Five observations about Inflation

1. We are at the point of peak oil pass through: January and February 2016 saw oil prices reach their lows ($34.25 Brent January 20th and $26.21 WTI, February 11th), so this week’s inflation numbers will see some high year-on-year oil price base effects, as will February’s. This is one of the main reasons why we have been seeing significant rises in inflation in recent months.

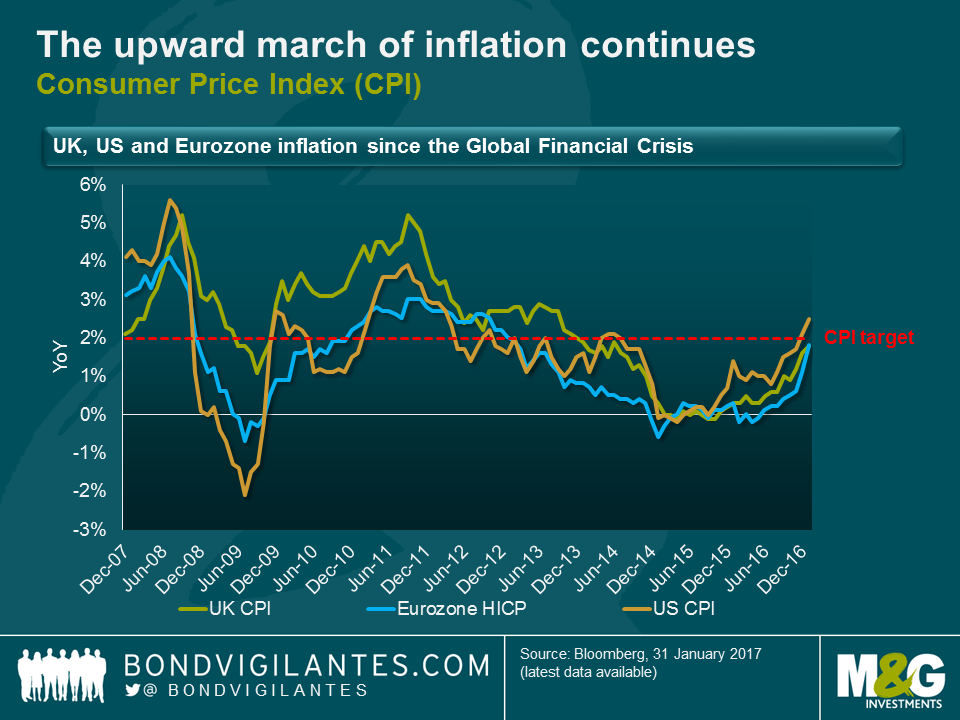

2. The upward march of inflation continues: US CPI was at 0% in September 2015, was less than 1% in July of last year, and is now back at 2.5%. European inflation was negative in May of last year, and this week approached the ECB’s target, at 1.8%. UK CPI was negative in October 2015, was less than 1% in October of last year, and this week reached 1.8%, only very narrowly below the Bank of England’s target.

3. The UK was the only market to disappoint expectations this week, with 1.9% expected in CPI and 2.7% in RPI. However, most of the surprise came from significant falls in clothing and footwear. January sales discounting, which had been falling in recent years, increased meaningfully this year and caught consensus out. The items experiencing positive base effects (fuel, lubricants) and sterling depreciation pass-through (imported goods) were up strongly on the year.

4. UK inflation is actually back on target: well, at least on the National Statistician’s preferred measure of headline inflation it is. As of next month, in fact, CPIH will be the official headline measure of inflation in the UK (don’t worry, gilt linkers still reference RPI!). On this measure, UK inflation hit 2% this week. More on this shortly.

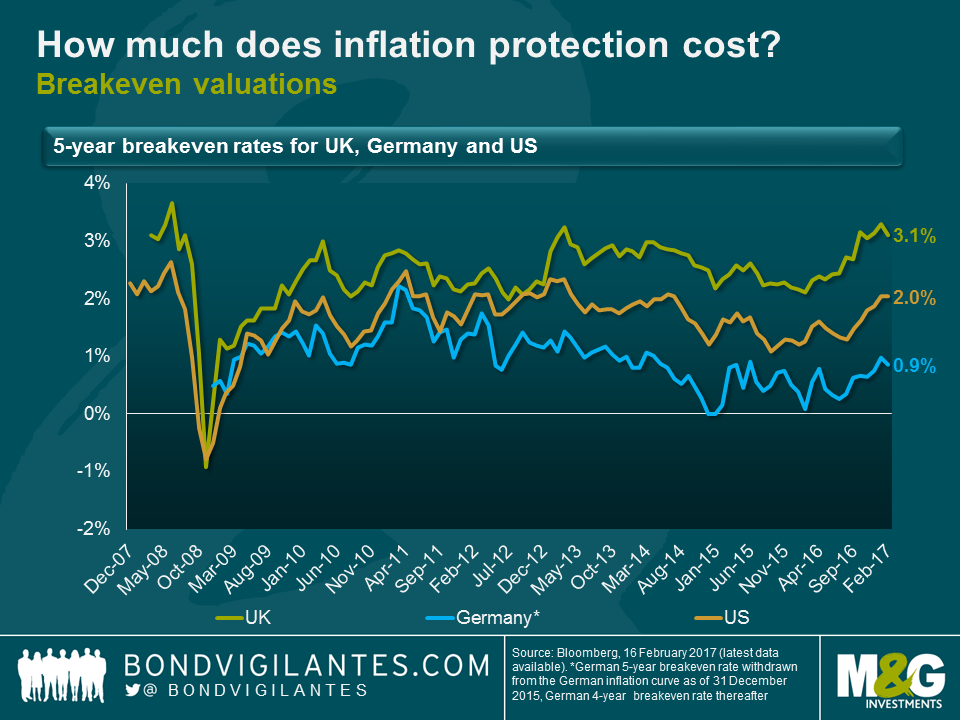

5. Breakeven valuations are no longer exceptionally cheap

6. US: 2% across the curve for the first time since 2014 tells us the bond market expects the Fed to deliver CPI at 2% on average from this point on. In actual fact, I would argue this is still somewhat cheap, as the Fed targets the PCE deflator at 2%, and over the long term, for the PCE deflator to be at 2%, CPI would be closer to 2.5%. Nonetheless, the last twelve months have seen a big move in US breakevens.

7. UK: with breakevens between 3.1% at the front end and at near 3.6% at the long end, the recovery since the lows of the early parts of 2016 is as remarkable as in the case of the US. In fact, barring some aggressive assumptions about the RPI-CPI wedge, the UK market is priced for UK inflation to be above target, forever. I see value in short-dated breakevens, because oil and sterling weakness are going to see a period of significantly higher inflation than target. But quite what the market is seeing that makes these inflation overshoots look permanent remains to be seen and, to my mind, makes long end breakevens vulnerable.

8. Europe: breakevens have also recovered strongly in Europe as elsewhere, but remain significantly below pricing in the achievement of sustainably on target inflation. Perhaps the concern is that the recent strong HICP numbers will not persist past the oil price base effects? And that seems a reasonable concern to me.

We have come a long way in the last year in the inflation markets. The question from here, though, is whether we are going to see inflation fall back once we are past the peak oil base effects period, in the middle of 2017, or whether momentum and the reflation theme can be maintained. In the US, at least, it appears to me that the labour market and, in particular, wages are going to see momentum continue. As I recently blogged, given the significant differences between US and UK household debt, it looks to me as if the Fed is already well behind the curve, and may find it hard to catch up with it. The prevailing question for me remains whether this rising tide in the US will lift all boats, or whether European inflation and the long end of the UK market will sink back from current levels.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox