Can the UK government meet its housing pledge?

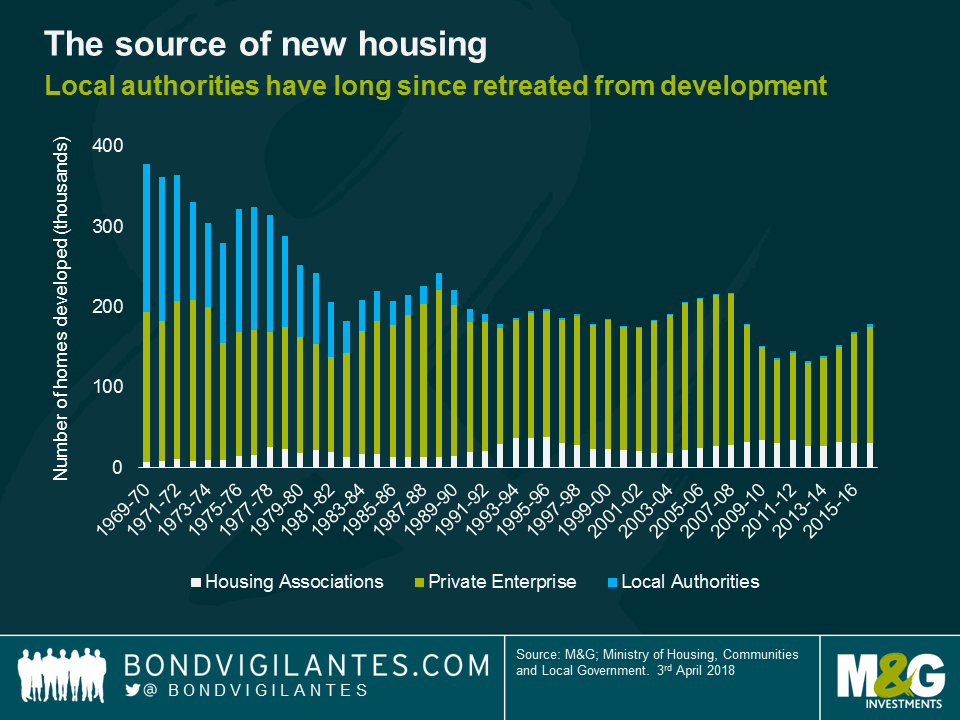

The current Conservative Government has pledged to meet its 2015 manifesto commitment to deliver one million homes by the end of 2020 and to “deliver half a million more by the end of 2022“. For this to be met, completions would need to rise to levels not seen since the late 1970s.

Unfortunately for the UK Government, increasing the housing supply has long been a difficult challenge. There has been some recent success with the number of new dwellings completed in 2016-17 reaching 178k, almost equal to the 2008-09 number. However, this is still well short of the pre-crisis peak in 2007-08 of 215k and the longer-term peak of 378k. Unfortunately, private enterprises are unlikely to increase the number of home completions from the 145k built last year due to the uncertainty surrounding Brexit and dwelling completions are likely to fall from current levels. In addition, Local Authorities have long since stepped away from housing development. The budget constraints now faced by Local Authorities gives little confidence that they will return to the market in a meaningful way any time soon.

Therefore, if the Government is to get anywhere near meeting its target, the most likely source of additional development will be from the Housing Association sector.

Housing Associations are mostly not-for-profit, charitable organisations which provide a mixture of housing types, predominantly social housing. These social units are let at sub-market rents and are in high demand across the country, particularly in the South East of the UK. A large proportion of the rent comes from housing benefit received by the tenant. This provides a significant source of very stable income and is one of the reasons housing associations can approach the property market in a different way to private enterprises and can take a longer-term view on market value.

This is evidenced in the below chart which shows that during periods of slow or negative economic growth in the UK, Housing Associations complete a greater proportion of total dwellings constructed.

Housing Associations are able take a longer-term view on the housing market compared to a property developer because they are not as impacted by market movements. Whilst they do develop properties for market sale, these are small in scale and could be converted to social housing, given the high demand, to provide a source of income until the market recovers.

In my opinion, the current target is totally unrealistic for the Government to hit. Not only will funding need to increase further, but a solution to the serious skills shortage is needed. As reported in their latest market update, the Chief Executive of the Federation of Master Builders said “The number of respondents reporting difficulties in hiring key skills, such as bricklayers and carpenters, has never been so high.” A serious problem particularly when considered alongside the issues with the large construction companies such as Carillion. The Government has a difficult job in solving all these problems and will inevitably not solve them all, however any progress it can make will be beneficial to all, not just investors.

Housing Associations source capital from markets in order to fund development projects, using a combination of debt and government grant. Capital markets have been an excellent source of cheap long dated funding, currently inside 150 basis points relative to gilts for the larger issuers, and the Government has pledged a further £2bn in grants. The question is whether this is enough to meet the Government’s medium-term goal. Investing in the sector is not without its challenges, including short term risks of exposure to an uncertain property market and indirect linkage to a potentially weakening sovereign, and the need for a long term view because of the tenors (usually 30 years) of the debt. However, for investors who are comfortable with these challenges, there is good value when compared to similarly rated corporate bonds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox