Mexico: a primer. Elections, inflation, the Bank of Mexico, NAFTA and gasoline

I’m just back from a fascinating research trip to Mexico City, to meet with policymakers, bankers, politicians, analysts, pension funds and regulators. Like many emerging market economies, the Mexican economy has suffered over the past couple of years due to lower commodity prices and weak global demand for goods. Of course, Mexico has had its own unique challenge with Donald Trump’s election and the potential impact that might have on trade and remittances from Mexican migrants to the US.

In this quick primer on the Mexican economy I look at the five areas that I found especially interesting. In particular there could be significant changes to Mexico’s political landscape.

Thanks go to HSBC for organising some extremely interesting meetings.

- The political environment is getting interesting – a left wing populist President up next?

Just as the UK, US and Europe have seen their electorates support populist parties and policies in the last couple of years, so too has Mexico. The Morena party is just three years old, but with the experienced anti-system left-winger Andres Manuel Lopez Obrador (“AMLO”) as its presidential candidate it could pull off a big shock in the 2018 Presidential election. AMLO has stood in previous presidential elections for the established PRD party, and is well-known to the electorate. AMLO’s campaign focuses on corruption, and in particular on an assertion that the ruling PRI party, which has had an effective 80-year hegemony in Mexican politics, is rotten. In an August poll, AMLO had the highest voting intention percentage of all the potential presidential candidates, and momentum is currently on his side.

Whilst no-one expects AMLO to win control of Congress as well as the Presidency, he would still be well placed to delay planned reforms to the energy and education sectors, halt some private sector-led infrastructure developments (for example the expansion of Mexico City airport), and tighten Mexico’s NAFTA negotiating stance with the US. AMLO may also reintroduce the gasoline subsidies which have only recently been eliminated. Comparisons with Venezuela’s Chaves are unfair though; AMLO was the mayor of the vast City of Mexico region and ran it responsibly. Nevertheless, comparisons will be made, and investors could start to get nervous as the election approaches. One analyst I met was worried about the potential impact of an election loss given AMLO’s belief that elections are rigged against him: “there won’t be a revolution, but…”.

- Inflation, and changes to the Mexican inflation calculations

In 2012 the IMF made recommendations that the Mexican inflation and national income statistics needed to be brought up to international standards. Data had traditionally been collected from larger towns and cities, but smaller, rural settlements were not surveyed. As these tend to be poorer areas, the household spending patterns which were used for the inflation component weights had been skewed to the spending patterns of relatively richer Mexicans. This meant that services have had a relatively high weight in CPI.

From July next year the weights in the inflation data will include far more rural communities: as a result the goods weight in the inflation basket rises from 34% to 41%, and within this, food rises from 15% to 21%. The implication for monetary policy, and holders of inflation linked bonds, is that inflation will become even more volatile as food prices are erratic (onion and tomato prices have skyrocketed in Mexico lately), and because goods prices are very sensitive to the level of the Mexican peso. It seems politically impossible for the Bank of Mexico to target only “core” inflation rates – the headline number is everything.

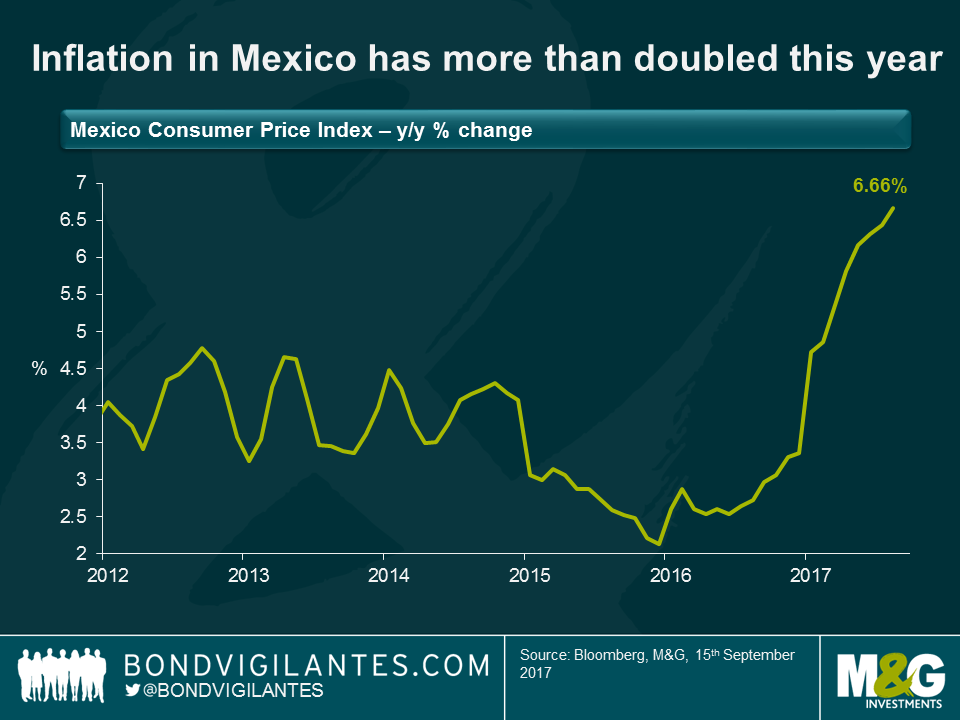

Mexico’s inflation rate has more than doubled this year, to the devilishly high level of 6.66%. Part of this move is as a lagged result of higher import prices following the peso’s depreciation to MXN 22, partly it’s due to those tomatoes (red AND green) and onions, and the rest is explained by the liberalisation of gasoline prices in January (itself adding 1.3% to inflation). The Bank of Mexico’s target is 3%. Whilst breakeven inflation rates derived from linker prices don’t suggest the Bank will quite achieve that target over the medium term, 2018 will see a significant fall in inflation, simply reflecting the base effects of 2017’s price rises falling away, and a stronger peso. Whether this will allow the central bank to cut rates is another question…

- The Bank of Mexico and monetary policy

Emerging markets central banks have a different approach to managing monetary policy compared to their developed market counterparts. Whilst both set rates to manage consumer, business and market inflation expectations, the Fed for example will hike rates to influence demand, whilst the Mexican central bank knows that the penetration of variable rate loans, especially amongst consumers, is extremely low and that a rate hike (or cut) will thus have little impact on economic activity.

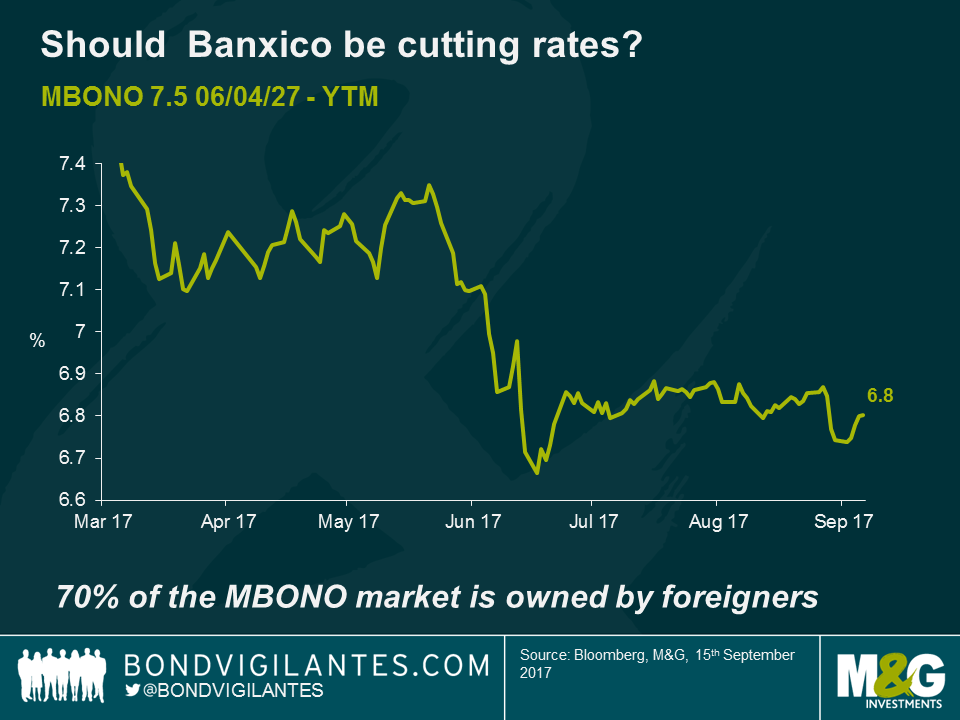

The transmission mechanism for EM central bankers works disproportionately through the exchange rate. Cutting rates will cause the exchange rate to weaken, which will result in more expensive imported goods prices (and significant second round effects – for example taxi drivers in Mexico put their peso fares up to keep the dollar value of those fares constant, above and beyond what might be the direct rise in imported fuel costs). A rate cut might therefore result in a drag on economic growth, rather than a stimulus. The Bank of Mexico, unlike the Fed, has just one policy target, which is inflation (not inflation and employment, and as mentioned, it is headline inflation, not core). With inflation almost certain to fall sharply in 2018, should the Bank be cutting rates already? And does this make the bond market look cheap (the 10 year MBONO yields 6.75% at the moment)? In theory yes, but the policymakers have two potentially peso-negative shocks to worry about; firstly the aforementioned presidential election volatility, and secondly a possible failure of the NAFTA negotiations. 70% of the MBONO market is owned by foreigners – a huge percentage, and most do not hedge the currency risk. Falls in the peso due to these factors and rate cuts could see the peso retest or exceed the “Trump-fear” lows, and selling could threaten financial stability. So the Bank of Mexico is yet to cut, and may be more cautious than the pure inflation forecast would predict. Perhaps they pay more attention to the level of foreign participation in their asset markets than I previously imagined.

Elsewhere, the Bank is puzzled over the same issues as developed market policy makers – why is there no wage pressure, despite falling unemployment rates? And is their neutral real rate estimate (r*) for Mexico too high at, say, 2.5% if the US’s r* is actually zero rather than an assumption that it’s 1%?

- NAFTA, Trump and trade

With the Trans-Pacific Partnership (TPP) scrapped by Donald Trump immediately upon taking office, attention now turns to his pledge to renegotiate the NAFTA agreement between the US, Canada and Mexico. Trump has three main areas of contention. Firstly, that the trade deficit that the US runs with Mexico must fall. Secondly, that Mexico should increase workers’ wages towards those in the US. Thirdly, that the “Rules of Origin” must be tightened such that more of the regional content in manufactured goods comes from within the NAFTA area (and preferably from within the US).

All three goals are contentious, and difficult to deliver without damaging the Mexican (and probably the US) economy. The third (of seven) round of NAFTA renegotiation talks begins in October. One trade expert we talked to suggested that the subsequent 4th and 5th rounds later this year would be the most precarious, and that Trump might be minded to withdraw from NAFTA then.

The good news is that most experts suggest that Mexico’s “Plan B” would mitigate much of the damage that NAFTA’s scrapping would cause. It would still trade under WTO’s Most Favoured Nation status with the US, with generally moderate tariffs; it’s possible that those WTO tariffs would not deter trade if a likely peso depreciation made Mexico’s goods cheaper to US dollar buyers; and it is negotiating other trade deals around the world to open up new markets (the EU, Brazil).

It’s difficult to imagine that a Trump tweet in November announcing the end of NAFTA wouldn’t send Mexican assets lower however, at least in the short term.

- Gasoline and Pemex

Historically many emerging market governments have subsidised the price of fuel for their populations, and especially those with ample reserves of oil. It’s a popular policy with voters, and helps to insulate a low income economy from volatility in global energy markets. However, it became very expensive for Mexico when oil prices were $100 per barrel a few years ago while its “cash cow”, the Cantarell Oil Field (named after the fisherman who discovered it), saw production collapse (from 2.1 million barrels per day to 400,000) causing its gasoline imports to increase.

In recent years then, government policy has been to liberalise gasoline prices, and allow them to move higher towards market levels. As we saw, this has been a big upwards influence on Mexican inflation, especially in January 2017.

Additionally, the government is trying to reduce the influence that the state owned oil giant Pemex has on the nation’s energy supply. Over the years Pemex has provided revenues to finance a huge chunk of Mexico’s fiscal needs, but by prioritising crude oil production at all costs, it neglected investing in maintenance (resulting in unplanned shutdowns 10 times higher than the industry standard), refining capability (resulting in Mexico importing gasoline from the US), and a nation where 40% of towns have no petrol station. In the US there’s one gas station per 2500 people, in Brazil it’s 1 per 5000, in Mexico 1 per 10000.

So on top of a move to end gasoline subsidies, Mexico is now open to competition all across the supply chain. Companies can bid for exploration blocks in the Gulf of Mexico, to build new pipelines, to import fuel by truck from the US, and to run and build gas stations. More competition should result in lower prices for consumers, higher efficiencies in the oil supply chain, and an end to the drag on Mexico’s growth rate that the energy sector has delivered in recent years.

- Worms

I ate one of these. I’d like to say it tasted of chicken, but it tasted of worm.

Further reading

Claudia wrote about Trump and Latin American remittances here: https://bondvigilantes.com/blog/2021/12/14/the-central-american-remittance-crunch-who-would-lose-most-from-a-trump-presidency/

Charles wrote about NAFTA here: https://bondvigilantes.com/blog/2021/12/26/research-trip-mexico-trump-key-call-emerging-markets/

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox