Case study: Could Trump’s brand affect bond prices?

Earlier this year I gave a top-down macro assessment of Trump’s potential impact on Latin American remittances, should he become President. As the race continues, I now take a bottom-up micro view and assess Trump’s potential impact on an individual bond issue associated with the Trump Organization.

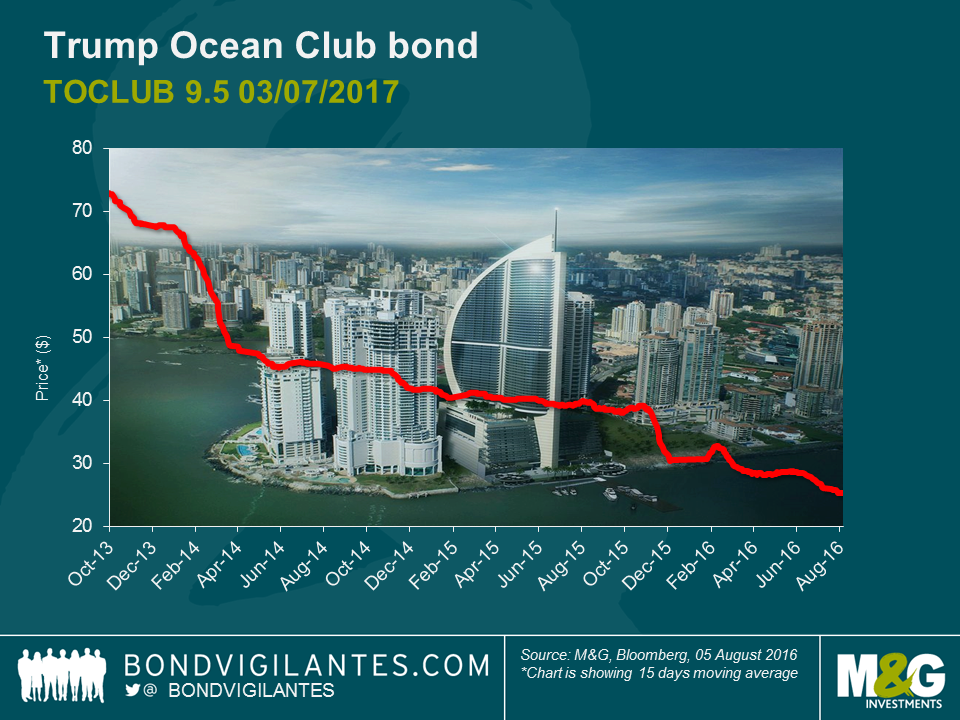

In 2007 the Panamanian real estate market was growing robustly, with prices experiencing double-digit growth. Given this backdrop, Trump Ocean Club’s $220 million bonds were issued in November 2007 through Bear Stearns and were initially rated Ba3 by Moody’s and BB by Fitch. The amount raised was used to finance the development of a high-end project in Panama, comprising of condominiums, a hotel, a casino and some shops and office space.

The developers – a Panamanian-Colombian controlled holding company – entered into a licensing agreement with the Trump Organization for the rights to use the Trump name for a fee of approximately $75 million (which was based on initial assumptions on gross sales). At the point of issue, the project was 64% pre-sold and it was expected that the rest would be sold by 2010. Given the timing of events, however, various factors contributed to difficulties. First and foremost was the US real estate crisis and the aftershocks of the Lehman collapse, which spilled over to the region. Panama is a dollarised economy, but a material share of the committed buyers were from countries whose currencies depreciated significantly, including Venezuela, Colombia and Canada, which led to some buyers defaulting on their purchase agreements. As of early 2015, just 74% of the units were sold. In addition to the adverse macro backdrop, cost overruns ended up stretching the issuer’s ability to service the bonds.

The bond defaulted in 2012 and was exchanged for a new security with a maturity extension until 2017. The new bonds are in default again, though the issuer has made some interest payments and partial tenders at low prices. It remains quoted at distressed levels.

The Trump branding continues to be used, despite the fact that the issuer has not fully honoured its financial commitments (for the name licensing fee) to the Trump Organization and the matter is under litigation. The bond issuer evidently places great value on the Trump name (the prospectus highlights “a decrease in the perceived prestige of the Trump brand name…could adversely impact our ability to market and sell our products”, as the brand was intended to “enhance the marketing and sale of our real estate products to affluent individuals”). As such, Trump’s controversial statements through his campaign could arguably have a negative impact on the brand image, and potentially on the property valuations as end-buyers shy away from the Trump-branded development in favour of other developments in Panama City. This could potentially lead to a larger proportion of the units going unsold, or being sold to investors at discounted prices.

Meanwhile in the US, building on this idea, the app Foursquare has attempted to quantify the amount of foot traffic into Trump-branded US properties over the last 1.5 years based on data sourced from its users. Foursquare found that the market share of foot traffic to Trump US properties in 2015-16 has fallen compared to 2014-15 by approximately 10-15%, particularly among women and Democratic states, which displayed even more pronounced declines (they have adjusted the data to account for the relative number of visits to Trump-branded properties versus visits to competing properties, so it reduces one-off factors such as weather-related issues. They also looked at the absolute number of visits to measure if the decrease in Trump properties’ market share was not due to one-off increases of visits to competitor properties). While these statistics are far from scientific, they do provide some food for thought.

As always, avoiding tail risk underperformers at this part of the cycle (i.e. of rising corporate and sovereign defaults) remains key for long-term performance. Bond investors have an additional reason to keep an eye on Trump.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox