SME financing in Europe – not out of the woods yet

In 2013 I blogged about how financing conditions had tightened aggressively for small and medium sized corporates (SMEs) in peripheral Europe. Three years later, we’ve seen the introduction of targeted longer-term refinancing operations, QE, negative deposit rates and other efforts towards creating a financially united, cohesive, European banking union. Now feels like a good time to revisit this topic in order to assess whether credit lending activity has improved for these small businesses which, in spite of their size, are essential contributors of growth and job creation to the euro area economy.

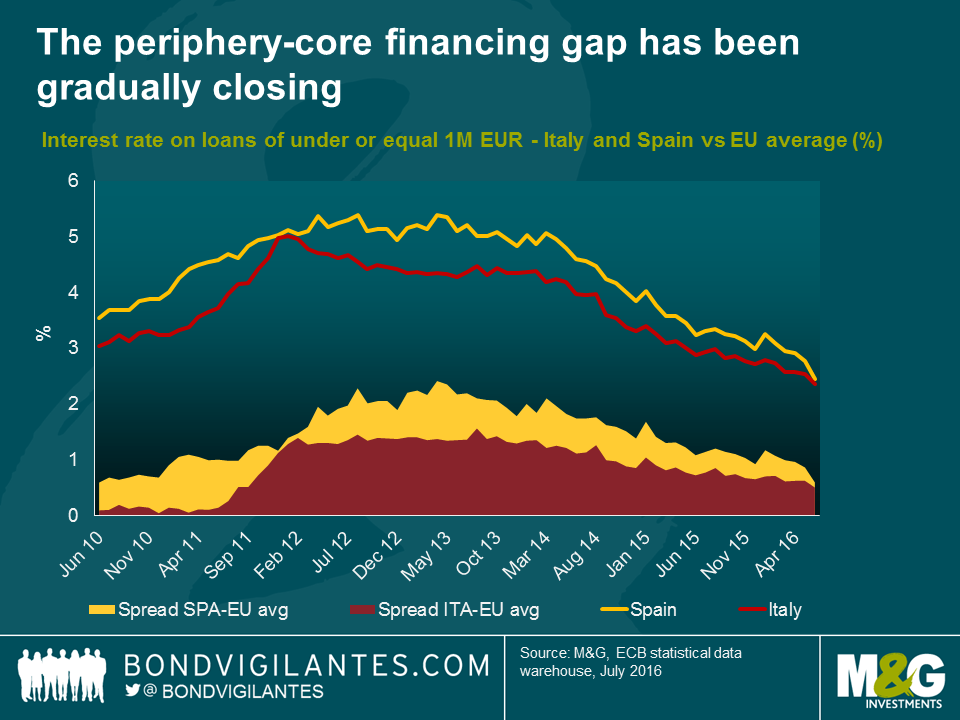

An assessment of loan interest rates could give an indication of the state of the European credit system. Back in the spring of 2013, struggling Spanish and Italian SMEs faced lending rates of 5.4% and 4.3% respectively, compared to the EU-wide average of just under 3.0%. The following chart demonstrates how the financing gap with the rest of Europe has been gradually closing with risk premiums having shrunk by 157bps and 85bps since March 2013. For Spain alone, this represents a decrease in funding costs of 52% over this period and 24% in the last 12 months alone. This improvement in peripheral SME lending rates mimics the recent trend observed in their sovereign funding costs. Continued progress towards the formation of a European banking union, some further relaxation of monetary policies, the ongoing banking sector restructuring efforts, and a revived domestic demand for credit have all been key drivers for the general improvement in investor confidence.

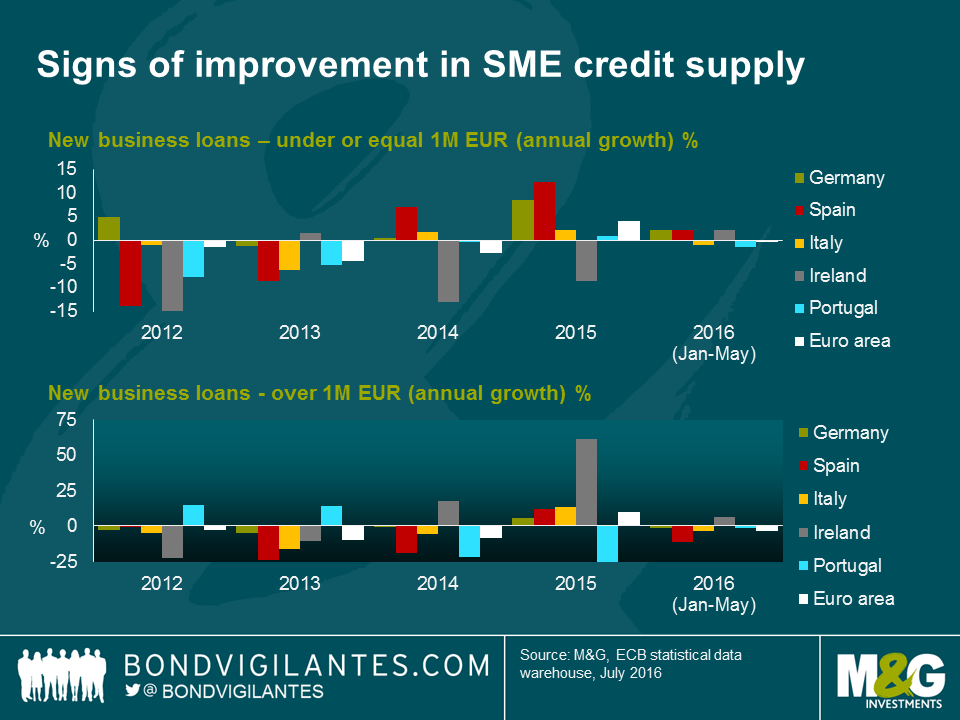

So funding is cheaper, but are SMEs utilising this? Since 2015, bank lending volume activity to SMEs (measured by new business loans worth less than 1mn EUR) has been on a rising trend. The chart below depicts annual credit lending growth rates across Europe and illustrates how the recovery in credit supply has been particularly strong in Spain, with annual lending activity growing by 7.1% in 2014 and 12.4% in 2015. Turning our attention to bank loans for larger size companies (i.e. represented by loans worth more than 1mn EUR), closer analysis reveals that lending activity has lagged that of smaller transactions (Ireland represents an interesting exception to the trend in 2015 where Irish banks increased >1M EUR corporate lending by over 60%). On the whole, a pick-up in demand did not fully materialise until 2015 and has since dropped in 2016. This could perhaps be explained by the ECB’s recent decision to enhance their asset purchase programme so as to include private corporate debt; the bigger companies with access to international financial markets have willingly taken the opportunity to substitute costlier bank lending for bond issuance at historically low interest rates.

While signs of improvement in the supply of credit have emerged, there is still some way to go. The smooth working of the transmission mechanism is of central importance to facilitate SME access to funding and it is therefore encouraging that some EU institutions have recently stepped up their efforts to address this problem. Financial innovation is welcome (to better allocate funding) and the promotion of measures that foster enterprise growth will be key to opening up alternative sources of funding (i.e. private equity, venture capital, wholesale markets). The rapidly developing FinTech or Crowdfunding industries are prime examples of incipient forms of SME lending. Progress from here will be beneficial; not only to break the strong dependence on banks, but to strengthen SME’s resilience in future economic downturns.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox