Poor old ECB. Damned if it does, damned if it doesn’t.

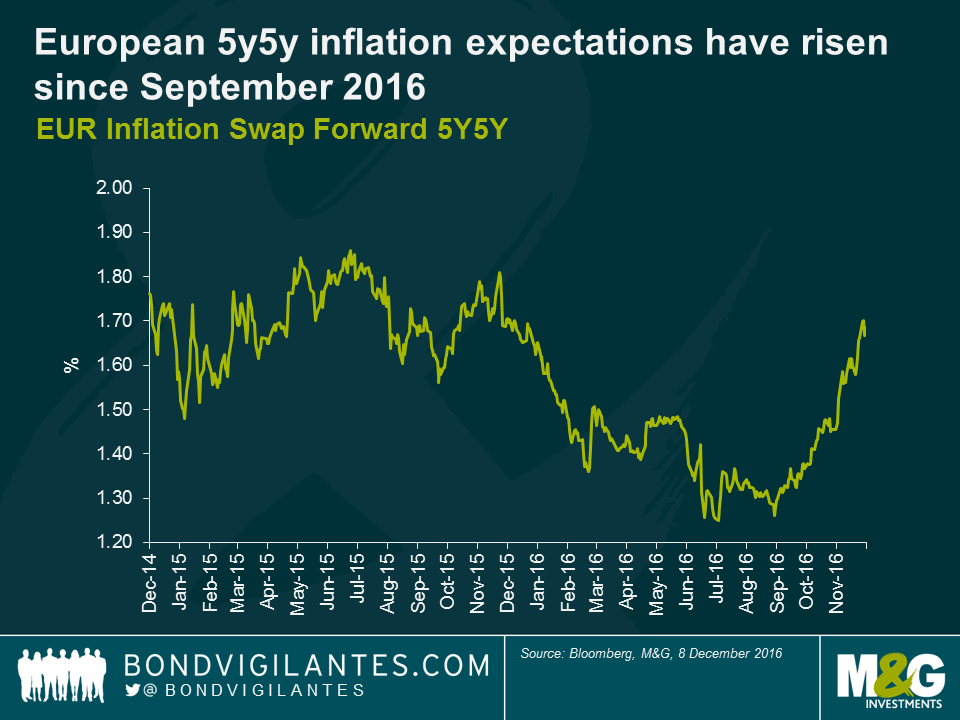

The votes are in and it’s pretty unanimous. Despite Mario Draghi’s best efforts to persuade otherwise, the market is clear that today’s announcements are tantamount to tapering. Frankly anything less than an extension of Euro 80bn per month, irrespective of the duration, was likely to have been taken as such, with scant evidence of the inflation target being achieved during the forecast horizon. Mario will have been well aware, but with market measures of inflation now discounting deflation risks the ECB hawks were always going to feel somewhat emboldened.

The reality, which we have observed before (see previous blogs), is that monetary policy has very likely reached its limits. For all the rhetoric that central banks will espouse to the contrary, the reality is that we have reached a tipping point. For each additional measure of monetary stimulus there is an equal or greater cost to be borne elsewhere in the economy- banks, insurers and savers the obvious losers.

The Eurozone may see some marginal benefit from fading fiscal headwinds in 2017 but these are unlikely to significantly move the needle. And the much hoped for structural reforms in Europe remain exactly that. This is Europe and red tape abounds.

The contrast with the US and the Federal Reserve is stark. Next week the Fed will surely hike rates. It should also find itself in a position to do so further in 2017, providing it with at least some ammunition should this seven year expansion be in its latter throws. With a US economy operating at full employment and likely to receive significant stimulus in the form of tax cuts and spending, the risk here has to be an overshoot in inflation with a central bank forced to pull hard on the handbrake.

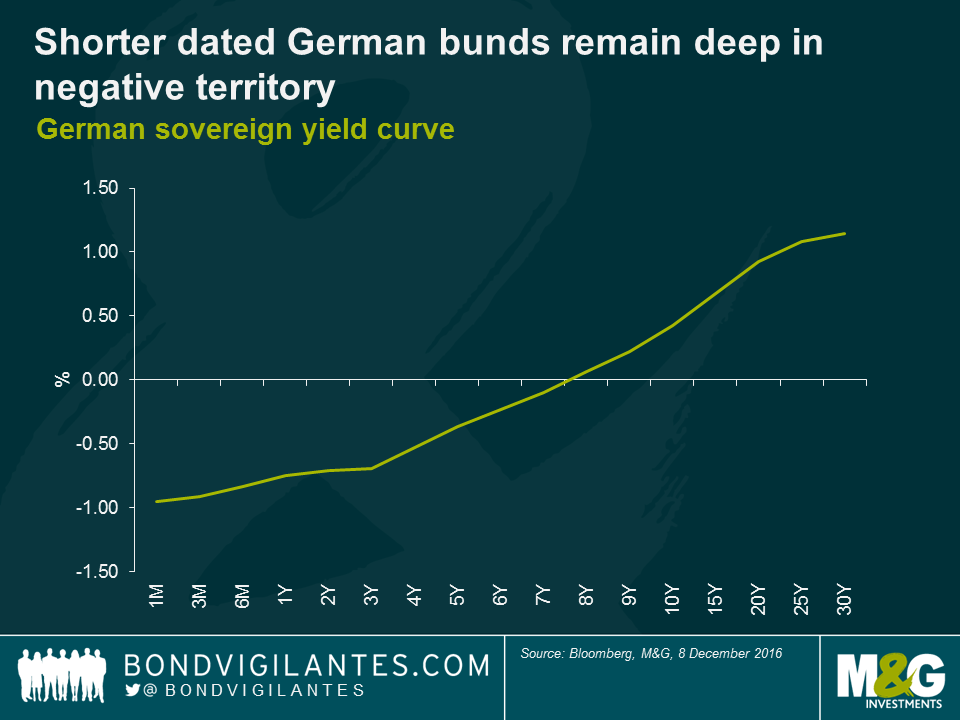

For the Eurozone, the most likely outcome for the economy is further muddle through, a very gradual closing of the output gap and no real prospect of hitting the near 2% inflation target until the end of the decade. Significant accommodation will be needed for years to come which is exactly what the shape of the German yield curve is telling us. The room to ease monetary policy in Europe if we were to run into a global slowdown in 2017/2018 is almost non-existent.

The irony for the ECB is that had it found the conviction to stimulate earlier and more convincingly it likely would have stood a greater chance of achieving its inflation and financial stability goals and, much like the Fed, would be well on its way to planning its exit today.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox