Good things come to those who wait – a look into valuations of USD long-dated credit

In a recent blog post, Ben discussed relative valuation opportunities in the US investment grade (IG) corporate bond market. Today, the long-dated segment of this market looks increasingly attractive given how steep credit spread curves in the US dollar IG space are at the moment.

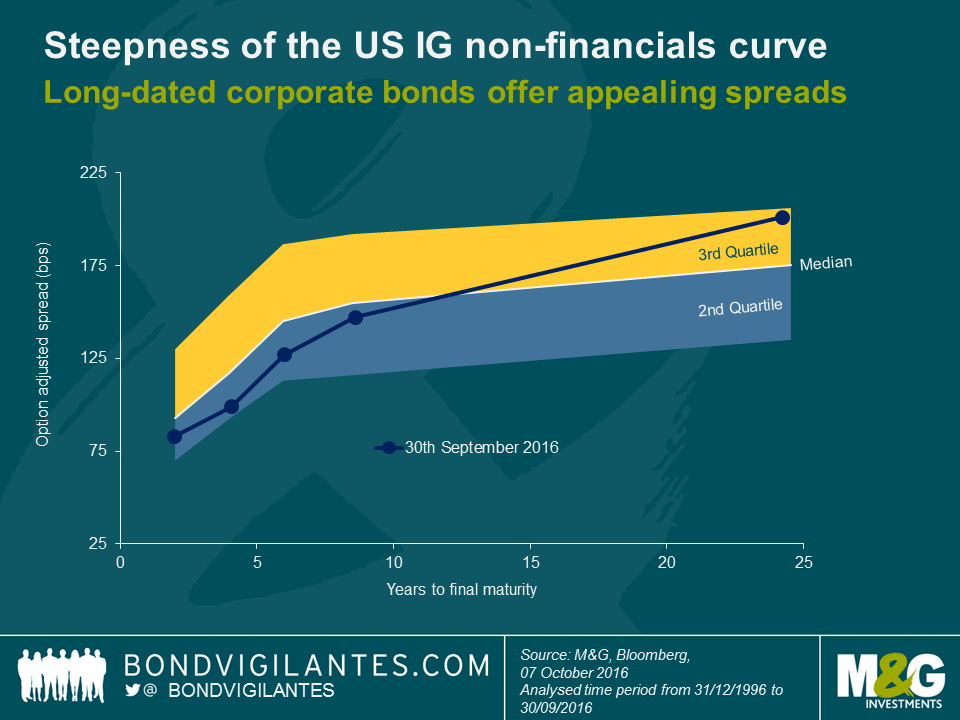

The chart below shows the credit spread curve, as of 30th September, of US dollar denominated IG-rated non-financials against the middle 50% of spread observations over the entire history of the constituent bond indices since year-end 1996. Credit spreads for bond maturities below 10 years are currently beneath their historic median values. On the other hand, the spread level for long-dated credit nearly touches the top end of the range at 201 bps, highlighting the current curve steepness. In fact, looking back at the last 20 years’ worth of spread history, long-dated spreads have been tighter than today in 71% of all cases!

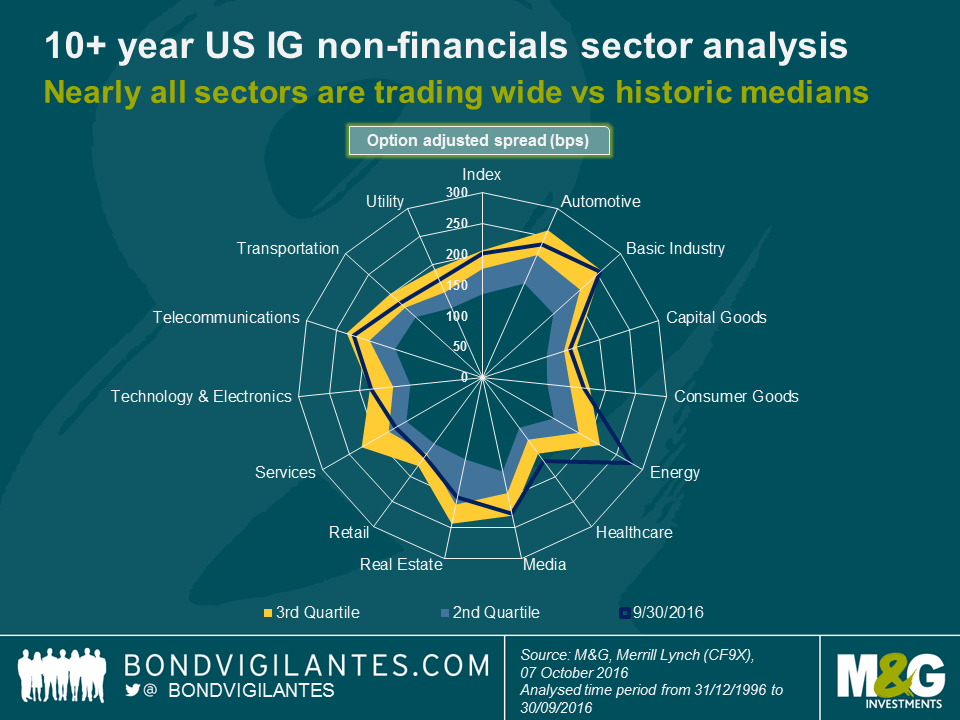

The following chart illustrates that attractive valuations of long-dated US dollar corporates are wide-spread across industry sectors. With the exception of real estate and services, all other sectors within the 10+ year IG non-financials space are trading in the 3rd quartile and, thus, above their historic median values. Furthermore, spreads for two sectors – energy and healthcare – rank even beyond 3rd quartile. This is not all too surprising considering the rather sluggish oil price recovery and political risks with regard to drug pricing, respectively.

With this in mind, it is fair to say that credit spreads of long-dated US IG corporates today provide a decent carry, particularly at a time when large parts of the government bond universe are trading at historically low or even outright negative yields. With attractive valuations like this, what could possibly go wrong?

Well, for instance, the high spread duration of long-dated corporate bonds makes them particularly susceptible to spread widening. The carry provided by the credit spread can act as a “cushion” for investors but will only absorb capital losses up to a certain point. In the case of the US non-financial 10 year+ corporate bond segment, which trades at a spread level of 201 bps and has a spread duration of 13.7 years, spreads can widen no further than 15 bps per year, all else being equal, before the carry generated from the credit spread is wiped off by capital losses. In a distinct risk-off episode however, as the one we experienced in the first quarter of this year, spiking credit spreads would seriously impact valuations of long-dated credit, at least temporarily.

Spread duration, like most other risk factors, is a double-edged sword, of course. If spreads continue to grind tighter, investors will enjoy capital appreciation on top of the credit spread carry. Considering current valuations of long-dated US Dollar corporates, we see potential for further spread compression in the medium and long term. Given how steep the spread curve currently is, there is reason to believe that long-dated credit is likely to relatively outperform short-dated corporates.

One factor that might prove to become a technical tailwind for long-dated US Dollar investment grade credit is the Bank of England’s newly launched Corporate Bond Purchase Scheme (CBPS). The eligible bond universe, as of 7th October, is distinctly long-dated in nature with a weighted average maturity of 13.5 years. In fact, around 55% of CBPS eligible bonds mature in more than 10 years and c. 25% even only after more than 20 years. Sterling investors who look for these maturity characteristics might find themselves increasingly crowded out by the CBPS. As the Euro investment grade universe is distinctly shorter-dated, they would not have much choice but to turn to the US Dollar market, exerting further downward pressure on credit spreads at the long-end.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox