M&G Panoramic Outlook: “Responsible Junk” – The challenge of integrating ESG factors into a global high yield Bond portfolio.

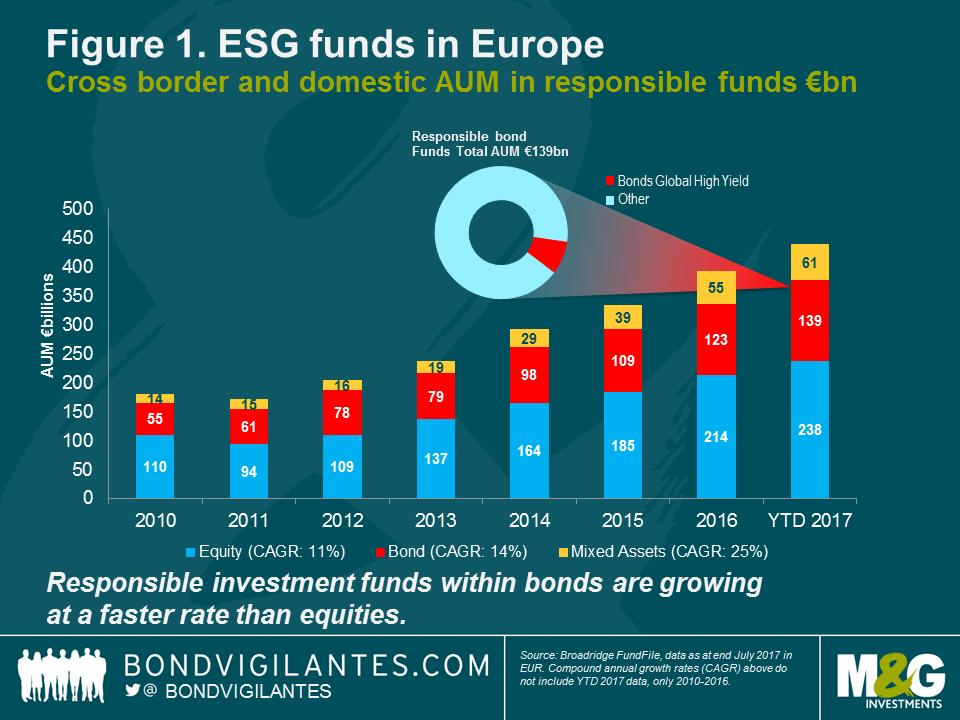

Growing awareness of a range of environmental, social and governance (ESG) issues has seen an ever larger number of investors move their focus away from purely financial goals towards an approach that also considers the ESG impact of their investments. Consequently, a pressing question that faces the asset management industry is how to integrate ESG factors into different asset classes and strategies. In this edition of the M&G Panoramic Outlook, fund manager James Tomlins provides an insight into the different ESG approaches from a high yield perspective. We will find out whether the European or the US high yield universe is more affected by ESG rules and what kind of ESG high yield approach is preferred by James to strike the right balance between ESG constraints and the ability to implement investment-driven views.

| View the Panoramic Outlook |

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox