Are debt markets and rating agencies giving M&A too much credit?

Guest contributor – Simon Duff (Credit Analyst, M&G Credit Analysis team)

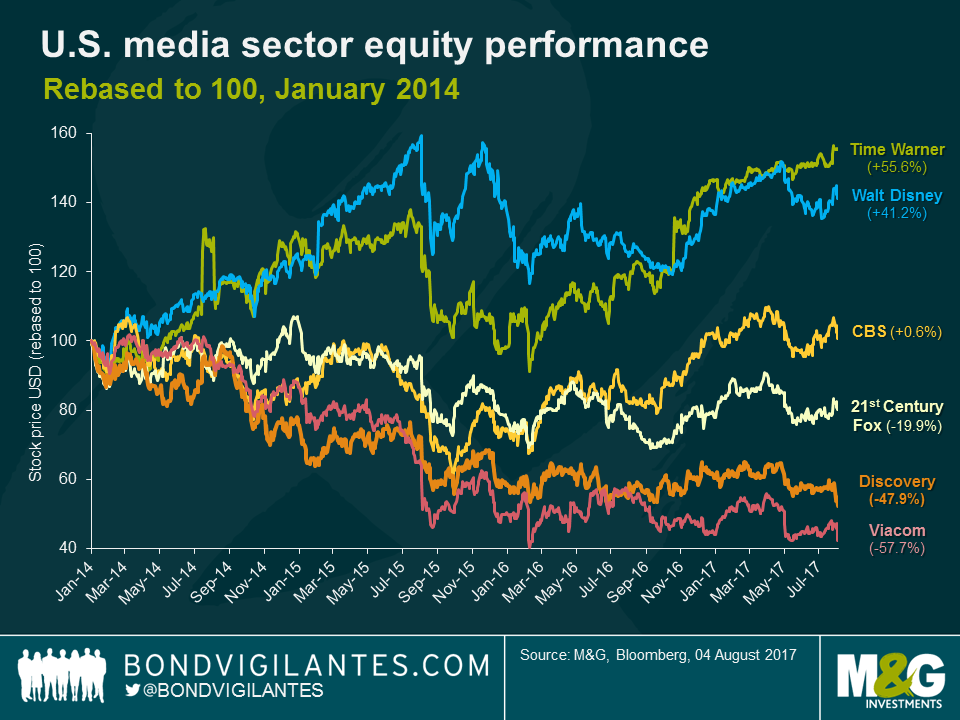

Last week, International TV network operator Discovery Communications announced the US$15bn acquisition of Scripps Networks. Scripps owns TV networks focused on food, home and travel, so it fits with the factual or “non-scripted” focus of Discovery’s core networks (Discovery, TLC, Animal Planet). It also offers an opportunity for Discovery to further diversify beyond its core male orientated demographic as well as boost US-centric Scripps’ efforts to expand into international markets by using Discovery’s global reach. So what’s not to like about the deal? Apparently a lot if you are a Discovery shareholder, with the stock falling 9% on the announcement of the deal. This is on the back of a stock that had already fallen over 40% since January 2014.

The decline in the share price was driven by concerns over the wisdom of a transaction that doubles down on the bundled pay-TV network business model. This is being caused by increasing structural pressure from the shift in consumer viewing habits to cheaper “skinny bundles” that exclude less popular networks, “over-the-top” on-demand viewing, and “short-form” mobile device viewing via platforms like Snapchat or Facebook. To illustrate this point, on the same day that the deal was announced Discovery disclosed that the pace of subscriber decline in its core US subscriber base accelerated to 4% in 2017 vs 3% in the prior quarter and 2% in the prior year. Scripps reported continued subscriber declines and guided down on forecast 2017 revenue and profits on weaker ratings. The concerns of shareholders were exacerbated by the knowledge that they cannot realistically block the transaction due to the dominant position of co-controlling shareholders John Malone and the Advance-Newhouse family.

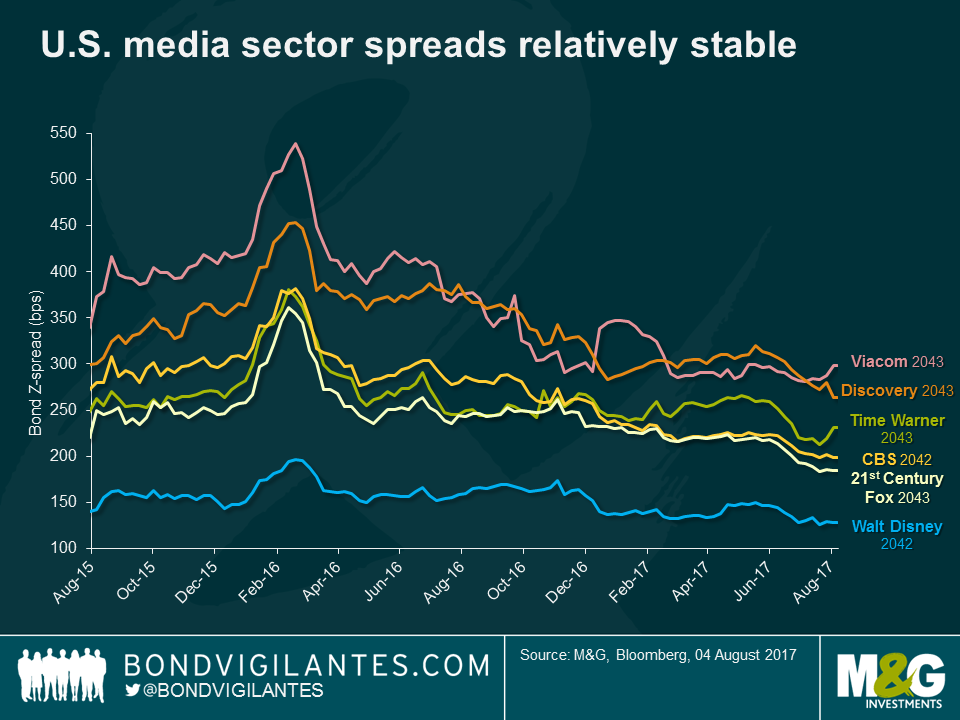

What surprised me most was the reaction of credit markets. The transaction is structured in an equity friendly manner with Scripps shares acquired with 70% cash (funded via incremental Discovery debt) and only 30% by Discovery equity issuance. Combined with around US$3bn of Scripps debt that Discovery will also be assuming, this will increase Discovery’s pro-forma leverage from 3.3x to 4.8x. This will more than double Discovery’s pre-transaction debt load with almost US$11bn incremental debt on the balance sheet. Of course, Discovery points to US$350m cost synergies and suspension of the stock buyback programme to support post-deal debt reduction towards a new 3.0-3.5x target. This is little comfort in a market suffering the aforementioned structural pressures with an issuer with an itchy M&A trigger finger. So what’s not to concern you as a creditor? Apparently not a lot if you are a rating agency, with both S&P and Moody’s affirming Discovery’s weak investment grade ratings at low-BBB. And it’s a similar story for bondholders who saw risk spreads barely move on the news.

So which reaction better reflects the news of Discovery’s acquisition of Scripps? In our view, the wisdom of equity market caution could, in this instance, stand in stark contrast to credit market and rating agency insouciance. For corporates, the lesson is clear: acquire assets and growth by exploiting cheap credit in a yield hungry environment underpinned by rating agency leeway on leveraging transactions. For credit investors, the message is equally clear: beware of M&A driving up leverage with limited incremental spread reward on new issuance to reflect a rising risk profile and potentially false comfort on the lack of spread widening on existing bonds in your portfolio.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox