Eurobonds: one bond to fund them all

The German federal election in September still seems far away. However, for the first time in years, it appears possible that Angela Merkel could actually lose the election. Martin Schulz, Chancellor candidate and chairman of the Social Democratic Party, is having some early signs of success in the polls and is gaining momentum. As a result, investors in European (and UK) debt might want to refresh their memory of Schulz’s five years as President of the European Parliament.

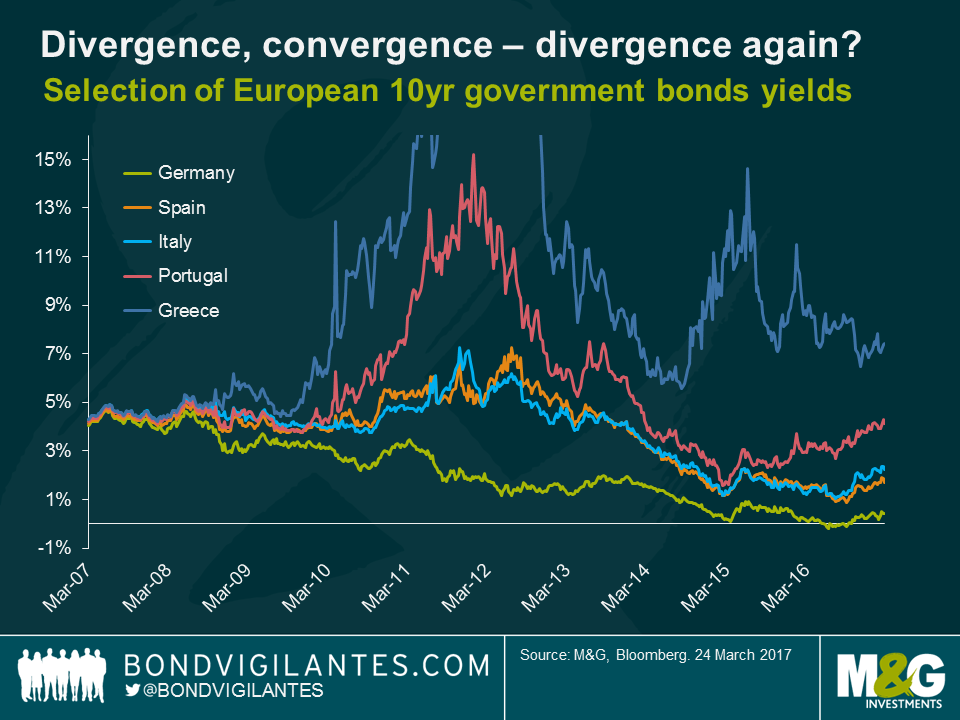

In 2011 and 2012, in the midst of the Eurozone debt crisis, Schulz repeatedly advocated debt mutualisation in the form of Eurobonds, i.e. sovereign debt issued jointly by all member countries of the Eurozone. The rationale behind this idea is clear: troubled peripheral countries would benefit from lower funding costs. As confidence in the ability of the ECB to do “whatever it takes” to support the euro area increased in debt markets, peripheral sovereign bond yield spreads narrowed. Over the past year peripheral risk premiums have generally trended upwards, albeit at a much slower pace than in 2011/2012, suggesting that Schulz’s position could become relevant again.

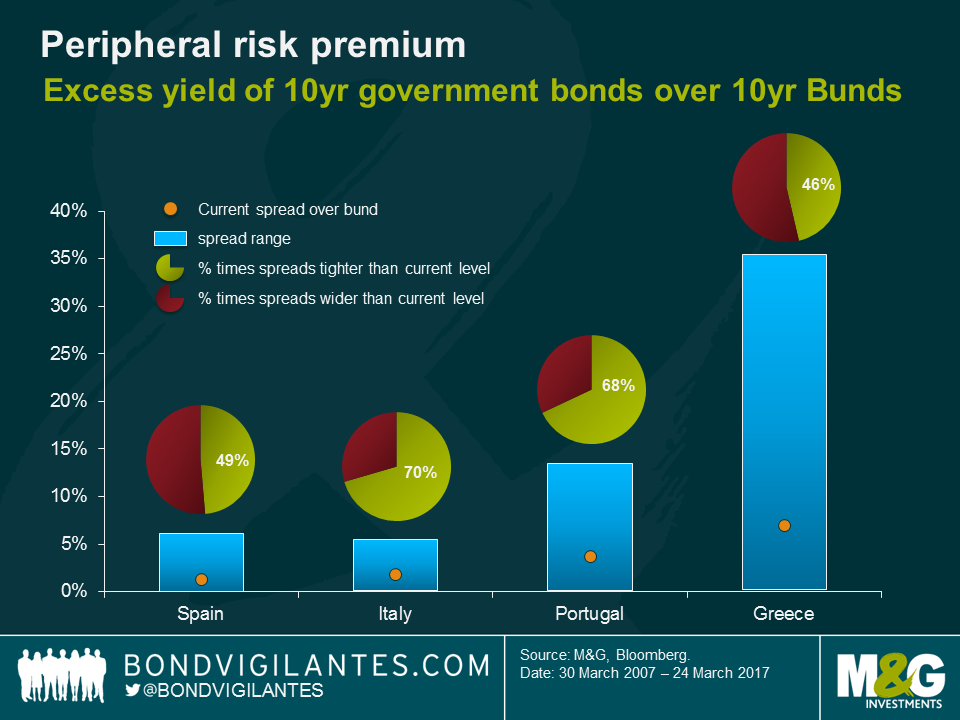

Looking at historic spread levels, the valuations of bonds issued by periphery Eurozone nations indicates heightened stress in some bond markets. The spread of Spanish 10-year government bonds over 10-year Bund yields is around 1.3%, which is close to the median over the past 10 years. The yield spread of Italian 10-year bonds is only half a percentage point higher (1.8%), which doesn’t seem much in absolute terms. However, compared to its 10-year history things look more severe: 70% of the time the spread has been tighter than today. The situation is similar for Portugal; over the past ten years its yield spread has been tighter than its current value of 3.7% for more than two thirds of the time. The Greek excess yield over Bunds of 7.0% is the highest in the periphery, but it’s actually below its own historical median. By this measure, the situation is most relaxed in Greece – a sentence one doesn’t read very often.

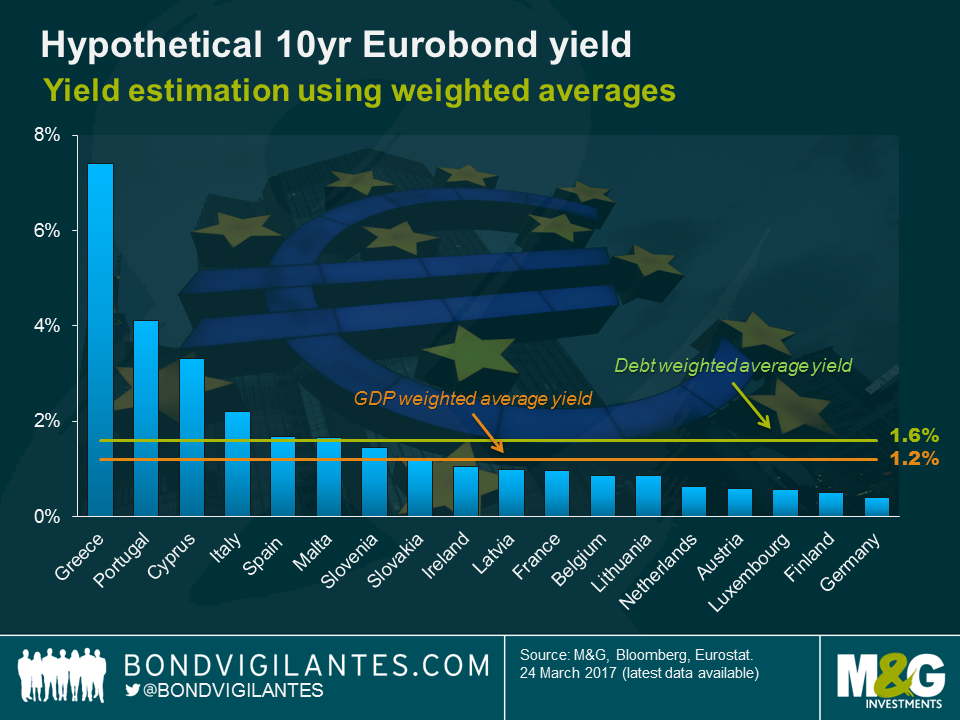

For the sake of argument, assume Schulz’s policy of joint 10-year Eurobonds is introduced. Peripheral yield premiums would disappear immediately, but what Eurobond yield should investors expect? All Eurozone countries, apart from Estonia, have government bonds outstanding, allowing us to calculate weighted average 10-year yields, which seems like a reasonable starting point. Here we have used two weighting factors: GDP and debt level. The GDP-weighted yield accounts for the economic power of countries and thus for their ability to collect tax revenues and pay back debt. A large weight is assigned to Germany due to its high GDP. Consequently, this drags the average yield down to 1.2%, which is pretty much at the same level as the current 10-year yield of Slovakia. If this was the actual yield of Eurobonds, funding costs for Germany at the 10-year point would roughly triple, whereas yields for peripheral countries would decrease meaningfully. In contrast, the debt weighted yield reflects the degree of financial leverage and the credit quality of the countries. Due to its high debt burden, the weight of Italy is large and pushes the average up to 1.6%, which is in line with Malta’s current 10-year yield and four times higher than the German 10-year yield.

Arguably the GDP and debt-weighted estimates of hypothetical Eurobond yields are too high as they ignore the enhancement in market depth and liquidity. Creating one class of joint Eurobonds would fundamentally transform the fragmented European government bond market and make it a lot more commoditised. Particularly smaller countries, whose local government debt markets might have been ignored by many investors, would benefit greatly from tapping into a deep and liquid Eurobond market.

It is unlikely that Eurobonds are introduced any time soon. Apart from the potential moral hazard created by debt mutualisation and possible conflicts with the Treaty of Lisbon, there are also major political obstacles in Germany. Chancellor Merkel, Finance Minister Schäuble and other members of the conservative parties CDU and CSU have steadfastly rejected Eurobonds in the past. And even if Schulz was able to organise a stable parliamentary majority without the CDU/CSU block after the election, would he really want to reopen the debate about Eurobonds? Unsurprisingly, the idea of Eurobonds is not exactly popular in Germany, which might explain why he hasn’t brought it up lately, now that he is running for office in Berlin. In this regard, he seems to be in line with Germany’s first post-war Chancellor Adenauer who famously said: “What do I care about my chitchat from yesterday […]”.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox