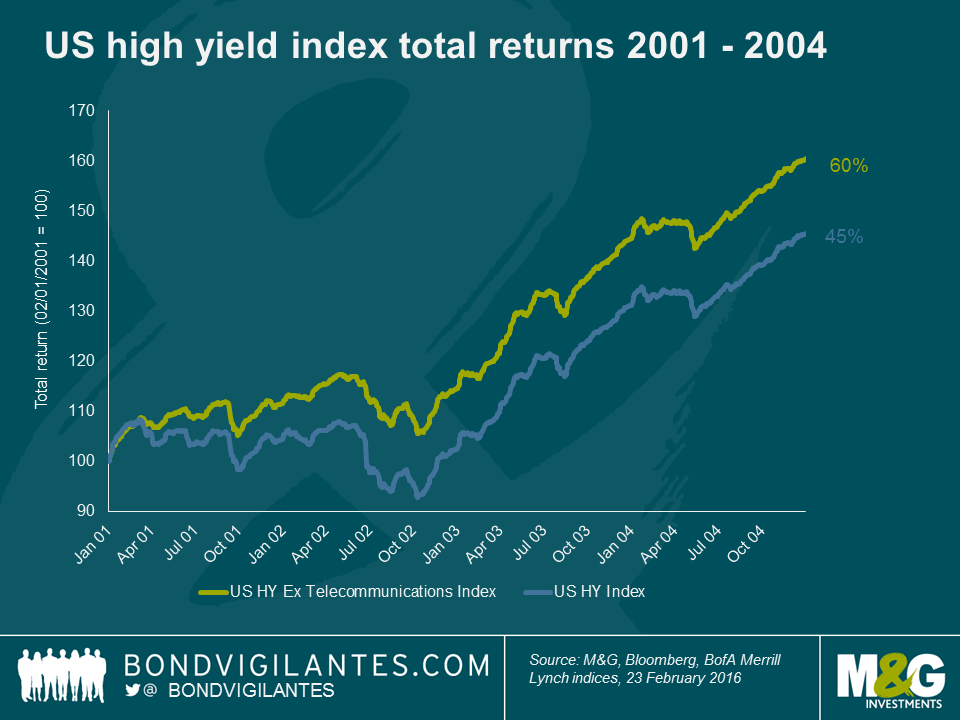

The interesting thing is that buying high yield when spreads first touched around 900bps wasn’t necessarily a bad call, even at the start of an extended default cycle. Buying into the market on Jan 1st 2001 would have meant a return over the course of 4 years, of 45% (remember – both defaults rates and spreads peaked a year later).

Also, a good sector call added significant value. If that investor bought the market without any telecommunications exposure instead, they not only saw consistently positive returns, but also a total return of c. 60% over 4 years, 15% higher than the market average.

It should be noted that the scope to achieve these sorts of returns was only possible with a significant contraction in spreads during the course of 2003 and 2004 – this generated significant capital gains on top of the high level of coupon income.

Nevertheless, being “early on the trade” when spreads first widened was not a punitive experience. The implication is that even if we do see an extended cycle play out, for the patient investor who can ride out a few bumps and scratches in the interim and get the sector call right, the total return opportunities in the high yield market are looking interesting.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox