Martin Ford’s Rise of the Robots: a short interview. Also win one of 5 copies of his book.

My book of the year in 2015 was The Rise of the Robots by Martin Ford. I wasn’t alone in liking it; it was the FT McKinsey Business Book of the Year, and set the debate for a year of robotisation stories in financial markets. Last week we held a Bond Vigilantes x Technology conference here at M&G, with great speeches from Diane Coyle on Digitally Disruptive GDP (are we measuring growth or inflation “properly” in today’s online world?), Dr Wolfgang Bauer on advances in battery technology, solar and fission energy, and Martin on the robots. Tesla also brought along a couple of cars for us to play with – I mean examine the battery technology in.

If you haven’t read The Rise of the Robots yet, you must. In it Martin Ford shows how AI and advances in robotics are putting at threat huge numbers of jobs in both developed and developing markets. And whereas previous advances in machinery replaced mainly manual jobs, this next phase will also cause massive disruption to higher skilled workers, threatening both jobs and wages. The knock on impact will be a huge demand deficit – who will be able to afford to buy the goods that the robots make? In the book Martin suggests that the governments may have to expand the state safety net significantly to prevent societal disaster.

You can watch my brief interview with Martin below. And if you haven’t read the book, you can win a copy by entering our competition.

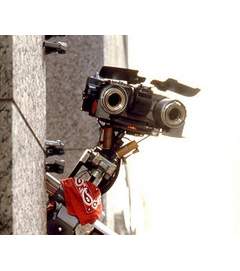

To win a copy of The Rise of the Robots, answer this simple question. Name these three robots.

The answers:

Robot 1: Metal Mickey

Robot 2: Optimus Prime

Robot 3: Number 5/Johnny Five

The winners of the competition are:

Simon Bird

Ian McCaig

Trevor Smith

Steven Smith

Graeme Wearden

Congratulations. Copies of Martin’s book will be sent to you shortly.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox