A tale of two bonds – diverging fortunes for GKNLN 22s and 32s

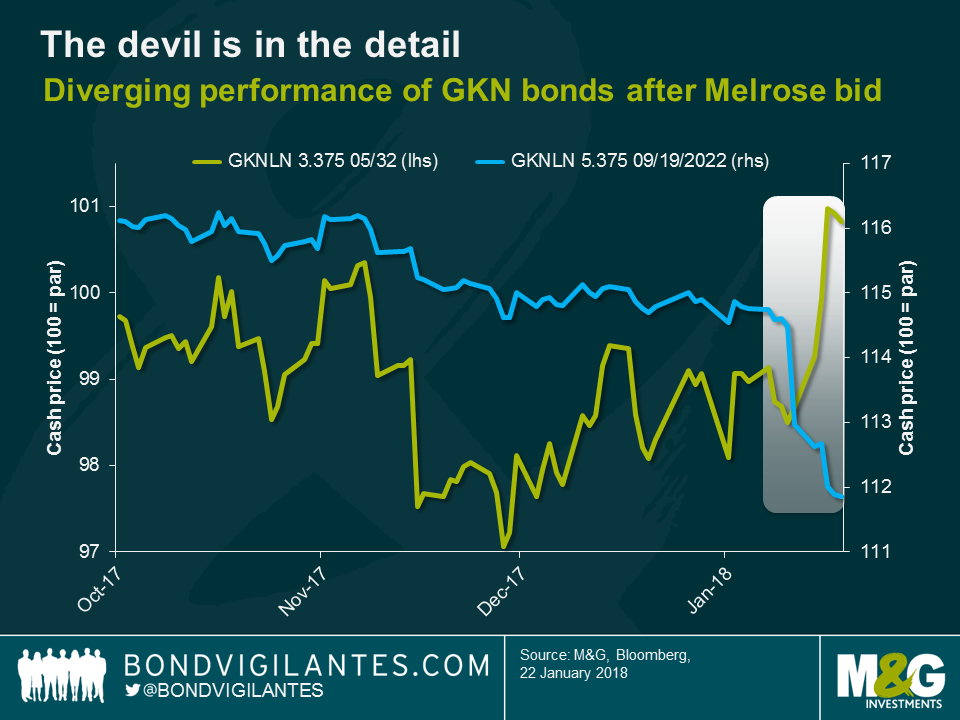

It was the best of times, it was the worst of times – to phrase it in a Dickensian way – for bonds of British automotive and aerospace components company GKN. After Melrose Industries, an investment firm specialised in turnarounds of manufacturing businesses, had made an unsolicited takeover bid for GKN on 8th January, GKNLN 3.375 05/12/32s have enjoyed capital gains of 1.7%, whereas the cash price of GKNLN 5.375 09/19/22s has dropped by 2.5%. This divergence seems counterintuitive, considering that both bonds are identical in many aspects: issuer (GKN Holdings Plc), rank within the capital structure (senior unsecured), currency denomination (GBP), credit rating (BBB-), to mention but a few. How is this possible?

In order to understand the diametrical performance trend, we have to delve into the nitty-gritty details of the bond prospectuses. There are three key differences related to bond covenants, which put holders of GKNLN 32s in a much better position than holders of GKNLN 22s and thus explain the opposing price reactions to the risk of a hostile takeover of GKN by Melrose.

- Change of control (CoC) put: If the takeover of GKN by Melrose goes ahead and triggers the CoC clause, which would also require that the GKN bonds lose their investment grade status, holders of the GKNLN 32s might want to exercise their CoC put at par. Since the bonds had been trading below par before the Melrose bid was announced, the bond price was pushed upwards. In contrast, the GKNLN 22s also have a CoC put at par but as the bonds had been trading well above par, the put is out-of-the-money.

- Make-whole call (MWC): In case Melrose succeeds in acquiring GKN, chances are they would refinance existing GKN bonds in order to clean up the balance sheet. The GKNLN 32s have a MWC provision at a redemption margin of 30 bps over Gilts, which offers upside for investors. The GKNLN 22s are lacking a MWC feature and it would probably require a tender offer with uncertain terms to take them out.

- Coupon step-up: If the GKNLN 32s are downgraded into sub-investment grade territory by S&P, Moody’s or both agencies, the coupon rate automatically steps up by 125 bps. This feature, which provides some level of protection of investors against deterioration in GKN’s credit quality, is not present for the GKNLN 22s.

We have written in the past about the importance of bond covenants, which can help protect the interests of investors, and the GKN case serves as yet another reminder. In the current market environment many corporate bonds are essentially priced for perfection and tight credit spreads do not leave much room for error. It is therefore vital for credit investors to do their research to fully understand even the finer details of the bond prospectus. Going the extra mile in terms of in-depth analysis and being fastidious about security selection are likely to be a winning investment strategy.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox