A problem with U.S. average hourly earnings, and why it may be understating the true picture

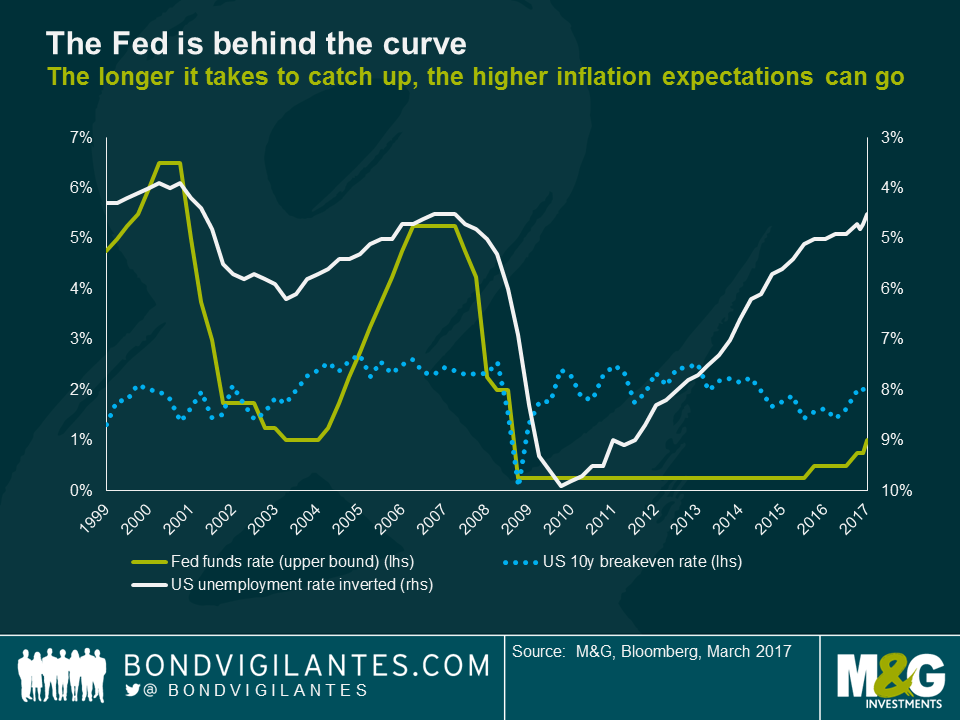

The last time the US had an unemployment rate below 5% and inflation expectations around 2%, the Fed funds rate was above 5% and had been aggressively hiked in the preceding period. Yellen’s Fed has been happy to let rates stay low amongst a tight and tightening labour market because wage growth has been lower than one would expect for a jobs market as healthy as this one. So, slow growth of wages must illustrate some underappreciated slack at work.

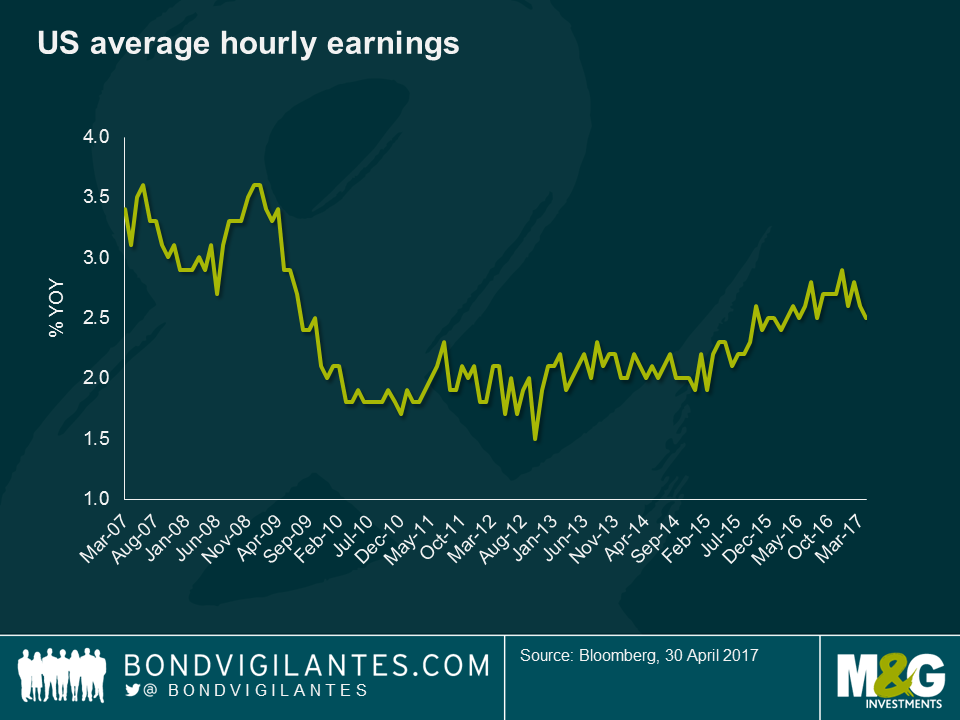

The monthly bell-weather of wages in the U.S. is average hourly earnings (AHE). This takes the aggregate wage growth of the US labour force and as the chart below shows has been curiously and worryingly (for central bankers) flat-lining in the years since the Great Financial Crisis. However, this measure does have a flaw that might lessen its signalling strength of labour market tightness: because it is an average of the aggregate wages of the US, it over-weights the higher paid minority of the population. Further, as younger people enter the workforce and older people retire from it, AHE would be biased lower, for example.

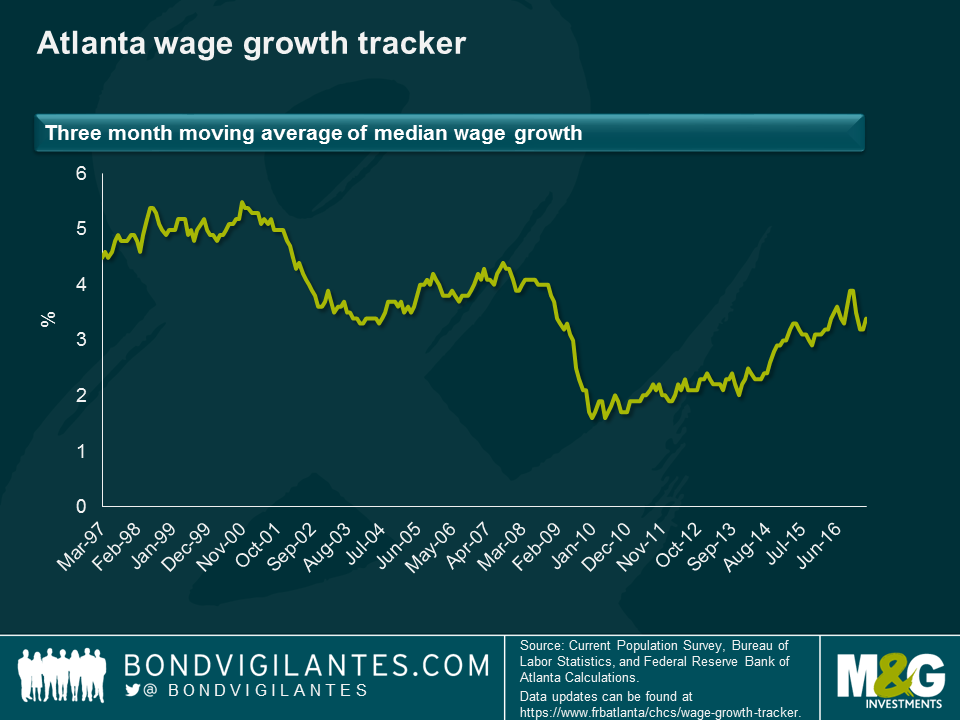

We have been watching the Atlanta Fed wage tracker recently, as a potentially better measure of wage growth given AHE’s biases. This measure is based on a matched micro sample of workers, whereby their wage growth is only measured if they were recorded in the same month a year ago. Thus, it avoids many of the compositional flaws of AHE. Furthermore, it is a median, rather than a mean, measure, which means that it will not over-weight the highest paid to the same extent as AHE. On top of this, the Atlanta Fed wage measure excludes the highest paid cohort from the measure. This is key today, because the highest paid have not been getting pay rises to anything like the same extent as the lower earners. Workers at Walmart, Home Depot, MacDonald’s and those citizens on minimum wages are those that are seeing the most significant wage increases. The Atlanta wage measure stands at a much healthier 3.4% today, having started 2016 at 2.2%, and shows clear signs of heading in an upward trajectory. For job movers, wages are rising at 4.1%. For workers of prime age, wages are rising at 3.8%, and for workers with a college degree, they are rising at 3.7%.

What growth rate of AHE would give the Fed confidence that the labour market is strong enough, and the outlook for consumption is strong enough, for the next series of hikes? We now know from experience that c.2.5% is not enough. But surely wage growth of more than 3% is? At 3.5% I would expect that the Fed has the confidence to signal an upward path of rate hikes. The point is, we are already there on one measure of wage growth, and we are probably only a few months away on the other, flawed but broader, one. Couple these tentative positive signs in wages with the fact that so much household debt is fixed, and the vast majority of it being fixed for more than 23 years (see this blog from earlier this year), and you can see why the Fed is content to press on with its hiking cycle.

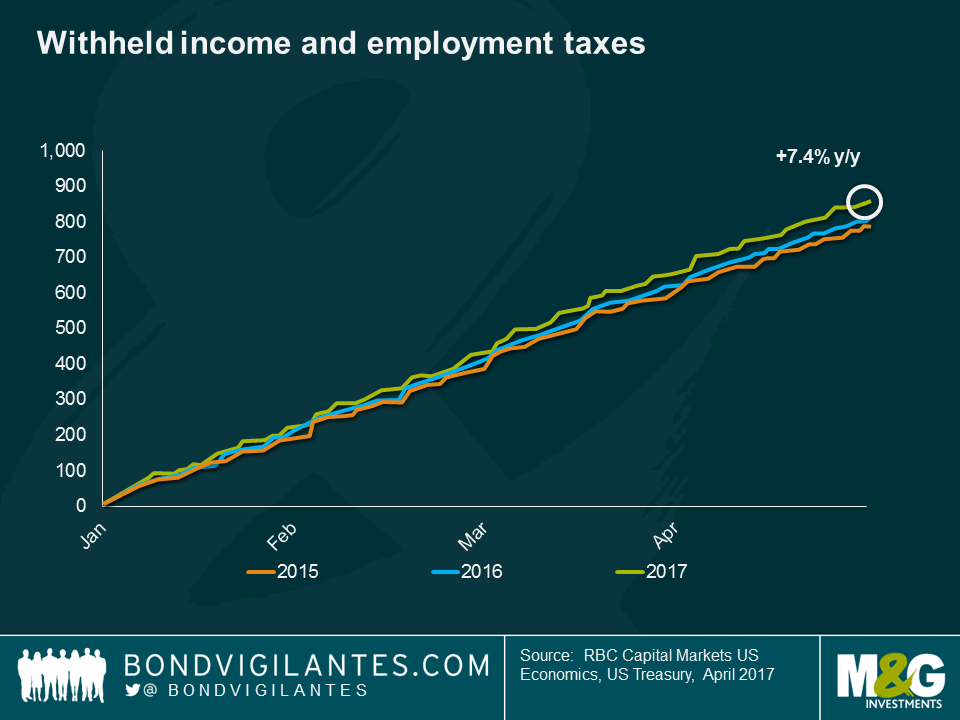

We need to acknowledge that both of these wage measures have flaws and biases. One data point that is being closely monitored by economists at Deutsche Bank and Royal Bank of Canada is withheld income and employment taxes. These are the amounts of tax taxed at source where employers send cash salaries net of taxes to staff and send the tax amounts to the authorities. This happens every day of the year, and so it does need smoothing to be applied. But Joe La Vorgna at Deutsche has long followed this data as it does not get revised and is obviously very timely. We have borrowed this last chart from Tom Porcelli at RBC, who came in to the office last week to give us his views. Currently withheld tax receipts are up 7.4% on the same point of 2016. Either more people are getting jobs, or people are being paid more. Or both.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox