Can bond markets digest the huge supply of U.S. Treasuries that will be issued this year?

The United States government routinely finances itself through short-term debt, which is normally less expensive than long-term debt, due to the upward sloping nature of the U.S. yield curve. This cost saving does increase the risk of default. Rollover risk arises any time short-term debt is used to finance long-term spending. It is what keeps debt management officials up at night.

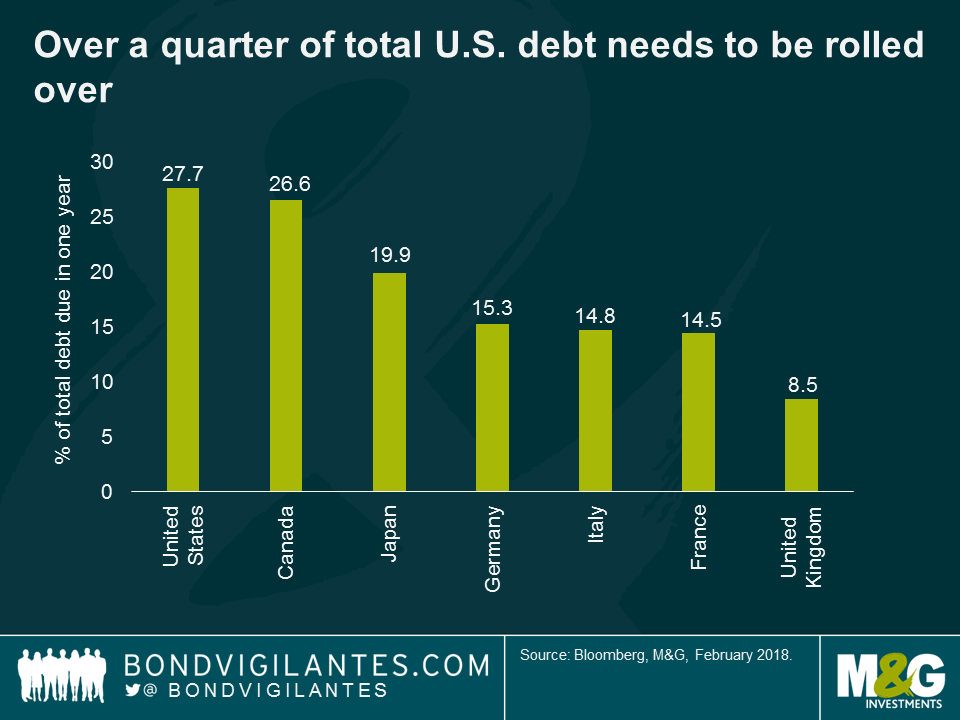

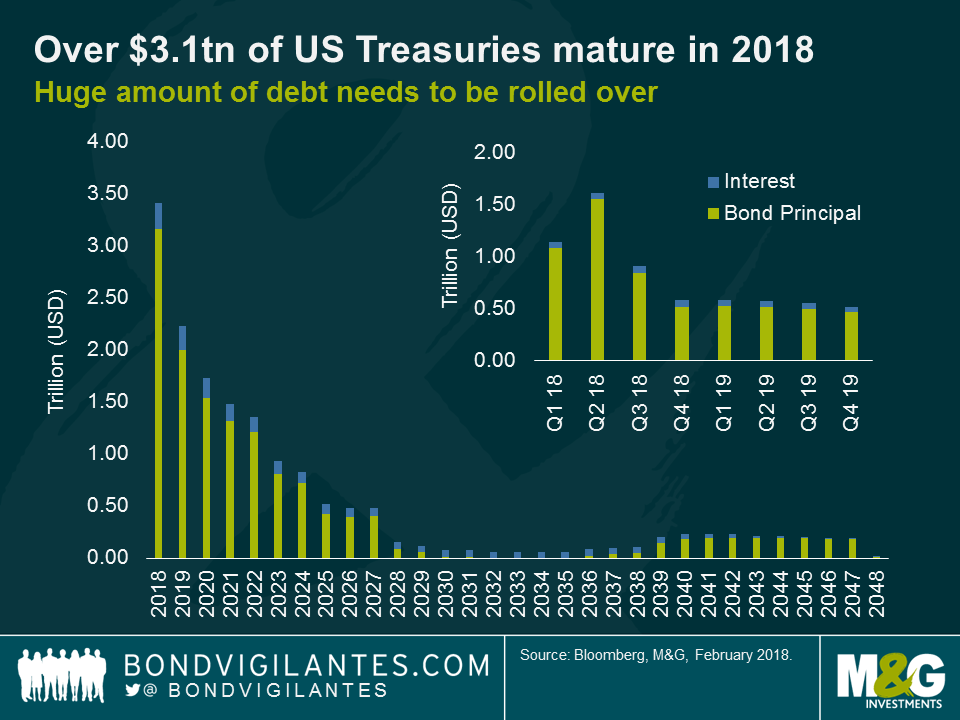

The U.S. government will have to rollover 28% of its total debt in 2018, equivalent to over $3 trillion in U.S. Treasuries. In addition, some estimates suggest that the US federal budget deficit is on track to rise to over $1 trillion in 2019. With the Trump fiscal expansion plans likely to be funded by the issuance of short-term debt, the next few years will see a large increase in U.S. Treasury supply.

The conventional wisdom suggests that the risk of a rollover crisis for the US is close to zero. The U.S. has special status as having the world’s deepest and most liquid government bond market in the world, and the U.S. dollar is the world’s reserve currency.

Whilst the risk of a rollover crisis is low, there are several factors that suggest Treasury yields must move higher from current levels to attract capital from investors. Firstly, senior Chinese government officials have reportedly recommended that the Chinese government reduce or stop buying U.S. Treasuries. With the markets already dealing with supply indigestion, the removal of a large buyer of U.S. Treasuries would likely see yields move sharply higher.

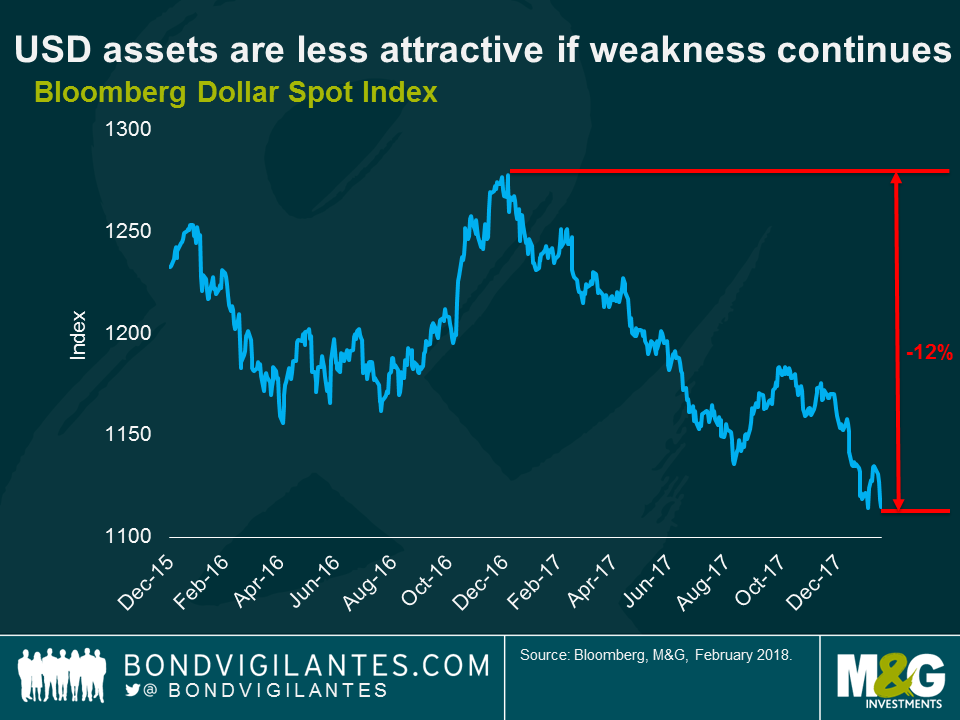

Secondly, the Bloomberg Dollar Spot Index has fallen by around -12% since the start of 2017. If foreign investors expect the U.S. dollar to continue to depreciate, then non-residents will look to reduce or stop the rate at which they accumulate U.S. assets and U.S. Treasuries going forward. This is exactly what the Chinese are reviewing, and we can expect other international governments and large institutions (like sovereign wealth funds) to follow. If this occurs, it will put further pressure on the U.S. Dollar and yields on U.S. Treasuries across all maturities will begin to rise.

Finally, the US has been able to get away with rolling over its debt since the financial crisis through monetising its debt. The U.S. Fed has engaged in quantitative easing (QE) by buying Treasury securities directly, thereby reducing the government’s cost of borrowing. However, QE is now over, and the Fed is hiking rates to cool a rapidly heating economy.

Whilst there are good fundamental reasons for yields moving higher, the huge amount of debt that the U.S. Treasury will have to issue this year and next, at a time of monetary policy tightening, will provide an important technical headwind for U.S. Treasury returns this year.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox