It’s Halloween. Here are some scary charts.

The financial world is a scary place. Debt, disinflation and deteriorating growth have plagued investors over the past year, plunging bond yields into negative territory in a number of countries. Perhaps most frighteningly, it is now eight years since the financial crisis and central banks in the developed world continue to employ an ultra-easy monetary policy stance. With government bond markets currently resembling a freak show at an extended point in the economic cycle, the next global recession could be around the corner. There is no need to watch scary movies this Halloween, as the following makes for some frightening reading.

- Owning government bonds is a scary thing to do.

Developed market government bonds have been one of the best performing asset classes in 2016, confounding many predictions at the start of the year. In general, the right trade has been to own long duration assets, indeed the longer the better. Year after year investors predict that bond yields will rise and year after year bond yields make new lows. Of course, there are some very good reasons to expect this trend to continue.

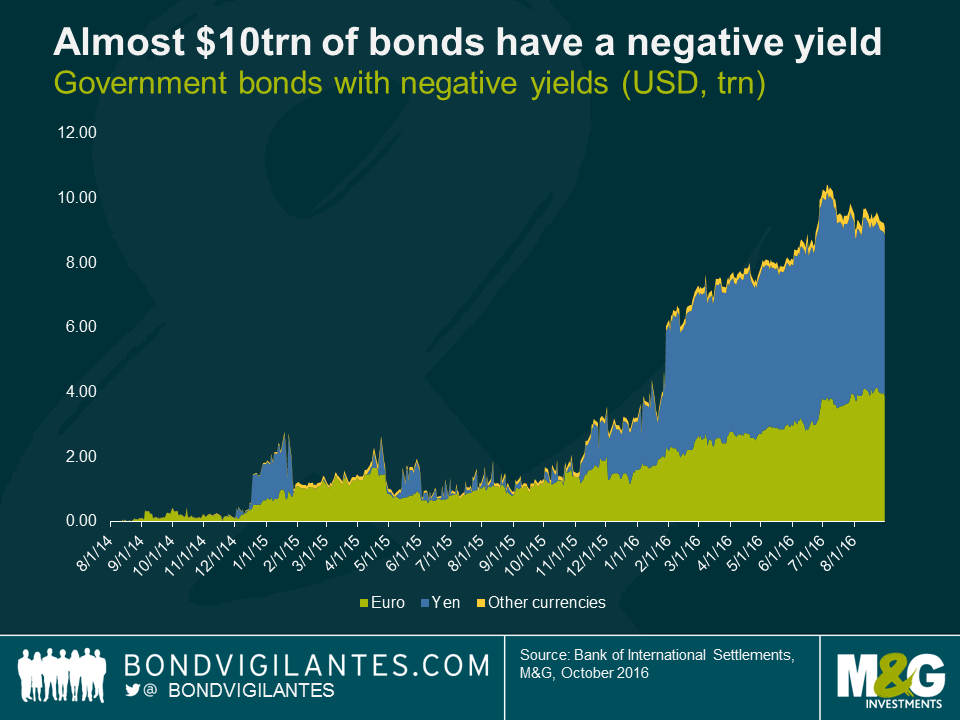

However, bond markets now expect that monetary policy normalisation won’t occur until some point in the distant future. Low inflation means that central banks continue to support their heavily indebted and ailing economies, resulting in almost $10 trillion worth of developed market government bonds trading with a negative yield. As a result, many companies – including banks – are struggling in this low (and negative) interest rate world. These companies are finding their existing business models challenged in an environment of low growth and tighter regulation. Pressures in the financial system are building, and it is unclear how these issues will be resolved.

- Central banks are fearless. They own a lot of the bond market.

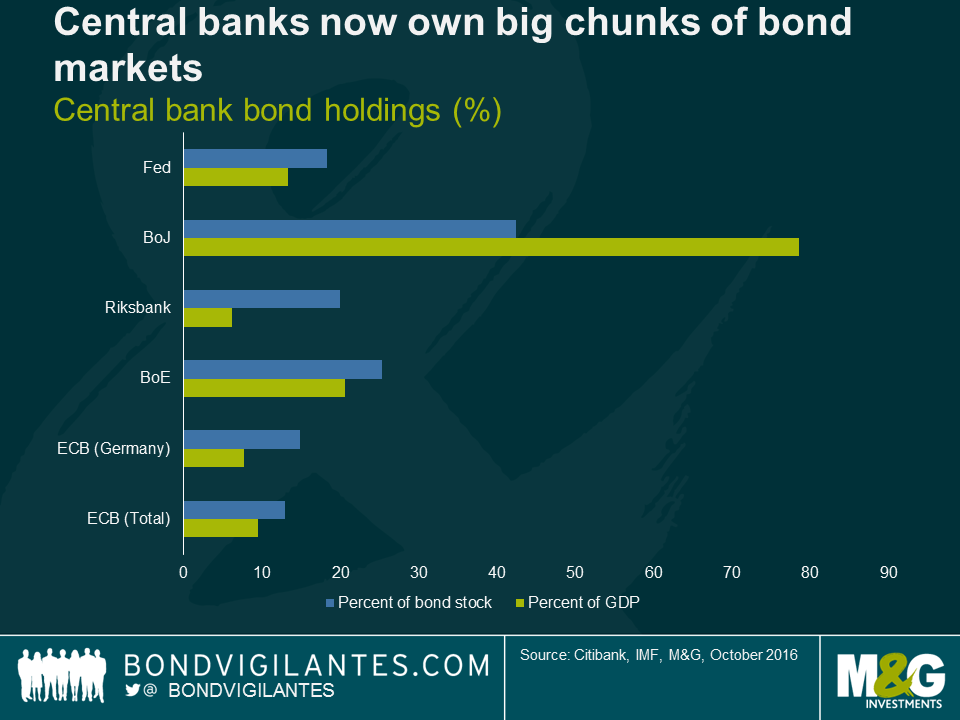

Central banks’ sizable purchases in government bond markets through quantitative easing means that term premiums (the extra amount that investors demand for lending at longer maturities) have been pushed further into negative territory. It was once inconceivable that investors would pay for the privilege of lending to a government. Now this phenomenon is commonplace not only in government bond markets but also for some recent corporate bond issuance.

It isn’t only central banks that are at the bond buying party. Demand continues to increase for long duration assets, from other large institutions like pension funds and insurance companies. The combination of central banks, pension funds and insurance companies has limited any sell-off in bond markets, reducing yields across the bond curve. Aging demographics mean that safe haven assets may continue to remain in demand, forcing investors into riskier assets if they want to generate a positive real return.

- If inflation rises, or interest rates go up, look out below.

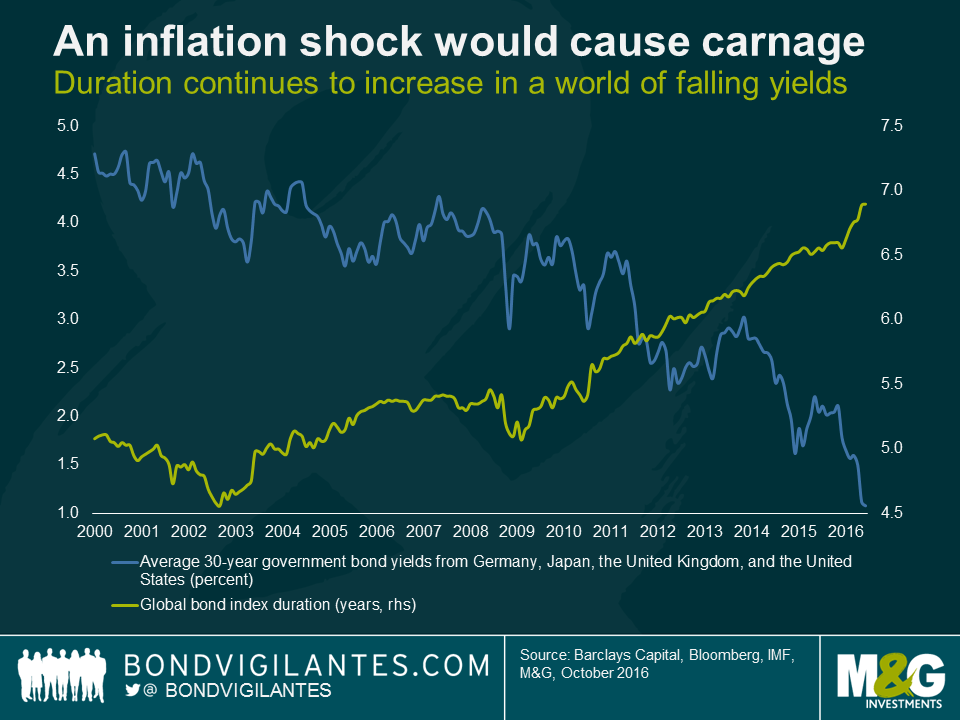

Despite the negative yield environment we now find ourselves in, how central banks react to the next inflationary shock will have huge ramifications for bond investors. With global bond portfolio duration close to 7 years, investors could face large capital losses if rates were to increase in a meaningful way. This raises a number of important questions. Will central banks hike rates in an environment of stagflation? How will politicians react when the paper losses on QE bought portfolios held at central banks are reported in the media? Could central bank independence come under threat? As many banks and insurance companies own long dated assets, will financial instability increase when long-dated bonds experience large capital losses?

Currently, the market is more focused on secular stagnation than inflationary concerns, but with oil up almost 100% from the February lows and trade protectionism starting to begin to carry favour in government buildings around the world, a global inflation shock might be closer than many currently expect.

- Political risks in emerging markets could lead to forced selling.

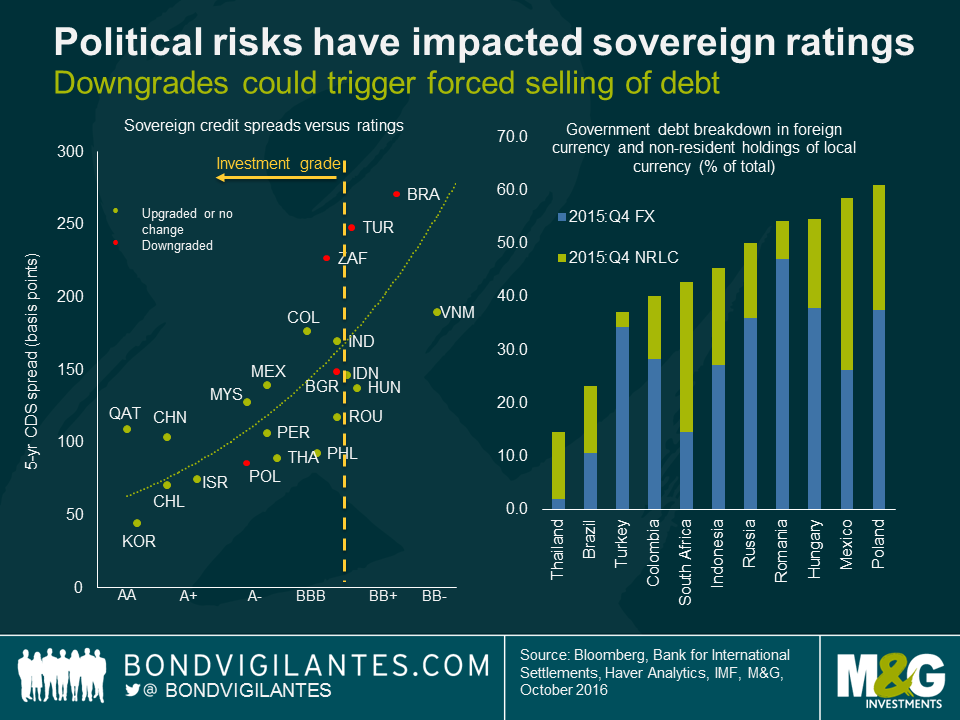

Several emerging market sovereigns have been downgraded over the course of the past year, with rating agencies highlighting political uncertainty as a major factor in the decision. The impact of the downgrade has been felt immediately, with heightened volatility in bond markets the result.

Large inflows into emerging market bond markets has left some countries vulnerable to increased political risks from abroad. Mexico is a good example given the current uncertainty surrounding the U.S. presidential election. Many emerging markets are also vulnerable should the US dollar strengthen, a possibility given the U.S. FOMC is by far and away the closest of any of the major central banks to hiking interest rates. An additional risk is the possibility of a large emerging market nation being downgraded from investment grade status, causing forced selling of hard currency debt by foreign investors.

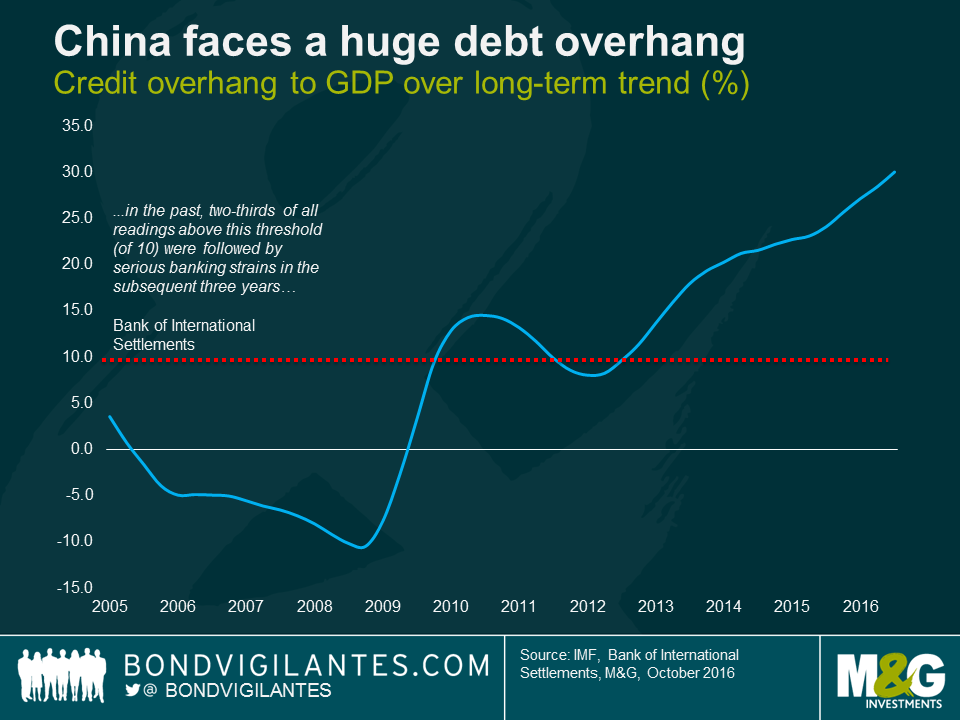

- China faces a huge debt overhang. Be afraid.

The most dangerous four words in finance are “this time is different”. And when it comes to credit booms, they don’t tend to end well.

One measure economists look at to determine excess credit growth is a country’s credit overhang. This measures the difference between the credit-to-GDP ratio and its long-term trend. It has proven to be a reliable indicator, with the Bank of International Settlements stating that “in the past, two-thirds of all readings above this threshold (of 10) were followed by serious banking strains in the subsequent three years”. China’s credit-to-gross domestic product “gap” now stands at 30.1 percent, the highest for the nation in data stretching back to 1995, suggesting the banking system could already be coming under severe pressure.

Numerous warning signs are flashing amber or red in the Chinese financial system, given that huge swatches of renminbi have gone into financing large-scale real estate projects and new production capacity for industrial sectors of the economy. This toxic combination of high and rising debt in a slowing economy tends to lead to an economic deterioration. As authorities continue to chase economic growth, capital is funnelled into unprofitable projects and overcapacity. Eventually, prices begin to fall and borrowers face large capital losses. Additionally, much of the finance available for investment projects was made available through the shadow banking system, which is more susceptible to a sudden stop in capital flows and a run on deposits.

Happy Halloween.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox