The US election result impact on high yield markets

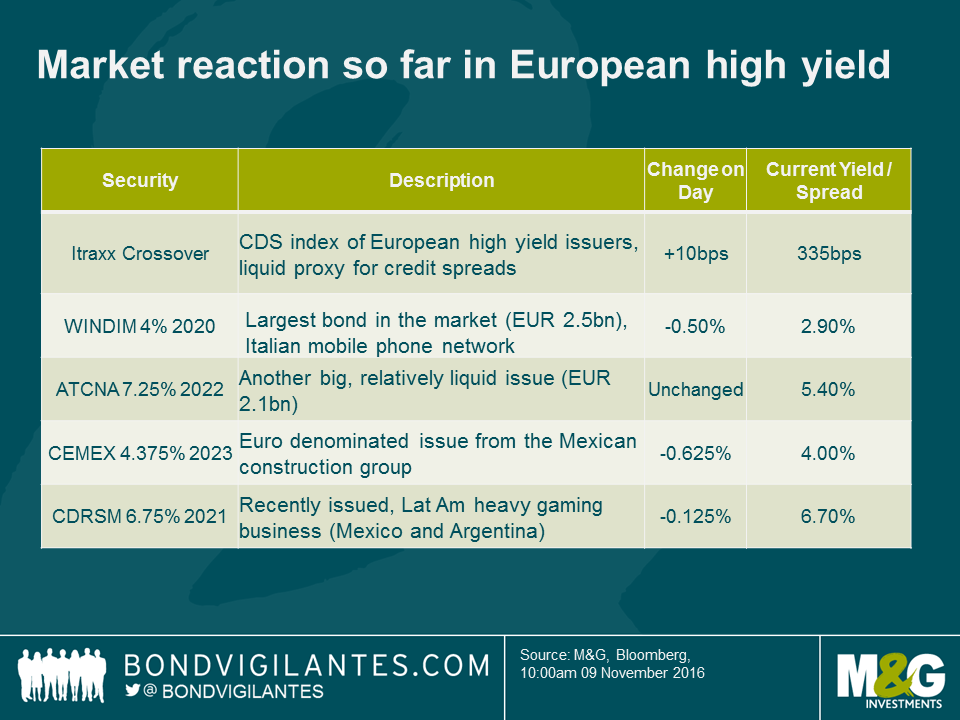

After the surprise election result, market reaction within the European high yield market has been surprisingly muted. Here are a few key moves that show how the news is being digested.

In general, the market seems to be pricing in little to no impact for European risk premia, and even for the more potentially directly impacted companies in Latin America, the re-pricing has been very mild.

It seems investors are looking through any short term uncertainty and seeing looser fiscal policy as a boon to nominal growth, something that should be positive for most high yield businesses. Cemex, for example, has a major presence in the US domestic market – in one of those ironies, it could end up being a major supplier to a Trump infrastructure programme.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox