Tantrums and tidbits: Government bond market déjà vu

I have been overwhelmed by a sense of déjà vu of late. Talk of rates not rising again this cycle (US), ever again (Europe), or even being cut even further (UK, Japan) prevails. Quantitative easing continues apace and could be set to broaden further, be that in its duration or via the inclusion of new types of assets. Economic growth appears to be stalling, corporate profitability is showing late cycle declines, inflation remains practically non-existent. I could go on. Everywhere you look there is pessimism about the global economy, concern about monetary policy having – perhaps long ago – reached its limits, and new reasons to buy government bonds and risk free yields.

I was recently having a conversation with my colleague Anjulie about valuations and the outlook for government bonds, and in doing so, realised that I felt unnerving similarities between now and the first few months of 2013. Back then, there was talk about ‘QE-infinity’, the Japanification of the US, rates never being hiked again; anyone else see any parallels? Anjulie’s view, more correctly than mine, so far, was that despite yields already being historically low, given the extraordinary central bank action, the case could be made for rates and government bond yields creeping lower still. I felt differently, and said that it would be a worthwhile exercise for us to go and look back at the ‘Taper Tantrum’ and ‘Bund Tantrum’ of 2013 and 2015. Perhaps we could learn something from these episodes that could be applied to today? Anjulie put together the below slides and her findings are worth discussing.

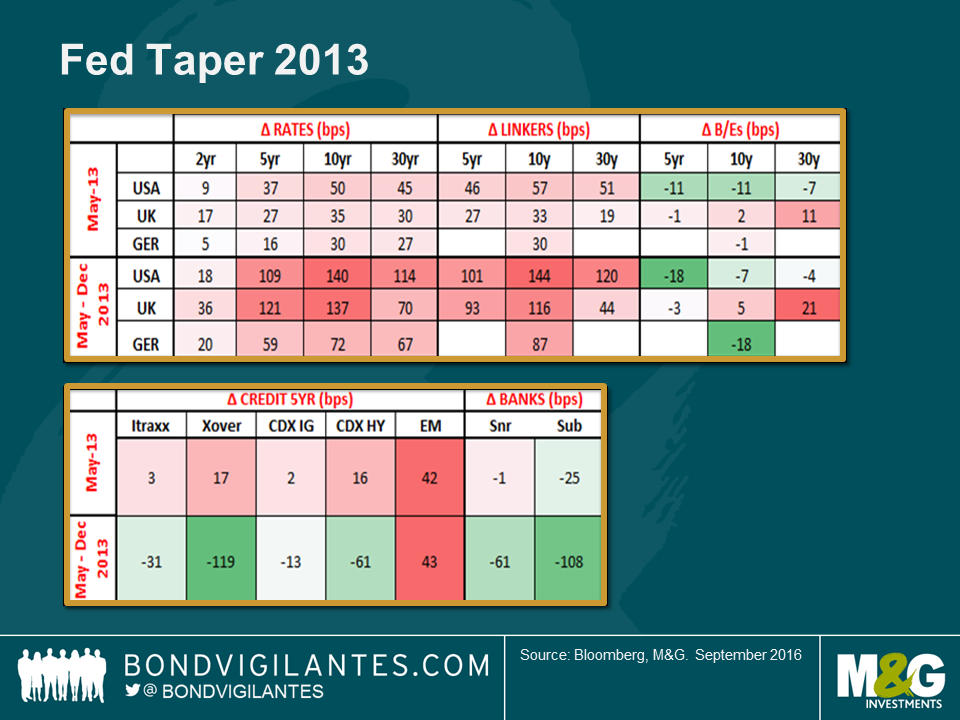

Following the insignificant comments made by Ben Bernanke in an afterthought to a speech in May 2013 (in which he referred to tapering off the rate of purchases of government bonds and mortgage backed securities; MBS), the bond market awoke and had a proper tantrum. As the chart shows, 10 year treasuries sold off by 50 basis points in May alone, and by 140 basis points in the eight month period May – December 2013. Bunds and gilts were dragged down with treasuries, in spite of the fact that there was no talk of ‘tapering’ in Europe and the UK. Index-linked bonds were hit too, in a resolutely negative manner. Credit, though, was more mixed, with an initial widening in credit spreads in May reversing very strongly by the end of 2013, except in emerging markets which took the utterance of the word taper downright negatively.

One word, taper, was enough to cause these massive moves in government bond yields. It wasn’t a change in policy, as rates didn’t move and the rate of QE purchases did not change. So we asked ourselves what actually drove the changes. In my opinion, the takeaway from this episode was that the “this time it’s different” arguments had hit fever pitch (i.e. arguments about why monetary policy was never going to reverse course, which had been used to justify positioning reaching extreme long levels in government bonds and fixed income generally). As the realisation dawned that zero rates and constant QE were not necessarily going to carry on forever, everyone rushed for the door, fast.

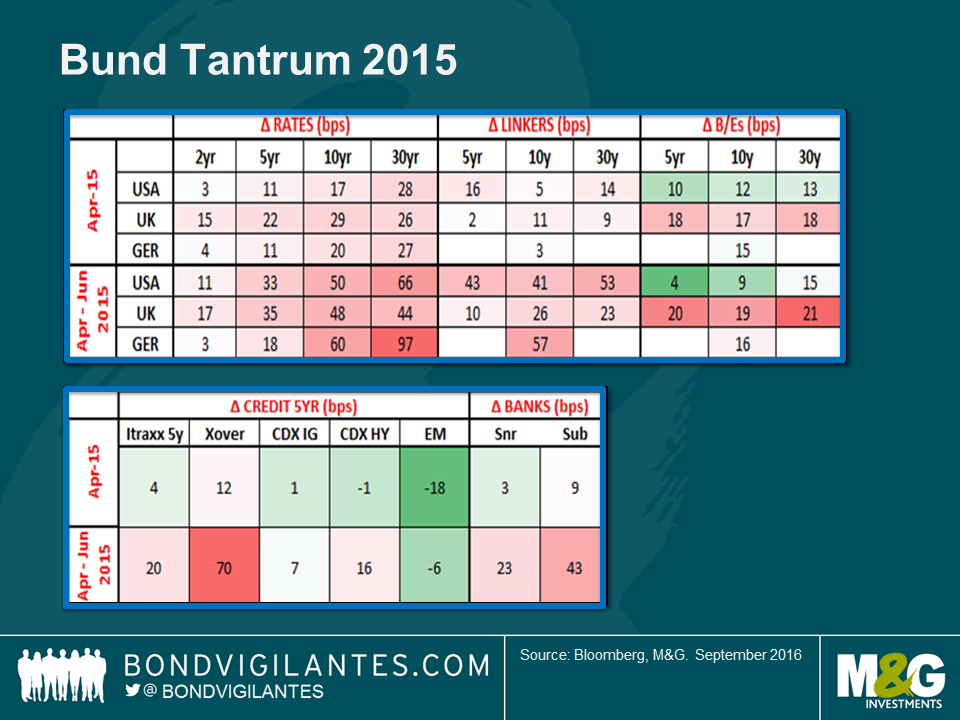

The bund tantrum of April 2015 was similar in that UK, German and US government bond yields all rose significantly, with bund yields up 20 basis points in April and by 60 basis points in the April to June period. The story in credit was much more mixed though, and it is difficult to draw anything from this period, other than to observe that bank bonds took rising yields to be starkly negative. How different it feels today!

Looking back at this tantrum it is hard to put one’s finger on the catalyst which caused sell off in government bond yields. Yields on 10 year bunds touched 0.1%, and two months later they were back at 1%, incurring a loss of around 9 percentage points. In this case, I would postulate that positioning had moved very long given negative inflation prints and the start of QE. At 0.1%, long term valuation considerations came back to the fore and investors started to sell. And then everyone did. Again, fast. Whatever the reason, the sell off serves as a stark reminder: sentiment can change suddenly without the need for an obvious trigger.

As I mentioned at the outset, I see many parallels between today and the periods preceding these sell-offs. “This time it’s different” arguments – how rates can’t rise, QE can’t stop, inflation can’t be seen anywhere on the horizon, and government bonds can’t fall in price – abound. These are being used as justifications for buying yields and duration, even at a time when starting valuations are at extremes. We saw the same in early 2013 and in the early parts of 2015, albeit the starting point for valuations in the build up to these two tantrums were not as extreme as they are today. Being aware of these similarities, and remaining fully aware of current valuations, to my mind, argues for caution in these times.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox