President Trump will be good for the transmission mechanism of animal spirits

The world will soon turn to the inauguration of Donald Trump. For at least the next four years, global investment markets will be focusing on his Presidency. This is always the case when a new President takes over the reins of the most economically powerful country in the world, but why does it feel more important this time?

Firstly, political deadlock has been broken. For the first time since 1928, the Republicans have the White House, the House, and the Senate. Therefore government policy is more likely to evolve from gradual, to radical.

Secondly, having a President that has no background in politics is going to result in a different type of leader than has historically existed within the US political system, making for a more unpredictable Presidency than has traditionally been the case.

Both of these points are regularly discussed, and are common themes amongst political analysts. The concept that I discuss below is a potential third dynamic that evolves from these two points.

The nature of leadership is a strange one. In a democracy the leader is a servant appointed by the electorate, whilst at the same time the President when appointed is expected to use his or her executive powers, that have been granted, to govern. The combination of the non-career politician and the electoral clean sweep in the US imply that the electorate have chosen a leader they want to lead and a political system that will facilitate his views. This makes for potentially interesting times.

We do not know the exact policies the Trump administration will pursue, and even if we did we cannot calculate the exact effect of these policies. It appears that a shift to the right in economic and social policies is a given in the short term. One thing is immediately clear, leadership is back.

Societies and markets have gone through a ten year phase of low confidence in economic and political leadership. Why did economists not see the recession coming ? Why did governments allow asset bubbles ? Where is the economic recovery amongst the lower and middle classes? Scepticism towards effective economic leadership from the politicians, and central bankers, is high. The cause and effect of policy decisions (such as quantitative easing) is often seen as confusing at best, and irrelevant to the real world at worst. The connection between decisions and consequences has become muddled. With the election of Donald Trump, this is about to change.

Donald Trump as President will make markets once again focus on the connection between policy decisions and market actions. We already have evidence of how his direct approach can influence economic outcomes, with the correlation between his ascendency and the Mexican Peso’s weakness being the most obvious example. The new President’s style is short and direct, and policy will be set by a man of few words, not many. Causal relationships will once again become very evident between the administration and markets. This will be evidenced in a number of ways, whether it is a wide-ranging economic decision, or a pointed dig at a particular company. In the short and long-term these pronouncements will effect economies and markets. Whether they are good or bad policies, and who they help or hurt we will find out over time. The one thing that will be established in coming months will be to re-establish the psychology of political and economic leadership over markets.

There was a lot of talk about animal spirits at the onset of the financial crisis. Animal spirits were singled out for fostering a boom in credit, and their subsequent collapse resulted in an anaemic recovery. We are now likely to see confidence in the US government to return, not necessarily because their decisions are correct, but because policy actions will produce an identifiable result. Policy scepticism will disappear as the link between policy decisions, and economic/market outcomes once again will come into full focus. This is something that has been absent post the financial crisis.

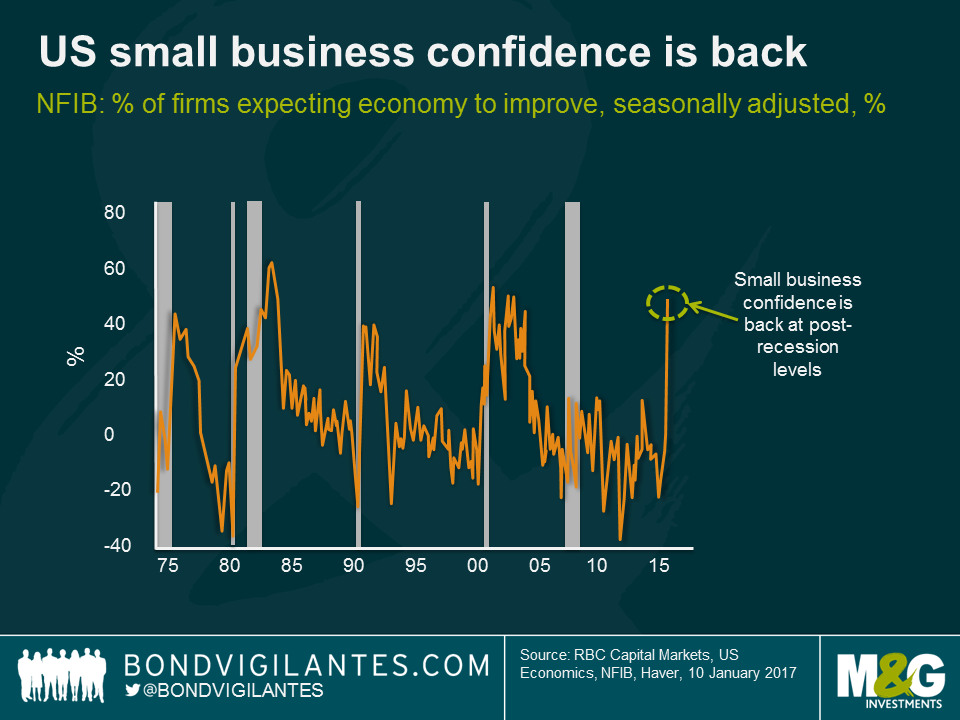

Indeed, a shift in confidence is already underway within the US economy. The chart below shows the jump in small business confidence, a sector that is a strong driver of investment, employment and growth in the USA. This swing in confidence is the biggest shift seen on record. Previous jumps in small business confidence mark the end of previous recessions, and point to periods ahead of economic growth for the US.

This is not the first time a change in leadership expectations has taken place. For example, in Franklin. D. Roosevelt’s inauguration speech he produced his famous quote; “the only thing we have to fear is… fear itself “. The FDR administration went on to embark upon a direct programme of linking government actions to economic outcomes.

Unlike those dark days, the US economy is fortunately currently near full employment. The rediscovery of belief in leadership will permeate through the rest of the new administration, and out into the behaviour of the leaders of companies in the private sector. This should help animal spirits, consumer confidence, and the economy. In asset markets it will mean the requirement for loose monetary policy will diminish, whilst corporate investment in existing businesses and through mergers and acquisitions is likely to increase. Leadership is back, decisions will be made, and let’s hope that they are good ones.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox