Private sector credit in China is approaching an historic crisis level

Credit is the oil that lubricates the engine of an economy. For this reason, economists watch credit statistics closely, in order to assess the sustainability of growth. If credit isn’t growing, it suggests households and firms aren’t confident enough in their respective outlooks to borrow and invest. If credit grows too quickly, it could result in financial and macroeconomic instability – history shows that banking crises are usually preceded by a large and quick build-up of credit in the private sector.

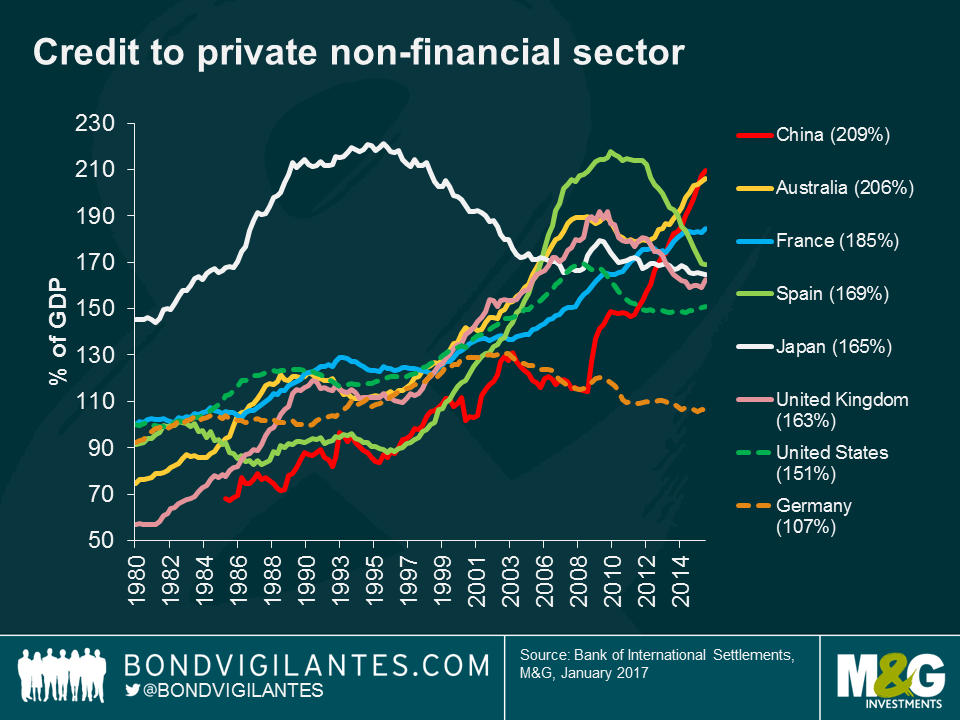

The chart below shows the level of total credit to the non-financial private sector as a percentage of GDP for some of the world’s largest economies. Importantly, this measure from the Bank of International Settlements includes credit from domestic, non-bank, and foreign lenders. Whilst there is no level of credit-to-GDP that will result in financial instability, the chart does show that Chinese and Australian debt ratios are nearing the peak ratio seen in Japan (221%) in the 1990s and Spain (218%) in 2010. Interestingly, China’s household debt-to-GDP ratio, which is incorporated into these numbers, at 42% is much lower than Australia’s at 123%.

Economists become concerned when credit growth departs from its prior trend. In this sense, what the debt is used for is important. For example, if a loan from a bank is used to purchase a new car, it will lift both debt and GDP, leaving the ratio of debt to GDP largely unchanged. However, if a bank loan is used to buy an existing asset, like a used car, the purchase will not add to GDP (which measures the production of new goods and services) but will raise the overall debt level within the economy.

It is not surprising that credit growth has accelerated post-crisis. The conditions are ripe for credit growth: low yields and ample liquidity being pumped into the global economy by central banks. The problem with heavily indebted economies is that the financial cycle could peak at any time. At some point, borrowers like households and corporations will conclude that their income is not sufficient to service their debt obligations. This will see the non-financial corporate sector enter into a deleveraging cycle: as has happened previously in Japan, Spain, and the U.S. These are all economies which witnessed a large build-up in debt which was subsequently unwound to a degree with the assistance of central banks, which quickly cut interest rates so heavily indebted households and companies would not go bust.

Whilst the reflation trade has dominated investment markets in recent months, leading to higher bond yields and equity prices, many have taken their eye off the high and rising debt ratios in some of the world’s largest economies. As we are now nine years into the expansionary phase of the global economic growth cycle, and developed economies are still characterised by rock-bottom central bank rates, one has to wonder whether the next global recession will be much longer than the experience of 2008-09.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox