Fixed versus floaters: four reasons to like high yield floating rate notes right now

With the market currently pricing in an 84% chance of a US interest rate hike in December it appears likely that there is some pressure for bond yields to move higher on a medium term view. This is on top of the re-pricing that we have already seen in risk-free assets like US Treasuries over the course of the past four months. High yield assets are not immune from the laws of bond maths, with longer duration assets suffering in the current rising yield environment. In my opinion, there are four reasons why high yield investors should be looking to the floating rate note market to help manage their exposure to interest rate risk at this point in the cycle.

- New Issuance helping to diversify and grow the market

The High Yield FRN market is seeing a pick-up in new issuance and supply at the moment. As a relatively small but developing area of the bond market this is important, as this allows investors increased choice and diversification. The chart below shows a selection of new issue deals we have seen over the past few weeks.

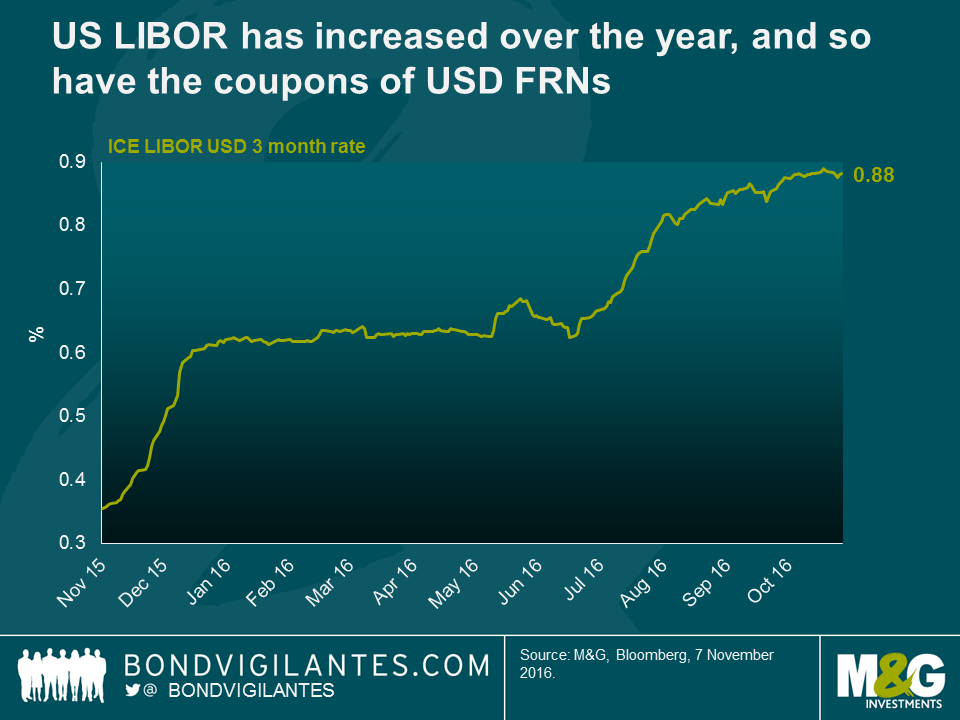

- USD FRN investors benefitting from rising USD LIBOR rate

For US dollar investors, floating rate notes have benefitted greatly from the re-pricing of risk in money markets. As US LIBOR has increased over the year to c. 0.90%, so have the coupons of all USD floating rate portfolios, with no associated hit to capital values. Further interest rate hikes from the Fed over coming months could see subsequent increases in USD LIBOR going forward.

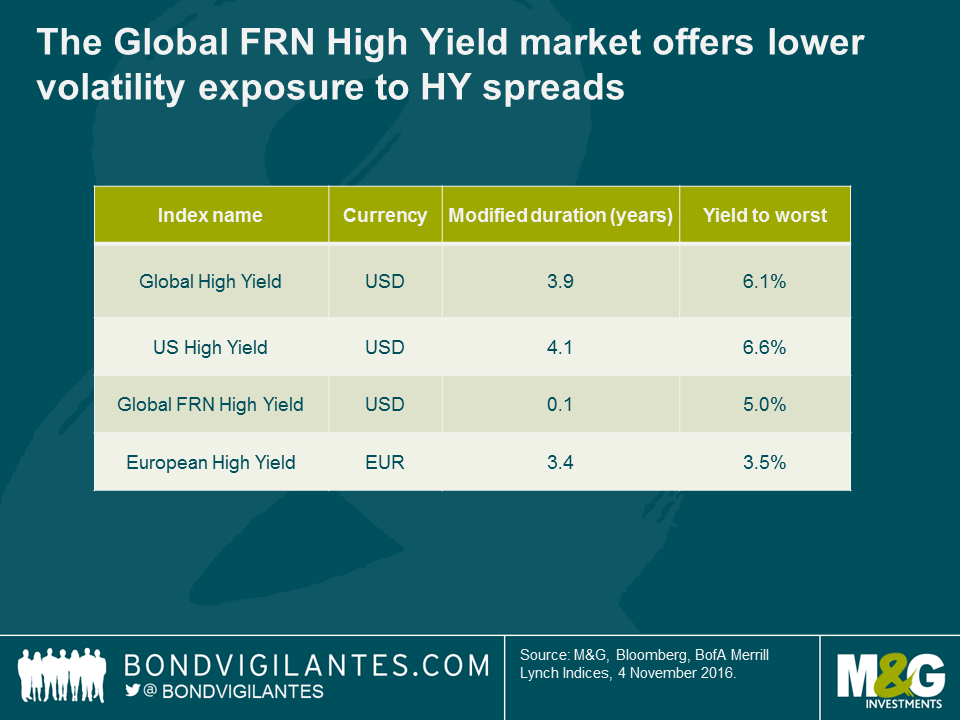

- Risk-adjusted value supports FRNs versus fixed high yield

As shown in the table below, the high yield floating rate market offers similar yields to the conventional US and European high yield markets today, but with much less interest rate risk (i.e. close to zero) and lower volatility in periods of risk aversion. We believe this feature makes this part of the market more attractive on a risk-adjusted basis for investors who are looking for lower volatility exposure to high yield credit spreads.

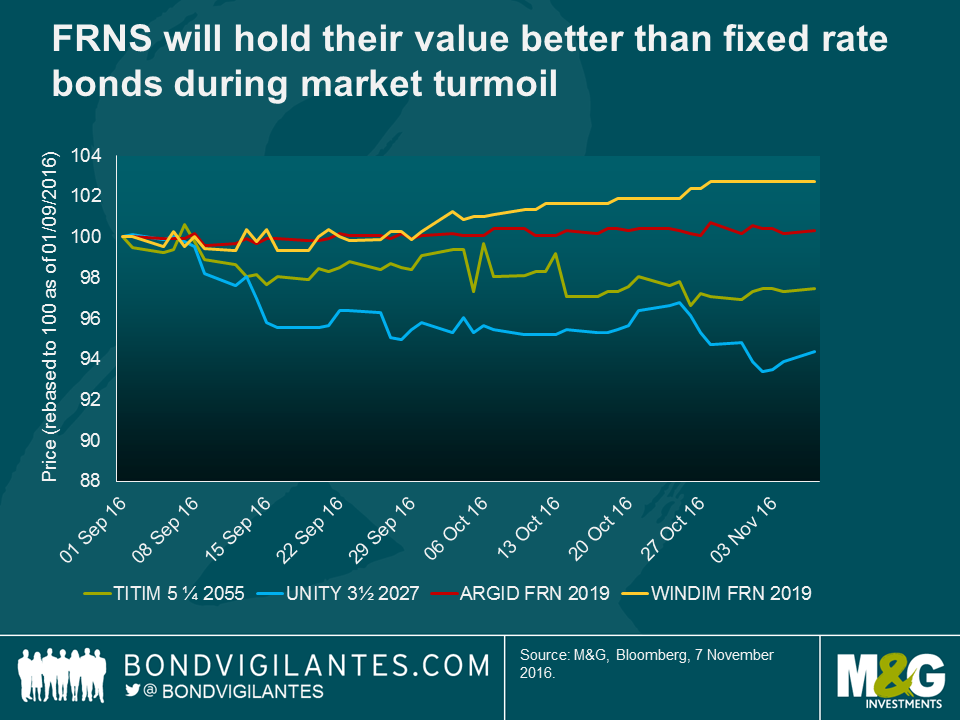

- Capital preservation if government bond markets continue to sell-off

If government bond markets continue to weaken, FRNs will hold their value better than fixed rate bonds. This has indeed been the case over the past 3 months, even for high yield bonds. The chart below illustrates in practice how floating rate bonds have held up, or even marginally increased in value, over the past few months. On the other hand, longer-dated conventional high yield fixed rate bonds such as those issued by Telecom Italia (TITIM) and Unity Media (UNITY) have fallen in price by several percentage points due, largely, to their much greater sensitivity to government bond market volatility.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox