Japan research trip: how will the Bank of Japan exit YCC?

Guest contributor – Jean-Paul Jaegers, CFA, CQF (Senior Investment Strategist, Prudential Portfolio Management Group)

Recently Jim Leaviss and I travelled to Tokyo to discuss local economic developments and Bank of Japan (BoJ) policy with economists and analysts based in Tokyo.

There was generally broad agreement that the potential path for Japanese government bond yields (JGBs) is asymmetric. The scope for lower interest rates was viewed as limited given the BoJ is aiming for an upward sloping yield curve and would not be comfortable if long-end yields fell by too much. Moreover, the move into negative territory with the policy rate has generally been perceived as quite negative by the wider public, affecting consumer confidence.

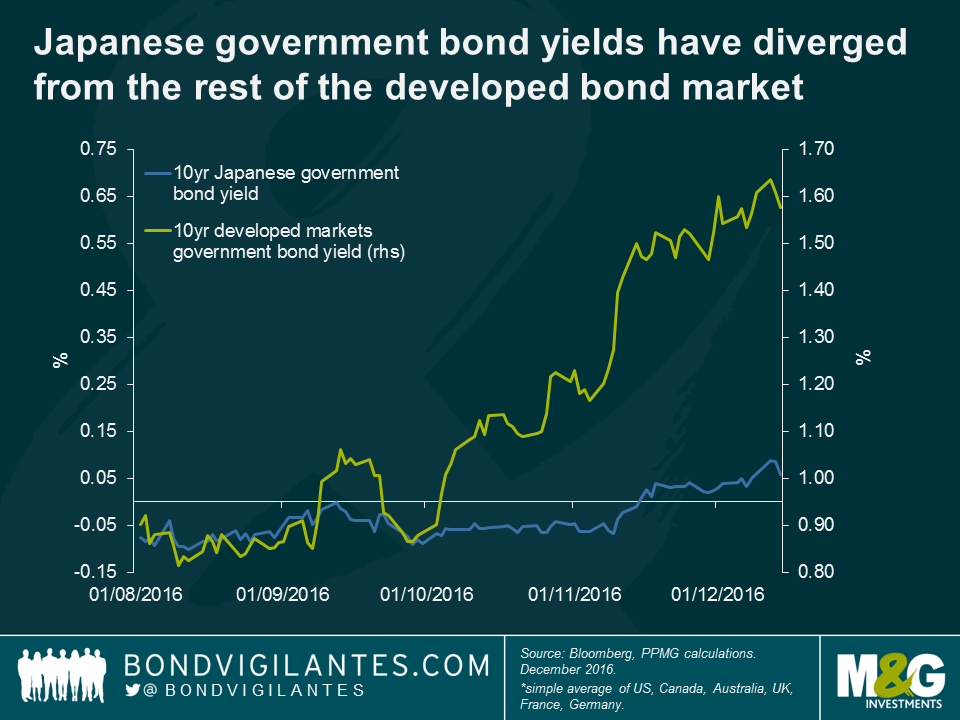

Market watchers have hinted at a preference from the BoJ to spend less than the ¥80 trillion rate, and a switch in policy from quantity to price targeting could be read as a way to taper bond purchases. However, there are a number of risks to the BoJ rate of government bond purchases. Firstly, if international bond yields continue to drift higher, the BoJ may be forced to increase purchases for a period of time to above their comfort level. Secondly, the BoJ risks falling behind the curve, as they attempt to balance the objectives of the yield curve control policy against the prospect of falling inflationary pressures.

One of the options to balance this risk would be to reset the yield curve targets from time to time, or to start using a ‘dot-plot’ as a guidance for yield curve targets to avoid any disruptions. However, this could be challenging in practice, as bond markets would likely take this as a negative signal and sell JGBs. The experience of the Federal Reserve in 1942-1951, where policy capped interest rates directly, shows in particular that the exit strategy is challenging.

One of the options to balance this risk would be to reset the yield curve targets from time to time, or to start using a ‘dot-plot’ as a guidance for yield curve targets to avoid any disruptions. However, this could be challenging in practice, as bond markets would likely take this as a negative signal and sell JGBs. The experience of the Federal Reserve in 1942-1951, where policy capped interest rates directly, shows in particular that the exit strategy is challenging.

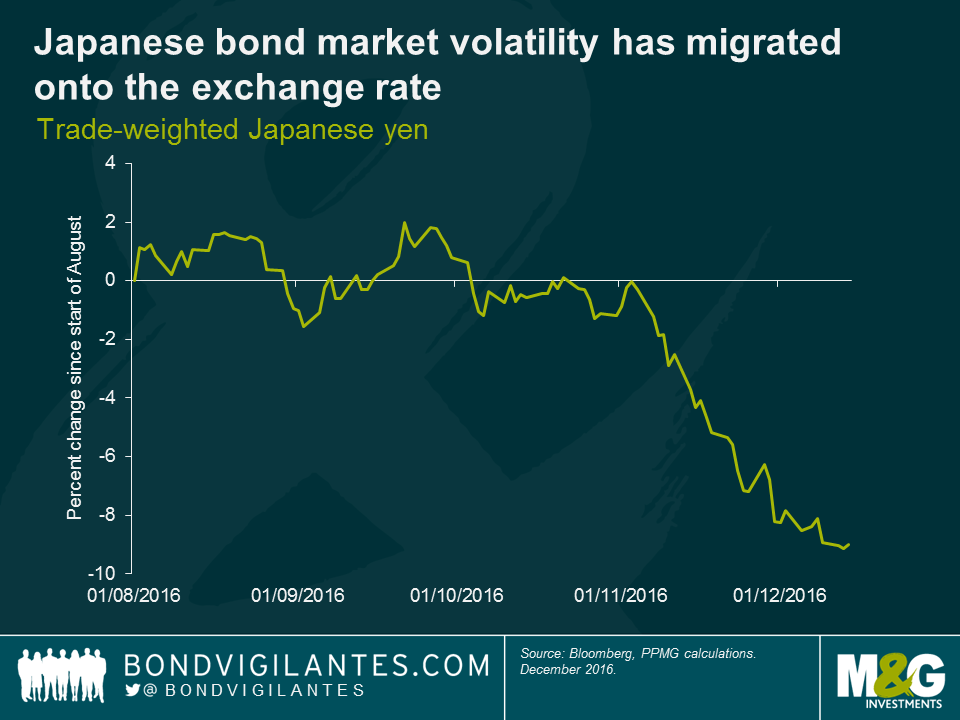

With the introduction of yield curve control the BoJ has in a way isolated the Japanese bond market from international developments. Consequently, volatility in bond markets has migrated onto the exchange rate. Given the yen is the transmission channel, a scenario of yen appreciation (for example US protectionism driving the US dollar down) would be an important element to keep an eye on.

Should yield curve control prove effective and the BoJ stick to its policy, there remains the question of how an exit strategy would look. The more one thinks about it, the more one tends to arrive at the conclusion asymmetry for bond returns is quite likely. This could be either by policy choice in an environment where global rates continue to drift up, or the result of the BoJ resetting the target to slightly higher levels. Any sign of upward management in yield curve control, in particular if the BoJ were eager to move away from negative policy rates, would signal to an investor on which side of the trade investors want to be. In the pure sense of control, such a scenario looks quite asymmetric for the investor (which for investors is a good thing), but also illustrates the challenge that increased control at a moment in time might come at the cost of less control going forward.

This content is prepared for information and does not contain or constitute investment advice. Neither PPMG, nor any of its associates, nor any director, or employee accepts any liability for any loss arising directly or indirectly from any use of this material.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox