Is it time for the Bank of England to target nominal GDP?

In December 2012, the then Governor of the Bank of Canada, Mark Carney, gave a speech entitled “Guidance” to the CFA Society of Toronto. Less than two weeks earlier, the UK Chancellor of the Exchequer, George Osborne, had announced that Carney would be the 120th Governor of the Bank of England (BoE). As this was Carney’s first public engagement since the announcement, traders and market economists waited in anticipation to hear from the new Governor (you can read our initial analysis of the speech here).

The speech will be remembered for the radical measures that Carney said central banks should take when interest rates are near zero. These included commitments to keep rates on hold for an extended period of time and setting numerical targets for unemployment. It is interesting that some of the proposals that Carney mused upon in the speech were subsequently incorporated into the BoE’s monetary policy framework. In August 2013, Carney broke with tradition and introduced forward guidance which was contingent on three “knockouts” events that incorporated the BoE’s forecast of inflation, inflation expectations, and financial stability. The forward guidance also hinged on an unemployment threshold, with the Monetary Policy Committee (MPC) stating that it would not hike interest rates until the unemployment rate fell below a threshold of 7%. Incorporating numerical thresholds for inflation and unemployment into forward guidance was precisely what Carney had stated in his speech in Toronto nine months earlier.

Carney included another important option that central bankers could use to guide economic agents in his speech that day. The Governor discussed the potential adoption of nominal GDP (NGDP) target, stating that

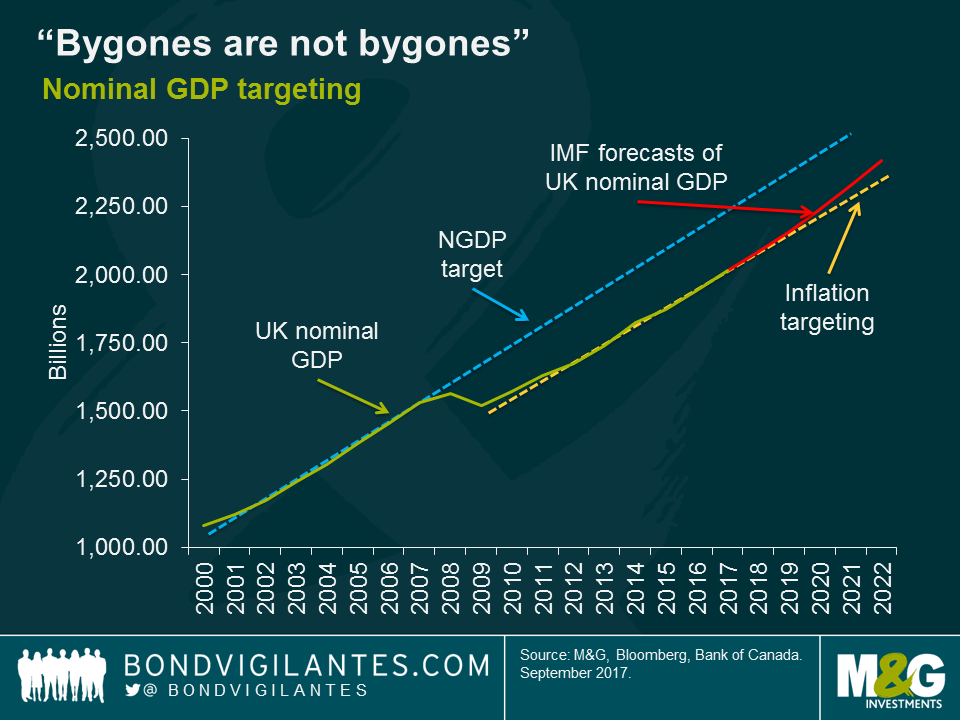

“…adopting a nominal GDP (NGDP)-level target could in many respects be more powerful than employing thresholds under flexible inflation targeting. This is because doing so would add “history dependence” to monetary policy. Under NGDP targeting, bygones are not bygones and the central bank is compelled to make up for past misses on the path of nominal GDP.”

He went on to say

“…when policy rates are stuck at the zero lower bound, there could be a more favourable case for NGDP targeting. The exceptional nature of the situation, and the magnitude of the gaps involved, could make such a policy more credible and easier to understand.”

Under NGDP targeting, Carney said that “bygones are not bygones”. The central bank is compelled to make up for past misses by targeting higher rates of NGDP growth to return the economy to its previous trend. In the short-term, targeting NGDP would allow the MPC to retain an easy monetary policy stance, even if inflation is above the Bank’s target for a sustained period of time.

It appears that many of the conditions that Carney stated in his speech could be applied to the UK economy today. The Bank Rate is only 0.25%, close to what economists call the zero lower bound on nominal interest rates. The UK is committed to leaving the European Union, which is clearly an exceptional situation and will likely have a large impact on the UK economy. The rate of inflation is above the BoE’s target, at 2.9%. And finally, the UK’s NGDP level has not returned to its pre-crisis trend and, according to IMF forecasts, is unlikely to do so for the foreseeable future.

With market expectations for an interest rate hike in December rising from around 20% to 72% over the past week despite the Brexit induced clouds that hang over the economy, is now the time for the BoE to consider a shift toward NGDP targeting? Central bank regimes have come and gone throughout history (such as fixing the price of gold, money supply targets, and exchange rate targets), and inflation targeting has only been the main goal of the BoE’s Monetary Policy Committee since 1998.

The advantage of a NGDP target is its robustness. For example, if productivity rises and inflation falls, an inflation-targeting central bank would likely ease policy, potentially generating asset bubbles. Under a NGDP target regime, prices would be allowed to fall. Alternatively, if prices rise due to an external event (such as higher oil prices), an inflation-targeting is compelled to hike interest rates, thereby reducing growth. One wonders if the ECB could have avoided hiking interest rates in July 2008, just as the European economy entered into recession, if it had been targeting NGDP instead of price stability.

Today, the MPC faces a difficult decision. There are signs that the economy is slowing, inflation is likely to peak in the next few months as the large depreciation in sterling and its impact on import prices falls out of annual calculations, and the political landscape both domestically and in the context of Brexit is challenged. The market is pricing in higher rates given the hawkish tone of the minutes of the MPC’s September meeting, which reflects the view of some members that an interest rate hike could mitigate the risks of a sustained period of above-target inflationary pressure. The question is, are these inflationary concerns justified, or could the MPC be about to repeat the mistake of the ECB’s governing council in 2008?

Next week, the Bank of England will be holding a conference celebrating 20 years of independence. Speakers include Gordon Brown, Fed vice-chair Stanley Fischer, ECB President Mario Draghi and IMF Managing Director Christine Lagarde. It will be interesting to see if Carney revisits his old speech from 2012 in his remarks. He has shown that he is willing to alter the BoE’s policy framework before and altering it again to incorporate a NGDP target may be his parting gift to the Bank and the central banking community before he leaves in June 2019. It would give the MPC some breathing space, and assist them in making the right decision at a very uncertain time.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox