A Germanic problem

I attended a conference last week where European Central Bank (ECB) bashing was approaching fever pitch. The crux of the argument goes a little something like this:

“The ECB have lost the plot. Monetary policy has become impotent. The ECB is at the lower bound and the law of diminishing returns results only in an ever greater misallocation of resources, punishing savers and rewarding speculation, whilst losing credibility with markets and the wider public. Furthermore the ECB’s willingness to placate markets only serves to relieve pressure on much needed structural reforms.”

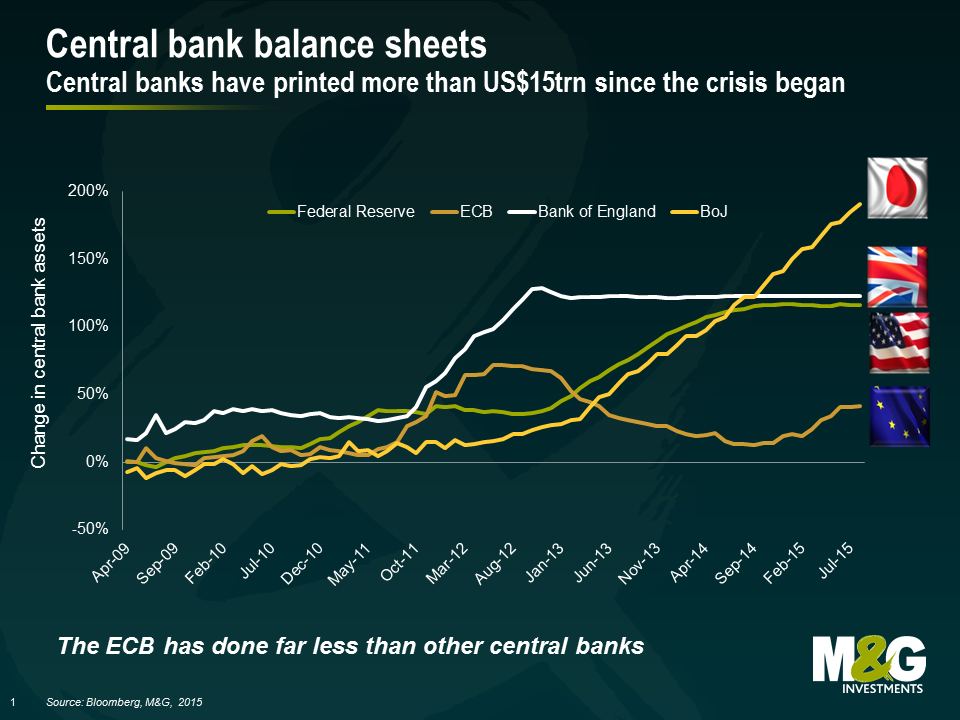

In my opinion, there could be some truth to the diminishing returns argument. It appears that each subsequent Federal Open Market Committee (FOMC) quantitative easing programme had a lesser impact than the previous on long bond yields, a key barometer of QE programmes. But the market has had to concede that the lower bound for monetary policy is not zero – 2 year yields in Germany, France, Italy, Spain, Sweden, Netherlands, Switzerland and Japan all sit well below. And the ECB has shown it has further room to expand its balance sheet by further scaling up its non-conventional measures. Let’s not forget that the ECB has still done considerably less than US Federal Reserve, the Bank of Japan, and the Bank of England. This might help explain why the Eurozone recovery has lagged that of the other major economies.

I believe the ECB should have done more monetary stimulus in order to support the Eurozone economy and done it sooner in order to meet its sole objective of achieving price stability. The ECB hoped that economically uncompetitive States within the Eurozone would pursue difficult structural reforms in order to become more competitive in the international marketplace. This hope has been misplaced. Whilst the heavily indebted nations of the Eurozone had taken some action, it is now clear that high unemployment rates, growing public and private sector indebtedness, and a fall in household consumption is what the ECB should have feared most. The irony is, it had all the monetary tools to assist the ailing Eurozone economy sooner. To those of us that don’t sit on the ECB’s Governing Council, it appears that the ECB has consistently and intentionally run tight monetary policy in order to avoid moral hazard in financial markets. This has come at the cost of supporting the real economy and failing in achieving its primary task – an inflation rate of below, but close to, 2%.

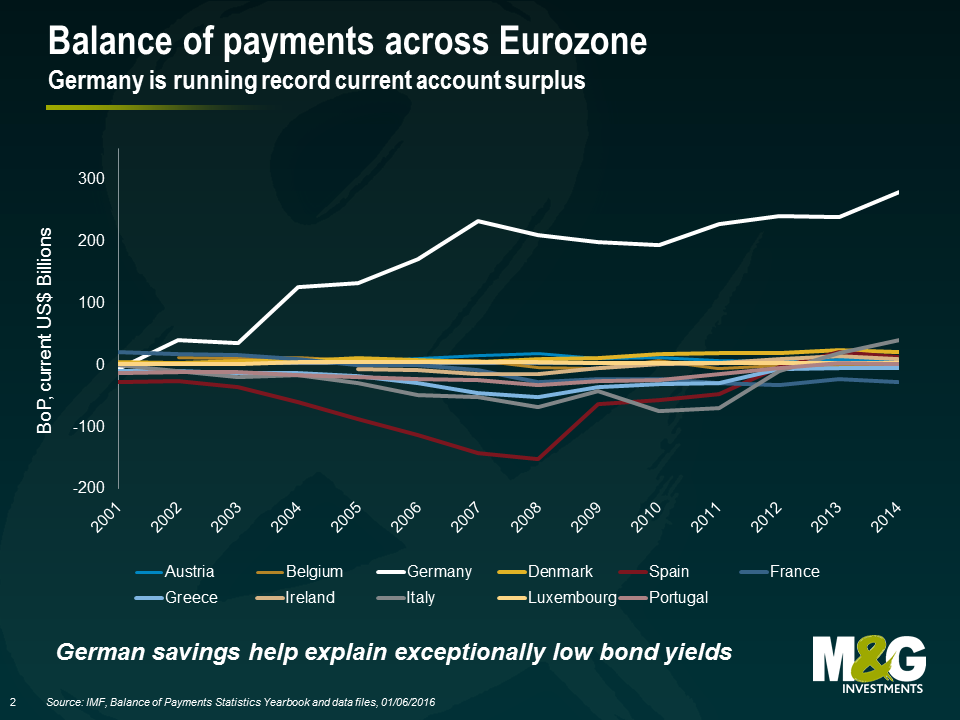

Of course, the ECB was dealt a bad hand to begin with. A currency union of diverse economies, absent fiscal union, is a fragile union at best. At the heart of the Eurozone’s fragility is Germany’s often overlooked and consistently growing current account surplus. Germany’s current account surplus is almost 9% of GDP. This is in violation of the European Commission’s Macroeconomic Imbalance Procedure, which limits surpluses to +6% of GDP. Martin Wolf from the Financial Times has labelled Germany as ‘the Eurozone’s biggest problem.’ Germany has the capacity to now borrow at negative or close to zero yields, yet the public investment in Germany is the second lowest in the OECD (1.5% of GDP), while net public investment has been negative since 2003. As we have pointed out previously, Europe needs a German fiscal stimulus package but won’t get it.

As the Eurozone’s largest economy and creditor Germany has been a major proponent of the Eurozone running a budget surplus. In order to acquire funds to service high debt levels, countries like Greece, Portugal, Spain and Ireland have had to attempt to move their fiscal balances from deep deficits to surplus positions. In order to achieve this, governments have had to implement harsh austerity measures, encouraging saving rather than investment. Consequently whilst Germany enjoys low unemployment rates, rising wages, higher house prices and a cheap currency; the Southern European economies have been mired in economic stagnation, recession and depression.

Addressing these fundamental fragilities is at the heart of the issue for the Eurozone. Ultimately this will require either large fiscal transfers from north to south, significantly higher inflation in Germany or many years of mass unemployment in Europe’s weaker economies.

Nearly ten years from the start of the financial crisis in 2008 it doesn’t feel like we are any closer to a real solution. Until politicians are willing, or more likely forced, to take some very difficult decisions the ECB will have to continue to shoulder the load and act as the de facto fiscal agent for the Eurozone. The criticism of its actions will continue.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox