Beware the death of Libor

Guest contributor – David Covey (Financial Institutions Analyst, M&G Fixed Income Team)

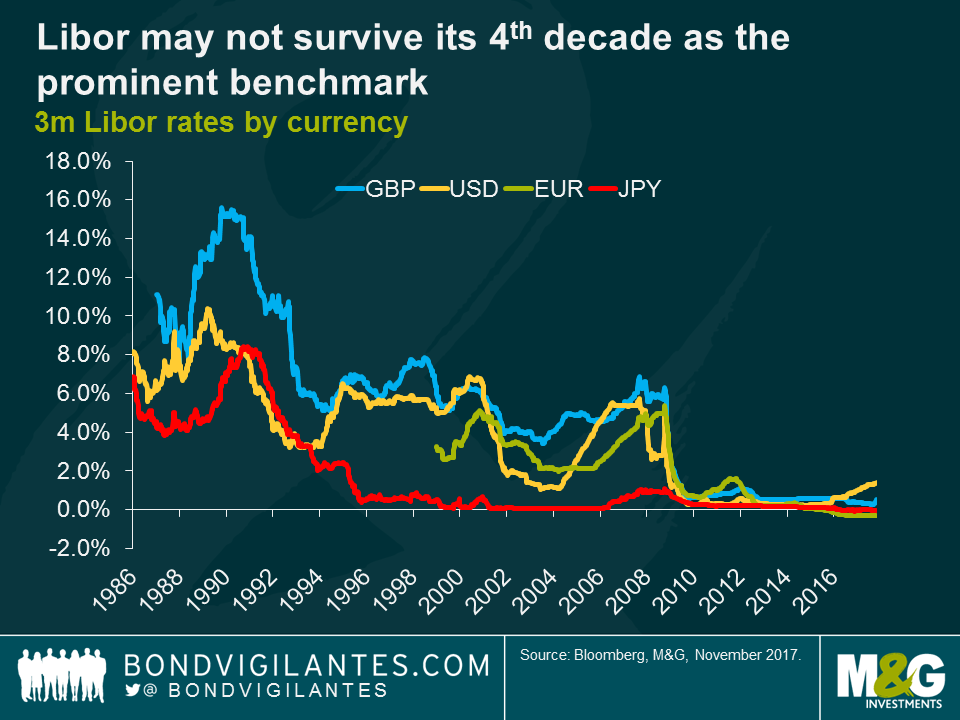

The end is coming for the London interbank offered rate (Libor). Ten years after suspicions emerged that this key interest rate was being manipulated in the financial crisis, regulators are ramping up their efforts to replace the benchmark rates. The Bank of England (BoE) and US Federal Reserve are leading the charge, proposing new benchmarks and setting a target of January 2022 for them to be in place, but they are not alone. Japan and Switzerland are also in the process of replacing Libor, and the European Central Bank (ECB) recently announced it would create a competitor to the Euro interbank offered rate (Euribor) by 2020.

The implications of Libor’s death are massive. They are also uncertain, dependent on not just how Libor rates are replaced, but also what replaces them.

It’s more than just fears of manipulation that are driving reform, though they are certainly part of the motivation. Regulators’ desires for greater transparency and credibility, in the form of transaction-based rates and central bank administration respectively, are also factors. Another is the simple problem that the lending which Libor rates are supposed to reflect – unsecured interbank lending – has declined sharply since the crisis. In the US market, there is little or no actual trading in more than half of the standard Libor maturities according to the Fed. It’s clearly not ideal to ask banks to provide Libor submissions when there are no transactions upon which they can base their quotes.

There’s hardly an investment market that doesn’t have some exposure to Libor. Swaps and other derivatives are clearly the largest, with over $400 trillion in notional outstanding as of year-end 2016. European asset-backed securities (ABS) are almost all Libor-based, as is a good portion of the US ABS market. Though most corporate debt is fixed-rate, leveraged loans are typically Libor floaters, and many corporate hybrids and bank/insurer capital instruments have Libor or swap-based resets. Any change to this key interest rate might be felt on Main Street as well as Wall Street, since a portion of residential mortgages and small and medium enterprise loans are Libor-linked too. Though some of these exposures may mature before 2022, a substantial portion of them will still be outstanding as of the planned transition date.

Uncertainty exists over both what the new benchmarks will be and how the market will transition to them. There’s been progress on the former, as a committee convened by the BoE recommended the “Sterling Overnight Interest Average” (SONIA) as the benchmark rate, while the US has suggested a “Broad Treasury Financing Rate” (BTFR), a rate based on overnight repo transactions. But there’s still some confusion over how these overnight rates will be extrapolated to create a full curve. Furthermore, the fact one benchmark rate is secured (e.g. BTFR) and another unsecured (e.g. SONIA) may create comparability issues. In my view, however, these pale in comparison to transition concerns. Even if there was unanimous agreement on the new rates, how can trillions of dollars of Libor-based contracts be converted to new benchmarks? And what happens to any contracts that aren’t changed?

There are a number of potential solutions, and none are ideal. An International Swaps and Derivatives Association (ISDA) protocol is being developed, but these derivative protocols are voluntary, and would not automatically apply to bonds or other cash instruments. A legislative solution is plausible, forcing contracts to switch over to new reference rates, but lawmakers seem less than keen on this idea and there are uncertainties over the treatment of cross-border contracts.

A cheeky approach would be to change the definition of Libor on reference screens like Bloomberg and Reuters, but this isn’t particularly clean, and as is the case for the other solutions above, the key question of how to set appropriate spreads between the new rates and current Libor remains unclear. For example, a spread would be warranted where the credit risk inherent in a replacement rate differs from that in Libor. This would be particularly important when the former is secured, since Libor is unsecured and should therefore be higher. Requiring banks to continue quoting Libor indefinitely would make this question moot, but we suspect banks’ willingness to do so is limited due to concerns around legal liability.

Investors should be concerned. Assuming an ISDA protocol is followed for swaps, issuers and investors may be left to change bond and loan documents one by one, requiring a colossal amount of administrative work and in some cases, 100% investor consent. It would likely leave at least some “orphaned” investments unchanged, destroying value. The typical “fall-back” reference rate noted in bond documentation, in the event that Libor quotes are unavailable, is a previous Libor fixing. Indeed, it’s not uncommon for corporates to have no fall-back language in bond documents when Libor quotes are not available. This could have the effect of permanently fixing the rate at the last Libor setting, hurting investors in upward-sloping yield curve environments. Issuers which repeatedly access capital markets have incentives to treat investors fairly (i.e. not revert to this default measure), but others, such as “one-off” corporate issuers or ABS transactions sponsored by firms long gone (e.g. Lehman Brothers) may not.

Investors can start now to protect themselves. One way is to voice their concerns to regulators directly or via industry associations. Another is to demand that new transactions have appropriate fall-back language, protecting them from potential worst-case outcomes. Steering clear of exposures which may be at greatest risk of reverting to value-destructive fall-back rates may prove sensible, especially as the market has not yet priced in the risk. In the end, I suspect the vast majority of exposures will transition over smoothly to new rates at some point, but investors should be aware that the loss of Libor may create a real risk of loss in some fixed income investments.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox