The reversal of Operation Twist and ramifications for the yield curve

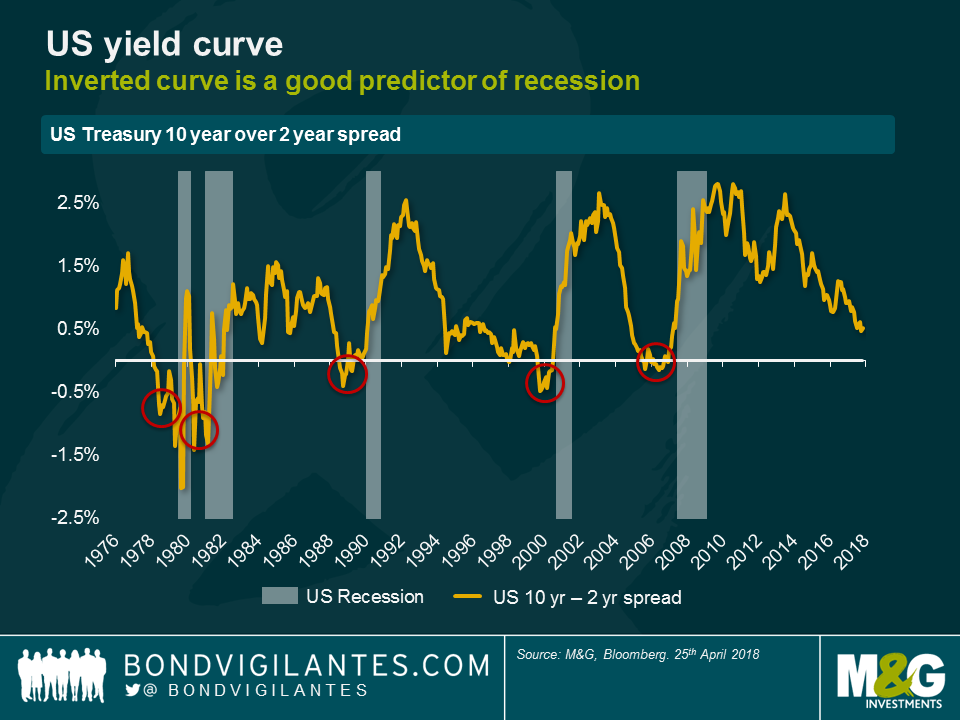

The flattening of the yield curve is carefully watched by investors as it is traditionally a good indicator of an economic slowdown. However, we always need to question conventional wisdom, and one thing we can say about the great financial crisis, and the great financial recovery, is that the actions central banks have taken to meet their mandates has been quite different this time.

The Fed has led the central bank policy response to the crisis, cutting rates aggressively, employing quantitative easing (QE), and Operation Twist – the process whereby the Fed simultaneously sold short-dated bonds and bought long-dated bonds to help drive down borrowing costs and boost economic growth. These policies have worked – unemployment has fallen to low levels, and capacity constraints have or are near to being reached. In this type of environment, monetary accommodation – both conventional and unconventional – needs to be removed.

The central banks firstly decided to reverse conventional monetary policy easing, increasing short-term interest rates back to a more “normal” level after being held close to zero since the onset of the financial crisis. The Fed has made good progress towards this level. When this conventional rate approaches the desired level, policy should finally shift to focusing on reversing the unconventional measures they have taken. The Fed has therefore relied on a series of gradual rate hikes to take some of the heat out of the economy – the resulting increase in short-term interest rates has led to a flattening of the yield curve.

In normal economic cycles this flattening implies a higher probability of the yield curve inverting, something that has historically had significant implications. The Fed has pushed rates up regularly and transparently in the first step of normalisation, accompanied by only a minor reduction in the balance sheet. Further reductions of the Fed’s balance sheet holdings are also hard wired into its monetary programme as existing Treasuries mature. However, one thing the Fed has not done is unwind the distortion they caused to the yield curve through Operation Twist.

I think that the next phase of policy will involve less reliance on interest rate hikes. It will feature a more aggressive unwinding of QE, and a reversal of Operation Twist. This unwind can be completed by reorganising the balance sheet of the Fed through buying of shorter dated securities and selling longer dated securities. This would have the benefit of removing duration risk from the Fed’s balance sheet, and would steepen the yield curve.

The market is very concerned about the flatness of the curve and its implications, and the Fed itself is also concerned considering the historical predictive nature of the curve. One presumes the Fed wants to tighten policy, maintain growth, remove the unconventional policy stimulus it has undertaken, and reduce the risk on its balance sheet. By buying short dated assets and selling long dated assets, the Fed will help achieve its policy goals, and re-steepen the curve. This should result in a lower need for short rates to be hiked to counteract the residual unconventional policy operations that hang over the market.

Operation Twist was first deployed by the Fed to distort the yield curve in the early 60s. This time let’s hope for Operation “Perfect”, and the Fed hitting its key objectives for monetary policy of maximising employment, stable prices, and moderate long-term interest rates. I think they can do it.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox