Which bonds have benefitted most from the ECB’s corporate bond buying programme?

European investment grade (IG) corporate bond spreads are now more than 40 basis points tighter than in early March 2016, before the European Central Bank (ECB) announced the expansion of its quantitative easing programme into the € IG corporate bond space. The technical tailwind provided by monthly bond purchases to the tune of around €7.5 billion from June onwards under the ECB’s corporate sector purchase programme (CSPP) has certainly been a key contributor to the strong performance of the asset class.

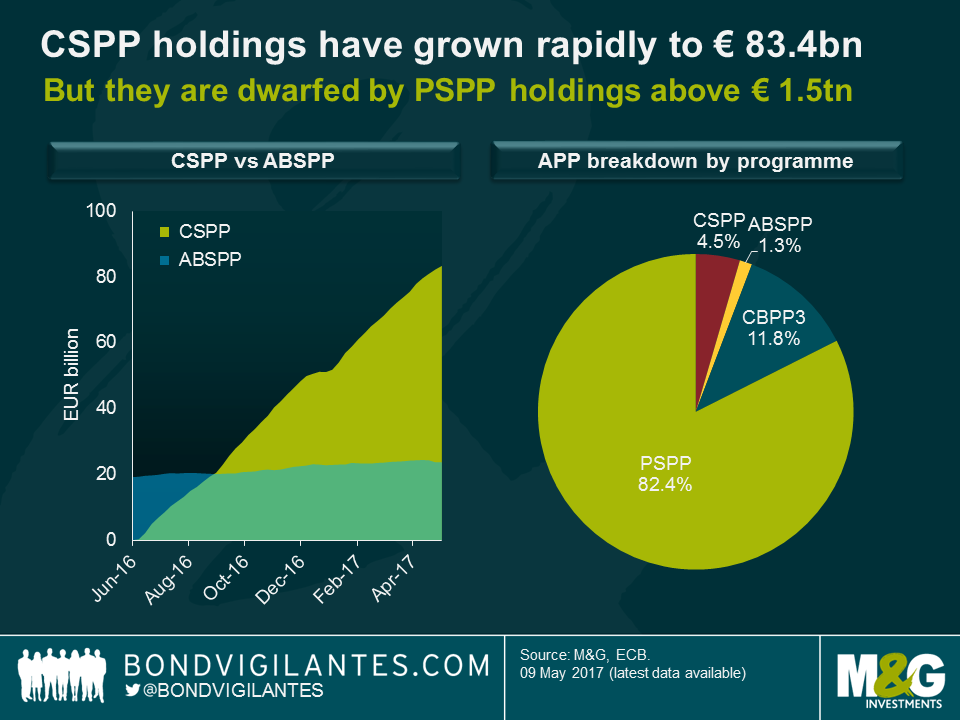

The ECB – through six national central banks within the Eurosystem, to be precise – has built up a CSPP balance sheet of around €83.4 billion worth of corporate bond holdings. As impressive as this number may sound, one has to recognise that the CSPP is only one of four programmes within the ECB’s expanded asset purchase programme (APP). While the CSPP has easily overtaken the asset-backed securities purchase programme (ABSPP) in terms of volumes, it is dwarfed by the third covered bond purchase programme (CBPP3) and particularly by the public sector purchase programme (PSPP). The €1.5 trillion of PSPP holdings account for more than 80% of total APP holdings, the CSPP makes up less than 5%.

In December last year the ECB announced an extension of the APP but a reduction of total monthly purchase volumes from €80 billion to €60 billion from April 2017 onwards. The big question for corporate bond investors like us was whether the ECB would trim CSPP purchases in line with overall APP purchases or not. Based on the ECB’s weekly financial statements, we calculated rolling four-week purchase volumes – a proxy for monthly purchases – from June 2016 onwards. The chart below reveals a pronounced seasonal pattern. Purchases were dialled back significantly in August and, even more so, in December. This is not particularly surprising, considering how bond market liquidity tends to dry up at the height of summer and between Christmas and New Year. More interesting is the recent decline in purchase volumes from January to April 2017. APP purchases are now at around €60 billion per month, and thus consistent with the ECB’s earlier announcement. Importantly, the tightening in monthly CSPP purchases to currently €5.6 billion seems to be happening in a proportional fashion with overall APP tapering.

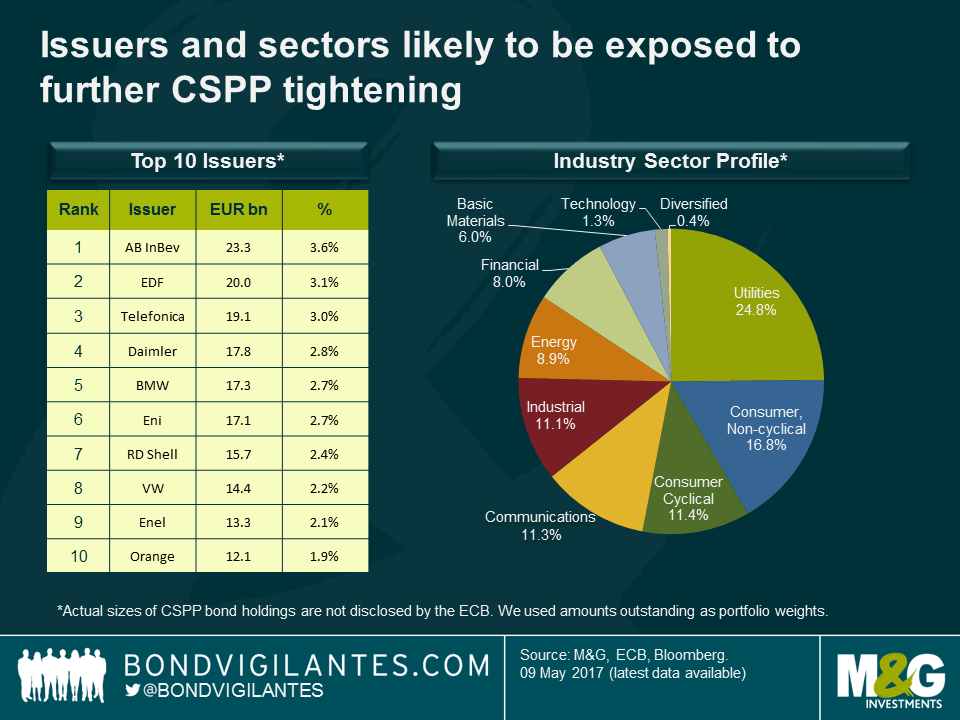

Taking it one step further, we had a look at individual corporate bond issuers and industry sectors whose valuations have so far benefitted from the CSPP but might become vulnerable when purchases get curtailed further or phased out entirely. This analysis is less straightforward than one might think, though. While the total volume of purchases and the identity of the 912 corporate bonds bought under the CSPP are disclosed by the ECB and national central banks, respectively, the holding sizes are not. We are therefore unable to calculate accurate portfolio weights for individual bonds, issuers or sectors. In our analysis we assumed that the ECB bought corporate bonds in proportion to their amounts outstanding – not particularly likely but nonetheless our best guess.

According to our analysis, the main beneficiaries of the CSPP amongst corporate bond issuers have been Anheuser-Busch InBev, EDF and Telefonica, followed by Daimler and BMW. For example, all 18 AB InBev bonds on the list of CSPP holdings have a combined amount outstanding of €23.3 billion, which is 3.6% of the total amount outstanding of all corporate bonds held by the ECB. With regards to industry sectors, utilities, consumer non-cyclicals and consumer cyclicals have attracted most CSPP demand. All else being equal, with falling and eventually disappearing CSPP purchases, the demand and supply dynamics for these issuers and sectors are likely to deteriorate, which could potentially lead to underperformance against the wider € IG corporate bond universe. However, it is important to point out that these technical considerations are one factor influencing bond valuations. The credit and sector fundamentals are at least as important, particularly for investors with longer investment horizons.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox